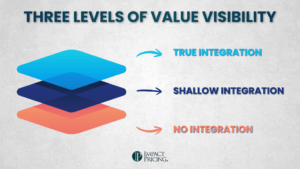

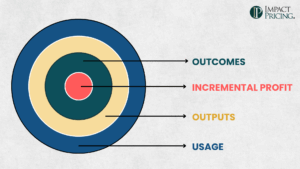

Pricing AI is hard because no single metric captures how value is created and how costs behave. A per-user fee feels simple but ignores automation. A usage-based charge feels fair but creates unpredictability. An outcome-based model looks elegant until you try to measure results.

This is why hybrid pricing models are becoming the default in AI and SaaS. They combine multiple metrics to balance fairness, predictability, scalability, and profitability. These are the same trade-offs captured in Michael Mansard’s COMPASS framework for evaluating pricing metrics.

A well-designed hybrid is not a compromise. It is a deliberate system for managing uncertainty and aligning how buyers pay with how value is delivered.

Why Hybrid Pricing Exists

In theory, every product should have one perfect pricing metric that mirrors customer value. In practice, that almost never works.

Pricing is a constant negotiation between simplicity and accuracy. A single metric may be easy to explain but too rigid to handle real-world variation. It might offer predictable revenue but fail to scale with customer success. Or it might perfectly reflect value yet make forecasting impossible.

Hybrids exist to smooth those trade-offs.

A SaaS platform that charges only per user gains predictability but loses fairness if some customers use it ten times more intensively than others. Adding a usage component connects payment to activity. An AI vendor that charges purely per outcome faces uncertainty about attribution. Adding a fixed fee stabilizes revenue while keeping incentives aligned with results.

In AI especially, costs fluctuate with compute and model complexity, usage patterns vary across customers, and value depends heavily on context. A single metric cannot capture that nuance. By combining fixed access fees with variable usage or outcome-based charges, sellers can stay aligned with both costs and value creation.

The Purposes of Hybrid Models

Hybrid pricing models serve distinct purposes that pure models cannot achieve.

- Share risk between buyer and seller. A fixed base protects the seller, while a variable component ties payment to performance.

- Improve predictability. Combining base and usage fees allows stable budgeting without disconnecting from delivered value.

- Increase fairness. Buyers pay in proportion to the results they receive, while sellers recover costs from heavy users.

- Enable scalability. Hybrids flex across company sizes and usage patterns.

- Support segmentation. One structure can serve multiple markets by adjusting the weight between components.

Hybrid pricing is not about complexity. It is about balance.

Understanding Base and Access Fees

Before building hybrids, it helps to understand two foundational pricing levers.

A base fee is a per-organization charge, a flat amount that keeps the relationship in place and covers shared value like platform maintenance or customer support.

An access fee is per user or per agent, defining who or what can use the product.

Think of it this way:

- Base = per organization (financial stability)

- Access = per user or per agent (functional capacity)

The base keeps the lights working. Access determines how many people or digital workers can turn them on.

Nearly every hybrid model starts here, layering usage, output, or outcome metrics on top to reflect value more precisely.

Common Hybrid Structures

Here are the five hybrid structures that dominate SaaS and AI pricing today.

1. Base + Variable

A fixed base fee ensures predictability, and a variable component scales with activity.

- OpenAI uses this model with an enterprise platform fee plus token-based usage.

- Replit charges a base fee per organization and adds compute-based pricing for project activity.

2. Tiered + Usage

Functional tiers define capabilities, and usage charges scale revenue.

- Slack offers good-better-best tiers with additional costs for storage or history.

- An AI data platform might set tiers by workflow complexity and charge per record processed.

3. Outcome + Activity or Output

An outcome metric (results) is paired with an activity or output measure (work done).

- Hippocratic AI charges per nurse hour and adds bonuses tied to patient satisfaction.

4. Access + Output

Access pricing defines capacity, and output pricing reflects productivity.

- Salesforce’s AI suite charges per digital agent plus per interaction completed, blending predictability with performance.

5. Access + Outcome

Access provides stability, while outcomes connect directly to buyer KPIs.

- Intercom Fin combines a flat access fee with per-case charges for resolved conversations.

Each model balances different COMPASS dimensions such as fairness, predictability, scalability, and profitability depending on the market’s maturity and buyer expectations.

How Many Metrics Are Too Many

The best hybrid pricing models use two metrics. One provides stability, and the other connects payment to value.

Adding a third can fine-tune incentives but risks confusion. If your sales team or buyer cannot describe the pricing in one sentence, it is too complex.

The optimum number of metrics is the fewest that balance buyer understanding with seller economics. For most businesses, that means two.

Designing Pricing That Evolves

Hybrid models are built to evolve. The right combination changes as your product and market mature.

Think about how cell phone pricing evolved.

- Simplicity for adoption – Flat monthly fees attracted new users.

- Refinement for fairness – Pay-per-use plans aligned price with consumption.

- Expansion for scale – Base plans plus overage fees balanced fairness and predictability.

- Optimization for stability – Unlimited and bundled plans simplified again as markets matured.

SaaS and AI follow the same path. Companies begin with simple access or base pricing, move toward usage-based hybrids as adoption grows, and later simplify again for scale and competitive clarity.

Design your pricing to evolve. Build flexibility in from the start so you can shift between components without breaking customer trust.

A Framework for Building Hybrids

A simple, repeatable process helps companies design hybrids deliberately instead of by intuition.

- Evaluate metrics using the COMPASS Sevenfold Star.

- Identify gaps to see where a metric underperforms.

- Pair metrics intentionally to offset weaknesses.

- Validate with buyers through comprehension and fairness testing.

- Pilot, measure, and iterate before a full rollout.

- Reassess regularly as markets and costs evolve.

For example, a conversational AI company moved from per-agent pricing to a base-plus-per-conversation hybrid. The base fee stabilized revenue, and per conversation pricing aligned payment with value. Volume discounts later improved fairness and predictability.

Managing Transitions

Transitioning between models is where most pricing changes fail. Success depends on communication and fairness.

- Introduce new pricing as an option, not a mandate.

- Position the change around fairness, not revenue.

- Use data to show how the new model reflects customer success.

- Provide tools such as calculators to estimate costs.

- Phase adoption and communicate clearly.

- Listen to feedback since objections reveal design flaws or buyer confusion.

A well-managed transition strengthens relationships. It signals that your pricing evolves because you are learning how to deliver value better.

Why Hybrid Models Work

Hybrid pricing works because it reflects how value and cost actually behave. Buyers experience value across multiple dimensions such as access, usage, and outcomes, while sellers balance fixed and variable costs.

Hybrids align those moving parts. They balance risk, adapt to context, and evolve gracefully. They allow pricing to grow with your business instead of against it.

A hybrid model is not a compromise. It is a framework for fairness, flexibility, and long-term alignment between buyer and seller. That is what great pricing achieves.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: ai pricing, pricing, Pricing AI, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value

Tags: ai pricing, pricing, Pricing AI, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value