AI buyers change pricing more than any shift we have seen in decades. Not because they drive harder bargains. Not because they automate procurement. The real impact is far simpler and far more disruptive. Humans perceive value. AI computes it. Humans fill gaps in your value story with assumptions, intuition, and hope. AI does not. You either give it structured evidence or you get treated like a commodity.

Most companies today sell to humans who tolerate ambiguity. They accept fuzzy ROI claims. They believe case studies written to impress, not to inform. They make tradeoffs influenced by emotion, trust, urgency, politics, even fatigue. All of that works for you as a seller. Imperfect value stories still convert because humans are willing to imagine the benefit.

But an AI buyer cannot imagine your value. It needs to calculate it.

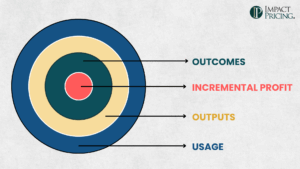

The average SaaS product creates real value, but it is not instrumented to produce hard signals that quantify that value. No clean attribution. No tight linkage between usage and outcomes. No measurement of improvement over baseline. No standardized KPI impact. The product works, but the evidence is not machine readable.

Human buyers tolerate this. AI buyers don’t. Without structured proof, the AI has to treat your product as equivalent to any similar product. And when alternatives look equivalent, price is the only lever left.

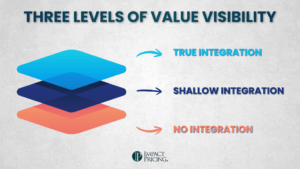

Companies tell themselves they do not need deep integration because their product is simple to deploy. In the AI era, shallow integration is a pricing handicap. Deep integration generates more signals. More signals mean clearer attribution. Clearer attribution means more pricing power.

The irony is that AI does not make value less important. It makes value unavoidable. You cannot distract it with stories. You cannot charm it with enthusiasm. You cannot coax it to forgive gaps in your math. It will compute the value you can prove and ignore everything you cannot.

This creates the most important mandate of the AI era. Companies must understand their value with a precision they have never needed before. They must measure it, attribute it, and communicate it in structured, machine-ready terms. The companies that already know their economic impact will gain pricing power. The companies that can’t prove it will see their prices collapse toward the cheapest credible alternative.

AI is not the end of pricing strategy. It is the enforcement mechanism. It exposes weak value. It rewards strong value. It raises the bar for everyone. In a world where buyers are algorithms, success belongs to the companies that can turn their value story into data that a machine can trust.

The winners will not be the best storytellers. They will be the ones with the cleanest evidence.

Now, go make an impact!

Tags: pricing, Pricing AI, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value, value-based pricing

Tags: pricing, Pricing AI, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value, value-based pricing