You can listen to the full audio version of this blog we call — Blogcast.

One of the most important lessons in pricing is this:

Buyers trade money for value.

That hasn’t changed, even with the rise of AI.

They don’t care how smart your model is. They don’t care how many engineers you hired. They care what they get out of it. They care about value.

And in B2B, what they “get out of it” typically comes down to one thing:

Incremental profit.

If your AI solution helps your buyer make more money or spend less, you’re delivering value they can quantify and potentially pay for.

But to price effectively, we need to go deeper. Because “value” isn’t one thing. Buyers perceive value in two different ways depending on the decision they’re making. And if we get that wrong, we risk building great technology with no pricing power.

Let’s break it down.

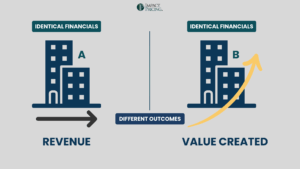

Two Buyer Questions, Two Kinds of Value

Buyers make new purchase decisions in two stages, whether they realize it or not:

1. “Will I buy?”

This is where inherent value matters.

Inherent value is what your product can do for a buyer in isolation. It doesn’t matter who your competitors are. It doesn’t even matter if you’re better. It just matters: Is this worth it to me? Think of inherent value as the value of solving the problem.

For example:

An AI tool that summarizes long documents might save a corporate lawyer 3 hours a week. That’s inherent value. It saves time, whether or not alternatives exist.

2. “Which one do I buy?”

This is where relative value takes over.

Relative value is about your advantage compared to other options. It’s what makes your product the best choice for a buyer who’s already convinced they need something. Think of this as the value of the problems you solve, but your competitor doesn’t.

In the example above, maybe your document summarizer:

- Handles legal terminology more accurately

- Works offline

- Integrates with a firm’s document system

That’s relative value, and it often drives the final buying decision.

The Concepts in Practice

Let’s say a company processes 10,000 invoices a month manually. Labor costs are high. Errors happen.

You sell an AI tool that automates invoice processing.

- Inherent value: The tool saves $20,000 per month in labor. That justifies the “Will I buy?” decision.

- But you’re not the only one. Another vendor offers something similar.

Now the buyer is asking: “Which one creates more incremental profit?”

What if your tool is faster, more accurate, or better integrated than the tool that delivers $20,000 in labor savings. Maybe your solution delivers $25,000 per month in savings. That $5,000 per month difference is relative value, and it’s likely why they will choose you (depending on the price difference, of course).

Even though both solutions are profitable, relative value wins the deal.

How This Plays Out in AI

AI has created a flood of new tools. And to most buyers, they all sound the same.

- Built on GPT-4

- AI-powered insights

- Automated analysis in seconds

That’s why so many teams struggle to monetize their AI features. They focus on inherent value, but buyers are making relative comparisons.

Examples:

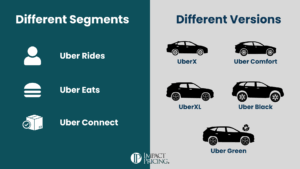

- A product that autowrites marketing copy may be useful (inherent value), but buyers compare it to Jasper, Copy.ai, and ChatGPT (relative value).

- An AI that predicts equipment failure may have huge business impact (inherent value), but the buyer is choosing between vendors who all promise the same thing (relative value).

And if you’re building on the same foundation, like OpenAI, your model isn’t the differentiator. Your UX, integrations, workflows, and brand are.

Where Companies Get It Wrong

Many AI vendors fall into three traps:

1. They confuse tech with value

Just because it uses AI doesn’t make it valuable. If you can’t tie it to time saved, revenue generated, or cost avoided, it’s not valuable.

2. They overlook the buyer’s frame of reference

You may think your solution is innovative. But the buyer may see five vendors with the same pitch. If you don’t spell out what makes you better, they assume you’re the same.

3. They don’t position relative value

Even if you are better, your pricing power depends on how clearly you communicate that. Especially in crowded categories. Not just how your features are better, but the results you can deliver that the alternatives cannot.

Your Job as a Pricer (or Founder, or Product Leader)

- Understand the problem you’re solving. What does the buyer lose today that your solution prevents?

- Know the alternatives. You’re not just competing with other products. You’re competing with in-house solutions, Excel, and inertia.

- Clarify your edge. What makes you better, and does that difference create more profit for your buyer?

- Tie value to results. Especially in B2B, if your AI delivers incremental profit, you can anchor your pricing in that value.

Checklist: How to Assess Value in Your AI Product

Use these questions to evaluate whether your AI solution is creating sufficient value to support pricing, and whether your buyer is clearly perceiving that value.

Inherent Value: Why Do They Buy?

- What problem does your product solve?

- Is that problem large enough to justify action?

- Can the buyer quantify the time saved, errors reduced, or revenue gained?

- Does the product create measurable incremental profit in a standalone scenario?

- Can the buyer succeed without your solution?

Relative Value: Why Do They Buy From You?

- What alternative solutions could the buyer choose?

- What specific feature, result, or integration makes your product better?

- Is your advantage valuable in the buyer’s context, not just technically superior?

- Do you communicate your differentiation clearly and credibly?

- If the buyer compares vendors side by side, do you win?

Signals You Might Be Missing the Mark

- Your pitch focuses on features, not outcomes

- You assume buyers understand what makes you different

- Buyers frequently say, “We’re comparing several tools that all do the same thing.”

- You’re getting trials but not conversions

- You’ve built on the same AI model as competitors but haven’t clarified your edge

Understanding value is the foundation of pricing, whether you’re selling AI, SaaS, or semiconductors. The key is recognizing how buyers make decisions and where your product fits into that process. Inherent value helps answer why they should buy at all. Relative value helps answer why they should buy from you. If you get both right, pricing becomes less about guesswork and more about capturing a fair share of the profit your solution creates.

Share your comments on the LinkedIn post.

Now, go make an impact.

Tags: AI, pricing, pricing metrics, pricing skills, pricing strategy, pricing value

Tags: AI, pricing, pricing metrics, pricing skills, pricing strategy, pricing value