In this episode, Dave shares how understanding market segmentation will help you figure out what consumers are willing to pay so you focus on that segment when you launch a new product. If you are an early-stage company who is concerned about building out a product, you can listen to Dave talk about growth hacking concepts. He also talks about the obstacles and advantages concept you can derive insights from.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Learn about the factors to consider in revisiting your pricing so you don’t leave money on the table

- Discover about using objectives and key results (OKRs) for a clearly defined product launch success

- Learn how to figure out where the least resistance lies so you meet your product launch objective and key results

“I would deeply understand their motivations for solving the problem that they want to solve. Because how acute that motivation is will largely determine what their willingness to pay us.”

– Dave Daniels

Topics Covered:

02:07 – Talking about the price class he took while he was at Pragmatic Institute

03:56 – Using objective key results for defining a successful launch

06:06 – What does it take to launch a product

07:32 – How do pricing and product launch tie together

11:57 – What is a concept of obstacles and advantages

14:38 – Why is it easier for startup companies to figure out their obstacles and advantages

17:37 – Taking the whole growth hacking concept for startup companies

19:31 – Setting price for new products

22:06 – How frequently do you change your price

24:39 – Validation of pricing by market segment

25:24 – How to factor in price segmentation over the lifecycle of a product

27:07 – Willingness to pay and how everybody relates to this phrase

29:07 – Your reputation and charging premium

Key Takeaways:

“Everyone says I want a successful product, but few of them define what success actually is. And so, my thinking has now evolved into using objectives and key results, OKRs, as a mechanism for clearly defining the success of a launch.” – Dave Daniels

“Your market segment and that competitive landscape will influence the willingness to pay for buyers that are in that market segment.” – Dave Daniels

“In order for us to be successful with that customer in that market segment who’s willing to pay the price that we want to charge, then what are the barriers that will keep us from being successful? So, what are our obstacles because we got to get rid of those.” – Dave Daniels

“As a startup, that’s a lot easier to figure out your advantages and obstacles. Because if you look at the ledger, you have a whole lot of things in the obstacles column, and you have very few things in the advantages column.” – Dave Daniels

Connect with Dave Daniels:

- LinkedIn: https://www.linkedin.com/in/davidkeithdaniels/

- Email: [email protected]

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Dave Daniels

I would deeply understand their motivations for solving the problem that they want to solve. Because how acute that motivation is will largely determine their willingness to pay us.

[Intro]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the accelerating relationship between them. I’m Mark Stiving. Today, our guest is Dave Daniels. And here are three things you want to know about Dave before we start. He is the only expert in product launch that I know or know of. He and I both had a chance to teach at Pragmatic Institute together. And he is the founder of BrainKraft, which is dedicated to helping companies master launches. And I guess, is a fourth; I’m actually happy to call him a friend. Welcome, Dave.

Dave Daniels

Hello, friend, how are you today? Well, only a friend would know that his dog is named Jake. Where’s Jake?

Mark Stiving

All right. Doing well, helping people do their launch thing and figure out what a launch is versus a successful launch. So, we’re helping them one at a time.

I’m looking forward to talking about that and how we tie the price in together. But I want to tell a really quick story, so I can launch into a question. When you first joined Pragmatic, you took the launch course, which is really cool. When I first joined Pragmatic, I took the price course which was really cool. And I got to learn how to teach launch. I love some of the aha’s in that class. You got to learn how to teach price. Would you tell me how great the price class is?

Dave Daniels

The price class is awesome. No, seriously, it’s awesome. I walk into it with years and years of experience thinking, oh, yes, pricing; the more I got to know you, that I read your book, and I got into the content and really understood it. And I think I was one of the few who actually got sort of the inside track of what those slides were really about. What does this really mean? And there were so many good things I got out of the launch class that actually still use today. I mean, I use in BrainKraft. And I will occasionally use it when I’m talking to a client, and they’ll say, well, we’re having an issue with this. I’m not, of course, I recommend you. But you know, I’ll ask him something like, so, is your product a will I or which one?

Mark Stiving

Okay, I got to say, Dave, I feel really guilty. I asked that as a joke. And thank you for the nice words.

Dave Daniels

Well, it is a great course. It’s based on a great book, from a great guy.

Mark Stiving

Let’s jump to talking about launch now. Thank you, by the way, let’s talk about the launch. When I was learning to teach the launch class with Pragmatic, I was amazed at the aha’s, the things that I didn’t even realize; oh, my gosh, this is launch. And that’s pretty fascinating. I would say the two biggest aha’s I had in the whole thing is that release and launch are different. I love that. And the fact that we need a set of goals to get us up the mountain, to get us to the point where we want to go. And those goals are not obvious when you first start out. Any thoughts? I mean, are those like the two big aha’s that most people get?

Dave Daniels

Yeah, those are in that course over several decades now, my thinking has evolved. I’ve had more exposure to more companies, and many, many more companies and many different complexities. But I got to tell you, the biggest problem that most companies have is they had no Northstar when they launched their product; they have no inkling. Everyone says I want a successful product, but few of them define what success actually is. And so, my thinking is now evolved into using objectives and key results OKRs as a mechanism for clearly defining the success of a launch. We can look at, hey, we’re trying to get this done. And then we can say, well, what does that mean? What are the key results, they show us that we’re getting there, and you can come up with a short set of three, maybe five and then the beauty of OKRs in the context of launch is, they allow you to cascade down into different operational parts of the business. And you realize what’s it going to take to sell that amount? What kind of pipeline are we going to need? And how are we going to drive demand and all of the things that go with that, which aren’t readily obvious, because you think, oh, we’re going to get 15 million in revenue, we’re going to throw it over the wall to sales, and they’re going to have all these great tools. We’re going to get everybody together and make some videos, and then we’re going to make 15 million in revenue. And no one really, few, I should say no, but few actually drill that down into. Alright, so what’s that actually going to take?

Mark Stiving

Yeah, I find it fascinating because I didn’t even think that launch was a thing before I took your class.

Dave Daniels

What is wrong with you?

Mark Stiving

I know. When we launch new products, it makes sense that you have to release them and get them in the marketplace. But don’t just love them because I built a better mousetrap.

Dave Daniels

Well, yeah, you’d like to think so, wouldn’t you? You’d like to think all I got to do is get the product on and get it out the door, and people are going to see it, and they’re going to fall in love with it. And they’re going to throw money at our feet. That’s what happens every time. I guess if you price it properly, but (to use an old African proverb) it takes a village to get a product out the door and prepare an organization to actually promote it, be able to sell it, be able to deliver it, be able to make sure we get money for it, we get paid. Make sure we can support it. I saw a lot of work that happened. It’s a big cross-functional initiative. And too often, it’s just relegated to one part of the organization.

Mark Stiving

Yeah. Okay. I agree completely. And I think coming up with these objectives, OKRs goals, however, we want to say it, the things that we need to do in order to be successful with whatever that final launch goal really is, our key. This is obviously a pricing podcast. So, when does pricing come into play? In your mind when you’re thinking about pricing, and you’re thinking about product launch? When do you think pricing comes into play?

Dave Daniels

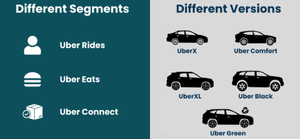

We’ve had this conversation before, and I’ve had a lot more time to think about my answer to that really insightful question. And there’s really two aspects to this. There are all of the things you talk about. There are the realities of your environment that you’re launching into. But you also have the other factors that I can tie in, like, sometimes what we do is we come to the table, and we have a one price fits all pricing strategy like this is how much we’re going to sell our product for. I haven’t considered, for example, price segmentation. Why this group of people, who has a problem we can solve, are highly motivated to solve that problem quickly. And they’re just like, get it to me as fast as you possibly can. Here’s money, just tell me if it’s enough. They’re not as price sensitive. Whereas another market segment might be huge in terms of the overall opportunity. But it might also be crowded competitively, where we have a lot more of a, which one buying decision going on where we don’t have as much control, so we can’t charge as much relative to the competitive landscape. I think there are two spots. What I’m getting at there’s the initial thought of coming from typically some strategic part of the product team that saying, we believe we should price our product about this much. And then there’s some stuff that goes on around that. But then there’s the reality. And the reality is, once you start doing your analysis and my spin on how to identify good market segments starts with what’s my ideal customer profile. Who’s the person who really has this problem I can solve? Then step two is where do they hang out? Where can I find groups of them? Market segments. Once I can figure out what those market segments are, I can look at who’s competing in that market segment to figure out who my competitive landscape is. Most organizations start with, here’s my target market segment, broadly defined, and then they determine who their competitors are based on the product category, not the market segment. And then they back into the ideal customer profile. I reverse that process and say, let’s start with that. Where I’m getting to be long-winded or windy, as my mother used to say, to Pennsylvania Dutch say, is your market segment and that competitive landscape will influence for example, the willingness to pay for buyers in that market segment. Now, ideally, I’d like to find lots of market segments where my product is a will I, and I don’t have price-sensitive customers. But that’s not reality. You got to spread that out. And some market segments look incredibly beautiful on the surface because you see, they’re underserved, and there’s lots of opportunity. But when you start digging into it, the willingness to pay isn’t what you think it would be. All of the effort that could go into getting 1000 sales over here could be equal to just 100 sales over here and this other market segment. And it’s important to think about that. It’s not a straight-line decision of where pricing comes in? I think it starts with a business case for the product. Where’s the revenue and that kind of thing? There’s a general understanding. But then there’s the reality of, well, who’s going to buy this? What segments are they in? And what competition are we up against?

Mark Stiving

So, Dave, I’m going to say what you just said. But I’m going to say it differently. And I think this was super insightful. I’m sorry that I had to compliment you.

Dave Daniels

I know, you’re going to say, but I’m going to say it better.

Mark Stiving

But instead of saying, hey, here’s how we find our price, or here’s when we set price, what you actually just said was, we need to understand our market’s willingness to pay so that we can choose the right market segment to go after when we launch our products.

Dave Daniels

Exactly. That’s one of the factors, is to figure out where will we have the least resistance in order to achieve the OKRs for the launch, and if a key result is revenue, you don’t just want to throw it out there and figure out what’s going to put a sticker, not what you’re trying to do is figure out and I’m going to add another layer to this, it’s a concept of obstacles and advantages. Now, once you’ve found a market segment that you think is ideal, so there are buyers with the right motivation, and they’ve got the right buying criteria that match your product. You don’t have to worry about discounting as much. And you’re in what I call the winning zone. You’ve got all the pieces lined up. Another thing you have to factor in is, what are our advantages, and what our obstacles are as an organization. An advantage is only an advantage if your customer believes it’s an advantage, not because you wrote it on a whiteboard or put it up on a slide on a PowerPoint slide in a rah-rah meeting. Most companies have a little bit too much optimism about what their advantages are. And so, they tend to inflate them more than they actually are. Obstacles are just merely the opposite of that. And that is, in order for us to be successful with that customer in that market segment who’s willing to pay the price that we want to charge, then what are the barriers that will keep us from being successful? What are our obstacles because we got to get rid of those? And those two things can help modulate what you can do around pricing. If you can’t remove the barriers that might affect how much you charge if you have many advantages, that may also positively affect what you can charge and where you can charge it.

Mark Stiving

I think that makes a ton of sense. Absolutely. As you were answering the question, I was actually replaying in my mind a conversation I had with a director of innovation at the University of Nevada, Reno the other day, and she’s trying to coach entrepreneurial companies. The ones with a high potential for scale. When you talk about launch, it almost sounds like we’re usually talking about big companies launching products. Do you think your concepts apply to entrepreneur launches? Do they scale it back a little bit, or is it the same thing?

Dave Daniels

Yeah, my experience comes from the larger companies. I tend to gravitate in that direction. But I have worked in smaller organizations, too. It just means that in a smaller organization, all of the roles are still there. They’re just not spread out among as many people. The short answer to your question is that it works beautifully in early-stage companies because it often puts them in a situation where they’re asking questions they’ve never thought to ask. Because they’re more concerned about the product and the features and building it, and getting it in the right environment and all the stuff, all the really hard stuff around building the product. It’s that segue that they have difficulty within getting that product now in front of people who actually care. And yeah, as a startup, that’s a lot easier to figure out your advantages and obstacles. Because if you look at the ledger, you have a whole lot of things in the obstacles column, and you have very few things in the advantages column. It’s easier to figure some of those things out; it’s just that the scale is much, much smaller.

Advertisement

Pricing decisions feel risky. How nervous are you knowing you need to raise prices? When, where, and how much should you raise prices, so you don’t lose customers or lower your rate of new customer acquisition. It’s risky enough to make you want to put it off till next year, along with any growth. But pricing doesn’t have to be such a mystery. When I work with clients as their go-to resource for pricing advice, I help them better understand the value of their products, and how their buyers use price to make purchase decisions. We jointly create strategies they’re confident implementing. I can do the same for you. Together, you and I apply pricing frameworks to your price increase initiatives or your new product launches, or even moving to new pricing models like subscriptions, the best pricing decision you can make right now is to gain access to proven pricing advice. Take some risk out of your pricing. Learn more at impactpricing.com/advisor. I look forward to working with you.

Mark Stiving

Okay, that was actually a setup for my next question because she asked about pricing for these people, pricing the new products they’re trying to come up with. And I had a mini epiphany. And I said I don’t think it matters that much. And the reason I said that was you need to get some revenue; you need to prove the people are willing to buy it. But there’s so much we don’t know yet. We’re going to tweak it; we’re going to twist it. And it’s going to happen a month from now or three months from now or six months from now; it doesn’t really matter that we get it right, coming out of the gate.

Dave Daniels

And you won’t get it right. Absolutely. You’re not going to get it right. Yeah, it is the whole growth hacking concept. You start with a hypothesis; you build an experiment around that hypothesis; you execute the experiment in a very short window of time you look at the data you’ve received. And you either go, aha, here’s something we should do, or you go, well, that didn’t work. So, let’s now do another experiment. The only difference is that in an early-stage company, a startup like that you’re doing those in really short cycles. You’re not doing anything with empirical data; you’re just getting enough to go, hmm, we’re going in the right direction. Let’s keep doing more of that because that was working. And then you find another little tweak and another little tweak, and eventually, something lands, and then you can just take off. But for the early-stage companies that are listening, don’t get depressed, right? Just think in terms of what experiment can I run over the next two weeks? What do I hope to learn from that, and then do another experiment and another experiment and just keep doing them and doing them? I know, it’s going to feel a little bit like running your head against the brick wall. But eventually, the brick wall is going to fall down.

Mark Stiving

Right. And obviously, they have ideas that they think are solving market problems someplace. They think that somebody really cares. Otherwise, they wouldn’t have built the product or rebuilt the company. Now we’re out trying to prove it. We’re trying to find those market segments that are willing to pay us the most? And how much would they pay us? And it’s just experiment after experiment. I think that makes a ton of sense. So, would you say the same thing for big companies, as in a big company is about to launch a new product? Does the initial price matter?

Dave Daniels

For a big company? The short answer to that is, it depends. And the reason I say it depends is because if the product is strategic to the growth of the business, then the price that they charge may be an incredibly valuable and important thing that they do. If it’s yet another product to an existing portfolio that’s been successful there may be boundaries. Guard rails around what you can or can’t do because you don’t want to eat your young, as it were. You don’t want to set a price on a product that will now suddenly think about customers coming back again. With your charge in this price for that, which is much lower, why do you charge so much for the other thing? And that can create a lot of problems for sales teams. But it really depends it’s, once again, go back to the customer, what problem are we solving? Are they highly motivated to solve that problem? What’s their willingness to pay? What market segment are they in, and then go from there, I’ve seen time and time again, Mark, where big companies, they can’t let go of the past, they can’t let go of the glory days, they can’t let go of when they could walk in and say, this is the price. If you want it, you pay this price. And now the markets evolved, and they’ve got competitors, and they can’t do what they used to do. But now the leaders in the company who grew up in the company are going, well, why can’t we do that? Because they remember the good old days, the glory days, and I think their own DNA creates these boundary conditions, these guard rails that prevent them from making mistakes, but at the same time, prevent them from taking on new opportunities,

Mark Stiving

Or trying risky things, trying something that might make a big difference.

Dave Daniels

Right, right.

Mark Stiving

One of the things that often happens in pricing and I make fun of this all the time, is that companies use the set it and forget it rule. Set that price; I just don’t ever want to revisit that again.

Dave Daniels

That was painful. Yeah, I don’t want to do that again.

Mark Stiving

It feels like at launch; we need to set it and revisit it frequently in the near future. Is that part of the launch plan or launch process you already put together?

Dave Daniels

I have not. I consider that part of the overall lifecycle of the products. For example, if you look at launch, it starts with planning and setting objectives. Then there’s a preparation phase (if you will) getting the organization and partners ready, perhaps the market, and then there’s going to market with it. And then there’s acceleration, and then boom, you hit your launch objectives, your OKRs, you’re out. Okay, now, the question is, what have you learned from that? And are you finding, for example, what was one question you would always pose is, what if you’re doing win-loss interviews and find out what is it? No one ever asked for a discount, or what is it? There was no competitor? What does that mean? Are you not charging enough? So, you’re leaving money on the table? Now, the other factor that goes into pricing over time is the product category. Where is the category heading? For example, will Tesla be able to sustain a premium pricing model over time, maybe? Maybe they’ll take the Mercedes, BMW, Jaguar route and they’ll always be a premium product. Or they can’t; there’ll become too much competition. They’ll have to succumb to the norms within that competitive framework. But that’s something that has to be visited over time because we might be able to charge more in one market segment. And we might have to charge less in another market segment. And if I’m in a big company, I’m dealing with a lot of markets, I’m looking at this, I’m assuming here, the pricing is where I would assume I would be looking at this at a portfolio level, just like a big discount store does right at Walmart, like that. They’re tweaking this here, but they’re raising this thing over here. And they’re just constantly adjusting those things. How frequently you can change your price depends on how much tolerance your customers have, you know, what and the market has?

Mark Stiving

Yeah, I almost think, and I haven’t spent a ton of time thinking about this. But I almost think that even for big companies, when you first launch, you should have an expectation in your mind that you’re moving the price soon. We’re testing; we’re tweaking, we don’t have it. Right?

Dave Daniels

That could be one of your launch OKRs. That could be validation of pricing by market segment or something like that over some time. The question is, will you have enough data and insight during that launch window to make that decision, sometimes it’s really obvious. Sometimes it’s not.

Mark Stiving

The other thing you talk about a lot is to pick a segment. Which segment are you going after? And it may be that we got the right price for that segment. But when we go off to the next segment, it’s going to be a different price. And it’s going to be, we’re going to do something differently. And so, I could see that, playing a role.

Dave Daniels

Yeah, for example, let me run this by, bring a new product to market, launch it, go after segment A, and you’ve done your homework and figured out that price you’re charging is appropriate for buyers in segment A. Now you’ve learned there’s a segment B you could go after. In the next version of the product, you make some major changes so that you can go after segment B. Now, to your point, should we be charging the same price for segment B so significantly different that we can charge a different price for them? Or did we opt to go after segment B because it’s just huge? And it would allow us to grow really fast, but we’re not going to be able to charge the price we used to we’re going to have to deliver that product in a different way, maybe at a lower cost point to us to get the same level of margin that we’re going to need to get from by charging less. The point I’m trying to make is that I don’t know that the frequency would be high enough within one product launch to make those decisions. But it’s an important thing to factor in over the lifecycle of the product.

Mark Stiving

Good, good, slightly changing topics. As we’ve been having this conversation, I dearly love the fact that you say the words willingness to pay or willing to pay over and over again. Now maybe you’re saying that because you’re talking to me. Now, I’m really curious, when you talk to other clients, do you say the willingness to pay when you talk about market segments?

Dave Daniels

Absolutely.

Mark Stiving

Is it not about me and pricing?

Dave Daniels

Right. It’s something that everybody can relate to. It’s a phrase that you create. Are you willing to pay for that price for that car? Are you willing to pay for that meal out at that restaurant? People can viscerally connect to that as opposed to charging the highest price the market can bear. Well, what does that mean? It means that people will walk in and they’ll go, sure, here’s my money, give me the thing and then walk out. And they won’t say give me a coupon. Or can I get a discount or any of that kind of thing? Me, I always ask for a discount. It’s just the way I am. If I can get just a little bit more, I just bought something the other day, oh, tires. I just bought tires the other day. I said, (and I hate buying tires) I just said to the guy, I’m standing there, and I think I’d be willing to pay that price of those tires anyway; it seems like a reasonable price to me. And I looked on my phone. And I said, Sir, is there anything you can do about the price? Boom, he took 10% right off the top?

Mark Stiving

Like, there you go.

Dave Daniels

There’s a dinner out.

Mark Stiving

Nice. Well, that’s everybody just made money by learning how to ask that question.

Dave Daniels

Now. Bingo on the price. Yeah, sometimes I think people feel uncomfortable doing that, like they’re begging or something. I’m not. Can you help me out?

Mark Stiving

So, I’m going to go back to the question I asked her. The comment I made isn’t the phrase willing to pay although I think that’s what I said, it’s really the fact that you’re using the concept of customers’ willingness to pay to drive so many other decisions in the launch. What market segments we go after? How are we going to communicate that to them? These are all really important things. But it comes back to my belief: pricing is the tip of the spear. Once I understand a customer’s willingness to pay, it drives all those other decisions. And I love the fact that you say that so much.

Dave Daniels

Oh, thank you. Well, look at this example. Let’s say that we are a company that already has products in the market, and we are able to charge a premium. And our customers do not balk at that. As a matter of fact, we accept that not everybody will buy from us and we’re happily charging a premium. That could be an advantage to us in launching a new product because we can say we have a really good brand people value what we do, we’ve got great respect and authority in the markets we serve. An advantage to us is we can charge a premium. Now, if we were, we didn’t have that authority, and we didn’t have that brand reputation. Our board or CEO is insistent about charging a premium price because somebody else can charge it, we might actually find that to be an obstacle to achieving our launch goals because, yeah, it’s fine, we can offer the price and they’re going to look at us. They’re going to say, well, we are willing to pay higher for the BMW because well, they’re BMW. And you’re not BMW; you’ve only been around for a couple of years. So, we’re not willing to pay that price. And so now, all of a sudden, it becomes an obstacle, don’t worry, the sales guy is going to get a sale. If the customer likes it, the prospect likes it. But the point I’m trying to make is sometimes the advantages, and the obstacles aren’t so obvious. And pricing can be one of those and whether you can charge or not a premium.

Mark Stiving

Dave, if one of us is being long-winded because we are way over time already.

Dave Daniels

We’re always long-winded. I’m going to blame you.

Mark Stiving

But can you try to answer the last question simply? What’s one piece of pricing advice you would give our listeners that you think would greatly impact their business?

Dave Daniels

One piece of pricing advice, I would deeply understand their motivations for solving the problem they want to solve. Because how acute that motivation is will largely determine their willingness to pay us.

Mark Stiving

Fabulous answer. Wow, it’s almost like…

Dave Daniels

I wouldn’t even practice or anything.

Mark Stiving

Dave, thank you so much for your time today. If they want to contact you. How can they do that?

Dave Daniels

You can either go to the website, BrainKraft website at brainkraft with a k.com or just email me at [email protected].

Mark Stiving

And those will be in the show notes, as well. So, Episode 120 is all done in the can. This is the time in the podcast where I beg all of you listeners to please leave us reviews on Apple Podcasts or wherever you happen to listen. They’re hugely valuable to us. And finally, if you have any questions or comments about the podcast or about pricing in general, feel free to email me [email protected]. Now, go make an impact!

Podcast: Play in new window | Download

Tags: Accelerate Your Subscription Business, ask a pricing expert, pricing metrics, pricing strategy