You can listen to the full audio version of this blog we call — Blogcast.

With SaaS, per-seat pricing was simple, predictable, and familiar to buyers. It became so common that many equated “SaaS pricing” with “seat-based pricing.” But AI has broken that mold. One agent may replace dozens of seats, compute costs can grow in unpredictable ways, and buyers increasingly expect to pay for results, not just access.

As a result, companies are experimenting at a rapid pace. Some AI companies have landed on workable models, such as Intercom Fin, which charges per resolution. Others have stumbled, like VMware’s vRAM pricing, which buyers rejected as penalizing the very thing they valued. Salesforce’s Agentforce began with per-conversation pricing but has already shifted to a more flexible, credit-based system. These pivots show just how unsettled the landscape is.

This is where the COMPASS framework, developed by Michael Mansard, comes in. COMPASS provides a structured way to think about pricing metrics and to map them onto how products create and deliver value.

The COMPASS spectrum includes Inputs, Access, Activities, Outputs, and Outcomes and in truth it applies not only to AI but also to SaaS and every other technology category. Each step along the spectrum represents a different way of linking what a product does to how a buyer pays. The closer you move toward outcomes, the stronger the alignment with customer value, but the greater the complexity and risk for the seller. Most companies will find themselves in the middle, with activities or outputs. But understanding the full spectrum helps clarify choices, avoid guesswork, and set the stage for evaluating which metrics fit best.

Inputs

The first category on the spectrum is inputs. These are metrics based on what the customer puts into the system, rather than what the system produces. Inputs are often attractive to sellers because they are easy to measure and scale with customer size. But they are also the least aligned with customer value, since buyers rarely think of the data they load or the records they store as the reason they purchased the product.

Classic SaaS examples make this clear. HubSpot charges based on the number of marketing contacts in a customer’s database. Dropbox originally priced by gigabytes of storage. Both of these models tie revenue to the volume of data a customer brings into the system. From the seller’s perspective, this made sense: more contacts or storage typically meant more usage and more infrastructure costs. From the buyer’s perspective, however, it can feel like a tax on growth. The more they succeed, the more they pay, without any guarantee of improved results.

In agentic AI, however, inputs as a pricing metric are nearly non-existent. Buyers don’t hire agents to store data; they hire them to perform work. What might look like an input in SaaS is almost always reframed in AI as an activity (tokens processed, agentic hours worked) or an output (conversations completed, documents summarized). Very few companies ask buyers to pay for what they feed into an agent. Instead, they charge for what the agent does with it.

The only places inputs occasionally appear in AI are at the infrastructure layer. A model training platform might charge based on the size of the dataset uploaded. For most agentic AI solutions, input pricing is irrelevant. After all, the purpose of an agent is to take an action.

The strength of input metrics lies in their simplicity. They are easy for both seller and buyer to understand, and they scale naturally with larger customers. The weakness is their distance from customer value. Companies exist to create value for customers, not to monetize the raw materials buyers feed into a system. This makes input pricing stable but often unpopular, especially in competitive markets where alternatives may offer metrics more closely tied to results.

Access

The second category on the spectrum is access. Where input metrics charge for what goes into a system, access metrics charge for who or what can use the system. In SaaS, this usually means charging per human user, the familiar “per seat” model. In AI, it can also mean charging per digital agent, effectively treating the AI itself as a seat.

Per-seat pricing has long been the default in SaaS. Salesforce Sales Cloud charges per sales rep who uses the platform. Microsoft Office 365 and tools like Slack or Zoom charge per human user. The model is simple, predictable, and easy for buyers to budget. It scales as companies grow headcount, and it feels fair because each person using the software represents more organizational capacity.

Agentic AI extends this logic, but shifts the focus from human users to digital workers. Instead of paying per human sales rep, a company might pay for an AI sales assistant or an AI paralegal. These “per agent” models treat an AI system like a salaried staff member—licensed for use regardless of how many tasks or processes it performs. A customer buys capacity in the form of autonomous agents.

The strength of access metrics is their predictability. Buyers know exactly how many seats or agents they are paying for, and sellers enjoy stable, recurring revenue. But access can drift away from value if the unit of access isn’t tied to meaningful productivity. A human seat makes sense when each new user contributes more work. An AI agent may create enormous value in one context and very little in another, yet the price is the same. This risks misalignment between value and revenue.

Access metrics are closer to customer value than inputs, since they represent capacity to create results, but they are still imperfect. In SaaS, per seat works best for tools that are integral to each user’s daily workflow. In AI, per agent may work in early adoption phases, when buyers are still learning what agents can do and prefer predictability. Over time, though, sellers need to evolve toward activity, output, or outcome metrics that align more directly with buyer value.

Activities

The third category on the spectrum is activities. An activity metric charges for the discrete actions an agent or user takes inside the system. These are the atomic steps that make up work—small, countable units that can be easily tracked.

In SaaS, activity metrics often showed up under the broad banner of “usage-based pricing.” Twilio charged per text message sent. AWS is priced per compute hour. Each activity was simple to measure and correlated, at least loosely, with the customer’s value. The customer sent more messages or consumed more compute, so they paid more.

AI brings a new set of activity metrics. The most prominent is the number of tokens processed—the number of words or characters the model reads and generates. This is an activity the seller can measure precisely, and it ties directly to compute costs. But tokens are difficult for business buyers to interpret. How many tokens will a customer service conversation consume? How many tokens are needed to summarize a contract? The buyer may have no idea, making tokens feel opaque and unpredictable even if they are perfectly aligned to seller costs.

Other AI activity metrics are more intuitive. Hippocratic AI charges per nurse hour, a familiar unit that resembles billing for human labor. In Agent Mode, ChatGPT uses one credit whenever a prompt requires retrieving information from external sources, such as the web, Gmail, or Google Drive. Prompts answered from ChatGPT’s own knowledge base do not consume credits. These activity metrics are easier for buyers to understand than tokens, although they still fall short of promising a specific result. The buyer pays for effort expended, not for a finished deliverable.

The strength of activity metrics is their simplicity and measurability. They align well with seller costs, and they scale naturally with adoption. But they also shift more risk to the buyer. Paying per API call, per token, or per edit request means the buyer is paying for activity, regardless of whether it produces valuable results. This can feel like time-and-materials billing, where the client bears the risk that the hours logged will not lead to progress.

This is why it is helpful to distinguish activities from the following category in the spectrum: outputs. Both are forms of usage, but they feel very different to buyers. Activities measure effort. Outputs measure deliverables. Activities are easy for sellers, but often frustrating for buyers. Outputs move the discussion closer to buyer value.

Outputs

The fourth category on the spectrum is outputs. Where activity metrics charge for effort, output metrics charge for deliverables. Outputs are the tangible units that result from a sequence of activities, the things buyers can point to and say, “That’s what I got.”

In SaaS, output metrics have long been a common practice. A payroll service might charge per payslip generated. An invoicing platform might charge per invoice processed. An analytics provider might charge per report produced. These units are closer to what customers value, since they can directly see the deliverables.

AI extends this logic naturally. Decagon charges per conversation completed by its AI agent. An AI summarization service might charge per document delivered. In each case, the buyer pays for something tangible and countable, rather than the raw activity that produced it.

Output metrics feel far more intuitive to buyers than activity metrics. They can estimate usage more easily, and they feel confident that what they pay for is something they can actually use. However, outputs may fall short of the intended outcomes. A conversation may be completed but unresolved. A document may be summarized, but it may also be inaccurate. An output is a deliverable, not a guarantee of value.

The strength of output metrics lies in their ability to strike a balance between buyer-friendliness and seller-measurability. They reduce buyer risk compared to activity metrics, but they do not expose the seller to the full risk of outcomes. That is why many companies, both SaaS and AI, find themselves here: outputs are a comfortable middle ground.

Outcomes

At the far end of the spectrum are outcomes. An outcome metric charges only when the buyer’s key performance indicator (KPI) improves. In other words, the unit of measure is not the seller’s cost or even a deliverable, but the metric the buyer already uses to judge success.

These KPIs can take many forms. In B2B, the desired outcome is usually incremental profit, but few sellers can measure or claim direct credit for that. Instead, they align pricing to more specific KPIs that buyers already track. For FinAI, that KPI is the number of completed support calls. For a fraud detection system, it might be the number of fraudulent transactions prevented. For PayPal, it is the dollar value of transactions processed. Even outside of software, contingency-based law firms embody outcome pricing by tying fees to the client’s payout.

To buyers, outcome metrics are ideal because they directly align with how they already measure results. Buyers are comfortable paying when their own KPIs improve. This shifts nearly all risk to the seller, ensuring that spending is tied to the metrics that matter most.

For sellers, however, outcome pricing is the most challenging. KPIs can be challenging to measure accurately and even more difficult to attribute. Did the AI reduce churn, or was it the new customer success initiative that had the most impact? Did the analytics tool increase sales, or was it a result of a new marketing campaign? Sellers also bear financial risk, since outcomes often lag behind activities and outputs.

This is why outcome metrics, while celebrated as the “holy grail,” remain rare in practice. Fewer than ten percent of AI offers today are truly outcome-based. Most companies operate in the middle of the spectrum, with activities and outputs, as these strike a balance between buyer comprehension and seller feasibility.

Still, outcome pricing sets a direction. It challenges sellers to consider the buyer’s KPIs, explore risk-sharing, and frame their product in terms of measurable business results. Even if most products never fully transition to outcome-based models, the spectrum reminds us that this represents the closest point of alignment with customer value.

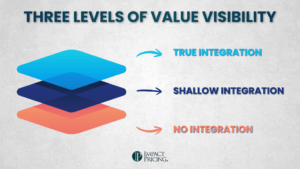

The COMPASS spectrum—Inputs, Access, Activities, Outputs, and Outcomes—provides a structured way to understand pricing metrics and their alignment with customer value.

Most companies find themselves in the middle of the spectrum. Activities and outputs dominate because they strike a balance between seller feasibility and buyer comprehension. Input and access metrics offer predictability but can sometimes feel disconnected from the value they provide. Outcomes align perfectly with buyer KPIs, but remain difficult to measure and attribute, which is why fewer than 10% of AI offerings use them today.

The spectrum’s value isn’t pushing every company toward outcome pricing. It’s helping you see where you are and what trade-offs you’re making. It provides a common language across product, sales, finance, and leadership teams, replacing debates over “tokens versus conversations” with discussions about value alignment.

Most importantly, the spectrum serves as a compass. It pushes you to ask: How close are we to the metrics our buyers actually care about? How can we refine our pricing to reflect customer value better?

Understanding the families of metrics is just the first step. The harder work—choosing among them, combining them, and adapting as products and markets evolve—comes next.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: ai pricing, pricing, Pricing AI, pricing foundations, pricing skills, pricing strategy, pricing value

Tags: ai pricing, pricing, Pricing AI, pricing foundations, pricing skills, pricing strategy, pricing value