You can listen to the full audio version of this blog we call — Blogcast.

Worldwide, tariffs are in flux. I’ve read a lot of great advice on how to prepare for them. For example, long-term contracts should be written so that you don’t have to absorb all new tariffs. This post, however, focuses on how to price to win new customers after new tariffs are enacted. To keep this simple (and sadly realistic), let’s use the example of a product being built in Europe and sold in the US as the US raises tariffs.

As usual, pricing basics haven’t changed. The key is knowing which pricing frameworks to use when the world changes. Always start by looking at the buyers’ decisions. Once a buyer decides to buy a product like yours, they decide which one. They choose between your product and a competitor’s product. What’s the next best alternative if they don’t buy from you?

If all of your competitors are from Europe, then everyone gets hit with the same tariff. As long as everyone is impacted by the tariff, you should be able to just add the tariff to your price. Your competitors should do the same. Overall demand may decrease a little, but market shares will remain about the same.

What if your key competitor manufactures in the US? That is a problem. You get hit with a tariff and your competitor doesn’t. Put yourself in the minds of your buyers. If you are used to pricing at parity relative to the value you deliver, the tariff didn’t change the value proposition to the buyer. So your price shouldn’t change. That implies you must absorb the cost of the tariff. Ouch! However, your costs and margin requirements may not permit you to hold the price. If you raise prices to recapture even a portion of the tariff, many new buyers will buy the US-based product. Your profits will go down no matter what you do.

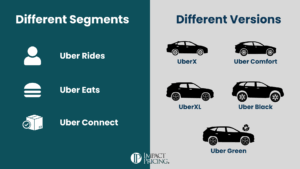

Another strategy against US-based competition is to target a smaller market segment. Some buyers value your differentiation much more than others, but you were probably priced to capture the larger audience. You could focus on those specific buyers, which may make it possible to pass through the tariffs. Of course, your market share decreases, but you identify and market to those buyers who are willing to pay more so you don’t lose your entire presence.

Market shocks are difficult to manage. Do you remember how Covid changed the demand of everything almost overnight? Tariffs, especially as they are talked about today, are market shocks. You want to prepare for them and even try to influence them. But in the end, you have to make pricing decisions based on the current market, not what you wish is true.

My advice: always put yourself in the shoes (minds) of your buyers. They get to make the final decision.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: pricing, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value

Tags: pricing, pricing foundations, pricing metrics, pricing skills, pricing strategy, pricing value