Fede de la Balze is the Co-CEO at Staff Schedule Care and former VP at Pacific Lake Partners, a unique private equity firm specializing in entrepreneurship through acquisition (search funds). With extensive experience in pricing strategy for small and mid-sized businesses, Fede has been instrumental in developing pricing bootcamps for private equity portfolio companies. His journey from supporting searchers to becoming a CEO himself provides valuable insights into the intersection of pricing strategy and business acquisition.

In this episode, Fede shares his fascinating experience with search funds, the critical role of pricing in business valuation, and the unique challenges of implementing pricing strategies as a first-time CEO. Together with Mark, they explore how pricing power indicates business quality, the importance of incremental testing over analysis paralysis, and the evolution of the search fund industry.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Learn about the unique world of search funds and entrepreneurship through acquisition.

- Discover how pricing power serves as a key indicator of business quality and investment potential.

- Understand the practical challenges of implementing pricing strategies as a new CEO.

“Come up with something that’s a little bit better than what you have and put it in front of someone and test it. I think that’s worth a lot.”

– Fede de la Balze

Topics Covered:

01:41 – What is Pacific Lake Partners and how search funds differ from traditional private equity

04:15 – The story that sparked the need for pricing bootcamps in the search fund world

06:33 – Why pricing isn’t just about changing numbers – it’s about market segmentation and value delivery

08:20 – Who owns pricing in small and mid-sized businesses

09:49 – How pricing power became a key criteria in Fede’s business search process

13:22 – The reality of being a searcher – “like floating in midair” with binary outcomes

17:16 – Why the search fund industry is becoming oversaturated with email outreach

18:42 – The three types of knowledge every new CEO must master

21:02 – Dealing with legacy pricing decisions and constraints as a new business owner

Key Takeaways:

“If you don’t think there’s a pricing opportunity, it’s probably not a good business to buy. Not because you’re going to depend on pricing to grow the business necessarily, but because if you don’t think there’s a pricing opportunity, there’s probably not enough value differentiation.” – Fede de la Balze

“The CEO needs to think and understand that this is their calling. No one’s going to figure this out other than them.” – Fede de la Balze

“Pricing is not a one-time event. It’s how you think about how you’re adding value and you should continually be thinking and tweaking your pricing model as you go to align with value.” – Fede de la Balze

Resources and People Mentioned:

- Pacific Lake Partners: https://www.pacificlake.com/

- Staff Schedule Care: https://www.staffschedulecare.com/

- Impact Pricing Bootcamps: https://impactpricing.com/value-optimization-bootcamp/

Connect with Fede de la Balze:

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Fede de la Balze:

Come up with something that’s a little bit better than what you have and put it in front of someone and test it. I think that’s worth a lot. And I think especially if you’re running a small business, like you’re too busy to do a ton of analysis and get to the perfect answer. So small incremental movement and test is just the way to go.

[Intro / Ad]

Mark Stiving:

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the direct relationship between them. I’m Mark Stiving and I run boot camps to help companies get paid more. And our guest today is Fede de la Balze. Did I say your last name right, Fede?

Fede de la Balze:

Yeah. Yeah, that’s pretty close. That’s pretty good.

Mark Stiving:

I don’t think I’ve ever said your last name before.

Here are three things you want to know about Fede before we start. He was a VP at Pacific Lake Partners. He’s currently Co-CEO at staff Schedule Care. And probably the most important thing, he started me down this path of doing boot camps for private equity firms and small and midsize businesses. Welcome Fede.

Fede de la Balze:

Glad to be here. Thank you for having me.

Mark Stiving:

Hey, it’s going to be a lot of fun. Going to be a lot of fun. So I actually want to, I want to talk a little bit about pricing for private equity firms. I want to talk about what you guys did at Pacific Lake. I think what you did was so fascinating and I didn’t, I didn’t even know that type of PE firm existed until you reached out to me.

So let’s start with, what is Pacific Lake and how are they different from any other equity firm?

Fede de la Balze:

Yeah. So Pacific Lake invests in what’s called the search fund world or entrepreneurship through acquisition. And what that means in general is a typical private equity firm, they come up with investment ideas. They go out and they find companies to buy, like, Hey, we really believe in this industry and sector.

And they try to meet people and invest in companies in those sectors and grow them. The Pacific Lake approach is a little bit different where we actually first meet people. We first find entrepreneurs. Typically it’s operators, typically in their mid thirties who have been very successful in their careers and they actually want and are ready to be in a CEO position. And that’s what they want to do from their career.

And essentially we give them funding so that they can go and meet business owners for whom selling to someone like this is a preferred buyer. And there’s a lot of sellers right now in the world that don’t want to sell their company to a private equity firm or to a competitor, or to kind of wind it down and they realize they need an exit.

And what they’re really looking for is someone that will take their company and their legacy to where they want it to go, which typically is to grow more, take care of the employees. And in a way like that’s the niche that Pacific Lake offers.

Mark Stiving:

I found that fascinating. And then I realized there’s a few other firms that do search firms and I’ve met a few other searchers as well. And I just, I thought the whole industry was neat ’cause to have the mentality of being a searcher. Someone is paying you, probably not a lot, but someone’s paying you to go out and look to buy a business. That’s just so unique.

Fede de la Balze:

Yeah, it’s pretty amazing. I’m not American, but this is like the most American thing in the world in a way if you step back about it.

Like what other country could come up with an idea this crazy, which is, you’re going to give someone who’s never been a CEO some money and, again, it’s not a lot, but you know, typically enough to pay your salary and maintain a family for about two years, to go meet business owners and convince one of them and find a good fit with one of them between what you want to do and what you want to build and what they want.

And the crazy thing is it works, right?

Mark Stiving:

Yeah. Well, and so the fact that they were never CEOs before, they’d never run a business before, says that you guys gave them a lot of handholding, right? Pacific Lake gave them, you know, you ran bootcamps in other areas. You supported them with HR, with legal, with all of the things that they really needed support with.

But the question I really want to ask you is, why did you reach out eventually to say, let’s build a pricing bootcamp?

Fede de la Balze:

Yeah, it’s a good question. Trying to think back when we’re going through that. I think one of the stories that kind of brought it to light, the importance of pricing, is we had a company that was a very successful story.

They grew the company tremendously. These two entrepreneurs, they essentially bought a really small business, like $700,000 in ARR. Maybe a million and a half or 2 million in revenue. Like really, really small. And they grew it tremendously. They grew it, I think to like 30 million and they really changed that industry.

And like it was the perfect story for what our kind of model can do when it works really right, which is we find a company that they have all the right pieces. And they just need some capital and they need a couple people that are essentially putting up their hands and saying like, Hey, I’m committing my life. I’m committing my career to making this work.

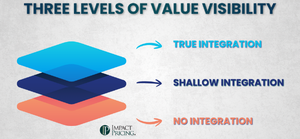

And that particular company I think did extremely well. And one of the things they learned years in is that they had this massive opportunity to rethink their pricing, not only to increase prices because they were undercharging versus competitors, but more importantly to change how they priced in a way that aligned with value for their customers.

And it was a big aha moment for them. And I think that became a little bit of a lesson for others to be like, there’s a big opportunity here that like many folks don’t know how to tackle. And we’re trying to think through like, okay, like we’re supporting many companies, right? Not just two, at least when I was in Pacific Lake.

And the question was always like, Hey, how do we do this at scale? How do we help multiple companies at once? And one model that we had found worked extremely well for CEO training and sales, was to bring three or four CEOs together, small group, super intimate, for two days together in Boston, in an office space where we had one about being a CEO. We had one about building a sales engine.

And then we realized like, Hey, why don’t we do the same thing on the pricing front and use that as a bit of a catalyst. To get people over the initial hump to have to think about pricing.

Mark Stiving:

Awesome story. And this was the company that came and presented at several of the bootcamps that we put together?

Fede de la Balze:

Yeah.

Mark Stiving:

And one of the fascinating things, maybe it’s an embarrassing thing, I don’t know, is that he always got much better reviews for his part than I ever got for any of my parts. People loved listening to his story because it was so powerful.

Fede de la Balze:

Yeah. It’s a part of the story. And when you hear a story of someone that’s your peer and you see what they’ve done, I think there’s lots of things in that story that I think really resonated and it opened people’s eyes to like, one, pricing is not a one-time event.

It’s how you think about how you’re adding value and you should continually be thinking and tweaking your pricing model as you go to align with value. And it also pushes you a really hard focus on delivering customer value. Like the reason this company was able to like ‘increased prices over time’ was because they were just building the right product for this customer set.

So their customers were just super happy because they were getting a great return on, and they were like, yeah, please keep investing because you’re solving more and more of our problems. And yeah, and I think it’s one of the powers of pricing when you think about it the right way. And I think a lot of it, what blocks people from doing more of it is, I think there’s a lot of fear of messing up. And I think there’s also a lot of like, I don’t know where to start, right?

Mark Stiving:

So what I found interesting about the conversation you and I just had, and I don’t know why I hadn’t realized this before. Most companies when they say, I need to go address pricing, they think they need to change the number.

And in truth, what this company did in this whole conversation we’re having is what we really did is we went out and looked at could we create different market segments? Could we change the way the product portfolio was there? Could we tweak the pricing metric and what it is we actually charge for, right?

And so, all of these other decisions come into play to say how do we take this value that we’ve created and deliver it to customers in a way that we get paid more for the value we’re actually delivering? And it isn’t the number. In fact, I think we rarely talked about the number.

Fede de la Balze:

Yeah. I think it’s just adding clarity on like, Hey, what are the things, how are you actually creating value?

Once you know that, well, you know what products you need to enhance. And you know where to invest. And it gives a lot of clarity to companies. But I think one of the interesting things about pricing, this is probably true across the board, but it’s certainly true in small businesses compared to medium size businesses, it’s like, who owns pricing?

And you go to a company and they’re, okay, who owns pricing strategy? The CEO, maybe?

Mark Stiving:

So I’d say in the small and mid-size businesses, it’s almost always the CEO.

Fede de la Balze:

Yeah.

Mark Stiving:

Everybody else is afraid to make the decisions.

Fede de la Balze:

That’s right. So the CEO needs to think and understand that this is their call. Like no one’s going to figure this out other than them.

And in fact, most of their team is probably going to tell them like, we shouldn’t do this. People only see the risk in it. Well, what if something goes wrong or what if someone gets bad? Or what if we just do it wrong?

Mark Stiving:

Yeah. So I was going to give you huge kudos for a second. So you and I did, I dunno, several of these together. And I thought by the time you ended up leaving Pacific Lake, you could have taught these, right? I mean, I was just impressed with how well you understood everything I talked about. So, I just thought that was huge.

And so, then you leave Pacific Lake because you want to go out and be a searcher yourself. It’s like, it’s time for me to become a CEO. How much of what we learned and talked about went into your search criteria?

Fede de la Balze:

Well, it’s a good question. I think at the high level, like any business that doesn’t have pricing power in some form or fashion is probably not a good business. If you’re competing on being the cheapest in your industry, typically that’s not the kind of business you want to buy.

So you typically do want to buy a business that has some level of pricing power because that means there’s some kind of differentiated value or differentiation that you’re bringing to the market. So I think that was very clear in helping me decide, Hey, what kind of business do I want to partner with? I think that’s very important.

Mark Stiving:

So how do you define pricing power? Just prices above market?

Fede de la Balze:

Yeah, it’s a good question. I don’t think that there’s one perfect metric on it. I think there’s a couple things you look at. One of them is the client retention rate. Two is like, how hard is it to move? And three, is competitive analysis.

Why do you win deals? Why do people buy from you? Why do people stay away from you? And the more you hear like, Hey, this is differentiated. I picked you guys ’cause you guys were different on this. The more you’ll know like, hey, like if we’re adding extra value, you are likely going to be able to have a higher price than your competitors.

Mark Stiving:

Nice. Given the story that we were talking about earlier, I could almost imagine that one of the criteria you’re looking at is, do you have a single product and a single price that’s really successful and I know that there’s a lot of room for us to tweak that. Was that a criteria? Were you looking at that?

Fede de la Balze:

Yes. I mean, I think typically for the kinds, like, for certain kinds of businesses, you almost assume you know that there’s a pricing opportunity. If the answer is like, have you ever done a price increase and you talked to a company, or have you ever, like, when was the last time you rethought your pricing?

And the answer very often is like, we haven’t done it in a while. And in fact, when we set up our pricing, our product goes, you know, completely different from what it is today, right? We have more modules, like it’s being used differently. Like it’s even a different value prop. And like I think the more you hear that kind of disconnect, the more you know that there’s probably something here that is doable.

Yeah. But I think that there’s still some judgment and you still need to understand a little bit of the competitive dynamics, but when you see a lot of these signals, I think they’re pointing to like, Hey, there’s probably an opportunity here.

Mark Stiving:

And as you went out and did your search, did you find opportunities where there wasn’t necessarily pricing opportunities, but yet you still thought it might be a really good opportunity for you?

Fede de la Balze:

I think if you don’t think there’s a pricing opportunity, it’s probably not a good business to buy. Not because you’re going to depend on pricing to grow the business necessarily, but because if you don’t think there’s pricing opportunity, there’s probably not enough value differentiation, right? You’re competing on price.

So it’s almost like you should not buy a business that doesn’t have a pricing opportunity. It’s a pretty negative signal. I think that this is something that you would want to own and run.

Mark Stiving:

Yeah. And so out of curiosity, when you buy a business like this, what’s the expected growth rate? What is everybody thinking is going to happen?

Fede de la Balze:

Each company’s kind of different, but some companies are, you know, growing 5, 10%. And that’s what they’ve been growing. It’s, they’re slower growing, but like there’s other ways you create value. You, maybe you have more debt, you’ll buy a cheaper price. It’s more cost savings and like maybe you bring that growth up a little bit.

Some, you know, growing 15, 20% or 30, 40%. So like there’s really a range. And like, I think the piece that’s important is to buy a business where there’s consistency between the price you’re paying and the growth rate.

Mark Stiving:

How hard was searching? Is it like being a salesperson?

Fede de la Balze:

Yes, I think it’s a sales job. It’s a weird sales job in that you only have to do one sale. But I think the best description of searching, it’s a lot like floating in midair where you’re doing a lot of activity and you’re trying to move forward and you’re kind of shaking your arms, but nothing really moves. And it’s day in, day out it is extremely hard to know whether you’ve been, you’ve had a good day or not a good day, right?

And you can come up with these like, vanity metrics of like, okay, I’m going to send this many emails or do this many cold calls, or go to this many conferences per month and meet this many people. And like, all those are good and they’ll keep you sane, but like it’s pretty binary, right? You either buy a business that you think is, it’s a great business to buy or you don’t.

And if you don’t, you probably spend two or three of your life, and I think you’ve learned, I’m sure lots of things about sales, but there isn’t really much of an in between, right?

Mark Stiving:

Nice. So I find it kind of interesting, this whole search field is interesting. I would say in the last year I’ve probably gotten a dozen emails from people asking if I’m interested in selling my business.

Now, I got to say my business is not saleable ’cause it is me. But I’m just shocked that I get so many emails and I never used to. So it feels to me like searching is becoming more common or more important.

Fede de la Balze:

Yeah, I think there’s a couple things. I think the big story here I think is the story around, I think the tools around searching, especially email, have gotten way better at number one, finding companies and their emails.

Like there’s tools today, the grata of the world where like they, they find people’s emails and they sell ’em. And like if you’re a searcher, you get access and you can filter different kinds of companies sizes, growth, and they make it much, much easier for companies. And two, I think, everything that’s AI related and all these sales outbound tools make it that much easier to send emails at scale and to customize them in a way that also feels personable.

So I think what’s happened is there’s been this explosion of email, and I think a lot of sellers are bombarded by it constantly. And I think the typical seller in this side of the market, they probably get somewhere between 1 and 50 emails a week, right? They’re bombarded, right? So if you’re a seller, you get 50 emails a week, right?

And you’re like, Hey, I don’t want to sell. I don’t want to sell for one year. You got 2,500 emails in your inbox. Now many of those are probably the same person. Fine. But at a high level, I think email is probably losing its ability to be a matchmaker in the search world. Just ’cause there’s so much more volume is really hard if you’re a seller to tell like, Hey, is this person legit? Are they a good fit or not?

And I think that’s probably going to change how the market happens and how that matchmaking happens. At the end of the day, if you stop and think about supply and demand, there’s hundreds of thousands of businesses in the US. Two, 300,000 that fit that profile of revenue and EBITDA size.

And there’s hundreds, you know, maybe low thousand searchers. So there’s still this massive mismatch where there’s way more companies than there are searchers. But I think those searchers are just reaching out to way more companies and it’s becoming harder for each individual searcher to kind of stand out.

And I think, my guess is, what’s going to happen is, email is going to be less of an important tool to find deals. And it’s going to be more about network, trade shows, in person events, and searchers becoming more industry experts. So I think searchers, entrepreneurs that like have a particular experience and expertise in an industry.

Maybe they’re, you know, they’ve been working in the supply chain for a very long time. Like, like those are going to be quite successful ’cause they probably have a network, they can speak the language, they’re going to really stand out versus those that are just like emailing and blasting, you know, flipping a coin and, and maybe it’s less than a 50/50 chance of acquiring something.

Mark Stiving:

Yeah. So when you reached out to a whole bunch of different companies, were these companies, you knew they wanted to sell or do you have to ask them, are you interested in selling?

Fede de la Balze:

Yeah. So email didn’t work out that well for me. Typically they’re, you know, you focus on an industry, you become pretty deep in that industry, and you start mapping out, okay, who are the players here that I’m interested in talking to?

I think email typically is not the right way. You see, the ideal way when you start becoming an expert in industry is you start meeting, you can start going to trade shows. So you meet people in person and you have a network, and then one person introduces you to another. You tell them what you’re trying to do and what you’re looking for.

And at some point someone goes like, Hey, look, you should talk to Mark over here. You should talk to John over here. I think you guys will get along. And I think that’s what I found most successful.

Mark Stiving:

Huh. And so, were you in the long-term care business? Is that what you were specializing in?

Fede de la Balze:

Somewhat. It was one of the industries I was looking at. I wasn’t the only one. But I had seen other investments in that space, so I knew it quite well. And my business partner, Tony, came from the healthcare tech space and this is one of the more interesting places that we thought in the healthcare tech space made a lot of sense.

So, yeah. It was just, you know, it was one of those things where, you know, I think it’s a combination of having a focus, a little bit of focus there, and also having a network that knows how to make some introductions.

Mark Stiving:

Okay. We talked about this a little bit before I hit the record button, but I just wanted to ask so everybody else could hear it. What’s it like being thrown into the role of a CEO when you’ve never been A CEO before?

Fede de la Balze:

It’s extremely fun on some days, it’s extremely challenging on other days. It’s like the roller coasters, probably the best way to think about it. And we were talking about this, Mark, but one of the interesting things about my prior role is I work with, you know, dozens of CEOs that were in very similar shoes to the ones that I stepped into a little bit later.

And I got to, you know, work closely with them on hiring and building sales, and I was pretty involved in many of them. And I think there’s a difference between, I think there’s three different kinds of knowledge.

I think there’s the ‘what to do.’ Which is kinda strategic pattern recognition. You’ve seen this movie a hundred times. This is not going to work and this is going to work, high level.

There’s the ‘how to do it,’ right? Which is in the world of pricing that’s like, Hey, how do you actually write an email? What’s a good email, right? When do you send that? How do you send it? Who do you send it to? How do you actually track what pricing communication you’ve done?

And then the third, I think there’s like, and initially like in my mind, that was all the knowledge. It’s like, okay, you need to know what to do and you need to know how to do it. Get those things that you’re good to go.

And I think there’s a third bucket of knowledge that just comes with experience, which is very experiential. I think it is more embodied, which is ‘surviving the ups and downs’ of what it feels like to have customer churn or to have a difficult pricing conversation. I’m like, yes, you can know what to say and how to say it, but I think there’s an emotional piece of it, an exploration piece that is like, I think you have to do it to learn it.

And I think, my journey so far, and look I’ve been CEO for a year, has been, you know, certainly that chart of, you know, you don’t know what you don’t know until you do it. And then you have this curve that goes really quickly down where you’re like, holy moly. You start becoming aware of all the things that you’re not doing as well as you should.

And with time and with the passing of months, you’re like, okay, yeah, I see that’s another gap. And I see that’s another thing that I could be doing better. And I see that, you know, and you start becoming a lot more aware of all those limitations, which I think is the beginning of like starting to get better at it. But I think initially you start from not knowing what you don’t know.

Mark Stiving:

Yeah. So I always thought this was fascinating because you were really good at being super confident telling people this is what you need to go do, right? And so, it was really nice to hear that and see that. And then, to hear you say, yeah, but it’s different when you actually have to do it, right?

Okay. So back to something else you said earlier. In your company, who owns pricing?

Fede de la Balze:

The co-CEOs. So, me and Tony, my business partner.

Mark Stiving:

Nice. Those are tough decisions, right? You can’t just pass it off onto somebody else.

Fede de la Balze:

No. And there’s a lot of legacy decisions that someone’s made years and years into the past, the way contracts are written, and grandfather customers.

And there’s a lot of decisions that can be made and you don’t have full scope of doing exactly what you would want from a pricing model perspective. You kind of have to just have an idea for where you want to go and start slowly moving that way.

Mark Stiving:

Right. I mean there’s always constraints. We’ve got to deal with whatever constraints we’re handed and we try to figure out how to get a little bit better at the pricing of the things we have to do.

So Fede, I’ve enjoyed this immensely. I hope everybody else has as well. I’m going to ask you the question I always ask at the end anyway. What is one piece of pricing advice you would give our listeners that you think could have a big impact on their business?

Fede de la Balze:

It’s a good question. I think the bias to action and not overanalyzing of like, come out with something that’s a little bit better than what you have and put it in front of someone and test it. I think that’s worth a lot. And I think especially if you’re running a small business, like you’re too busy to do a ton of analysis and get to the perfect answer. So small incremental movement and test is just the way to go.

Mark Stiving:

I love that advice. I think not enough people are just trying things. I think since you and I have worked together, I’ve come to the belief structure that says you should have an annual plan. So this is what we’re going to try to get accomplished from a big picture perspective. And we should be doing quarterly tests, right?

Every quarter we’re doing something new to see what happens. Then we can either roll it back or do more of it the following quarter. So, I love that advice. Allright, Fede, thank you so much for your time today. If anybody wants to contact you, how can they do that?

Fede de la Balze:

They can reach out to me on LinkedIn. I’m pretty active on LinkedIn. So, if you send me a message, I’ll reply.

Mark Stiving:

Excellent. We’ll put the LinkedIn URL in the show notes. To our listeners, thank you for your time. If you enjoyed this, would you please leave us a rating and a review. And if you have any questions or comments about the podcast or if your company wants to be paid more for the value you deliver, email me, [email protected].

Now go make an impact.

[Ad / Outro]