Steven Forth is Ibbaka’s Co-Founder, CEO, and Partner. Ibbaka is a strategic pricing advisory firm. He was CEO of LeveragePoint Innovations Inc., a SaaS business.

In this episode, Steven emphasizes the importance of shaping willingness to pay by understanding and communicating real value to customers. He also highlights the role of AI and context-driven pricing in adapting to customer needs dynamically, stressing that consistent delivery and documentation of promised value are crucial for long-term retention.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Explore the nuances of pricing strategies, distinguishing between perceived, real, and proven value and how each impacts customer retention and willingness to pay.

- Learn why documenting value delivered to customers can significantly reduce churn, with actionable steps to demonstrate value in B2B sales.

- Gain insights on Context-Driven Pricing, offering a fresh approach to optimize pricing in real time.

“You need to make sure that the value you promise in sales is the value that you deliver and that you can document that value. Because if you don’t do that, you’re going to struggle with renewals.”

– Steven Forth

Topics Covered:

02:09 – Why Steven believes that value-based pricing and willingness to pay are distinct, with value coming first shaping willingness to pay

06:19 – How techniques from behavioral economics, like anchoring, actually impact value perception rather than solely increasing willingness to pay

07:12 – Acknowledging Mark’s example of using “good-better-best” as a framing strategy but argues that it’s more than just a “trick”

10:40 – Introducing his concept of generative pricing, which leverages generative AI to dynamically adjust product configurations and prices based on each buyer’s context

12:35 – Steven emphasizes the need for a clear value model rather than solely relying on AI-driven willingness-to-pay estimates

14:49 – Highlights how value is not only unique to each customer but also varies over time for the same customer

17:05 – Underscoring that willingness to pay is actively shaped by how a company communicates and delivers value

18:34 – Emphasizes the need for a value model in pricing, contrasting it with software approaches like revenue management that estimate willingness to pay without actively shaping it

20:37 – Explaining why B2B pricing cannot rely on traditional price elasticity curves

21:36 – Steven’s best pricing advice

Key Takeaways:

“Willingness to pay is an outcome that you shape. It’s not something that is given to you by something outside of your product and how you sell it, and that you play a huge role in defining the context.” – Steven Forth

“We want people to pay a fair amount of money. If I can trick someone into paying more than something’s valuable, greater than its actual value, and value in this case means the economic return they’re going to get, I don’t think I’ve done myself a service in the long term.” – Steven Forth

People/Resources Mentioned:

- Pros: https://pros.com

- Pricefx: https://www.pricefx.com

- Zilliant: https://zilliant.com

- Vendavo: https://www.vendavo.com

- Tom Nagle: https://impactpricing.com/podcast/604-insights-into-value-based-pricing-strategies-for-b2b-with-tom-nagle/

- Barret Thompson: https://impactpricing.com/?s=barrett+thompson

- B.F. Skinner: https://en.wikipedia.org/wiki/B._F._Skinner

Connect with Steven Forth:

- LinkedIn: https://www.linkedin.com/in/stevenforth/

- Email: [email protected]

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Steven Forth

You need to make sure that the value you promise in sales is the value that you deliver and that you can document that value. Because if you don’t do that, you’re going to struggle with renewals.

[Intro / Ad]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the transformative relationship between them. I’m Mark Stiving, and our guest today is Steven Forth. And Steven, by now, so I’m not even going to give you three things other than he’s probably now the world’s foremost expert on AI and pricing. Although we’re not going to talk about AI today unless it happens to come up. Welcome, Steven.

Steven Forth

Great to be talking again, Mark.

Mark Stiving

Hey, we’re going to have a mini argument, I think. I hope, actually. And we’re going to talk about value-based pricing and willingness to pay and other topics like that. And it turns out that I wrote a blog probably a couple months ago, and I don’t even remember the topic. I probably should have looked at it, but it was something like value-based pricing and willingness to pay were the same thing. And that’s how I used to define value-based pricing is willingness to pay. And a bunch of pricing experts wrote on there, ‘Hey, that’s not the right definition.’ And I’m kind of tired of that, but I want to hear from you first before I tell you where I’m heading. Is value-based pricing the same thing as willingness to pay? Are they different? What do you think about those?

Steven Forth

Thanks, Mark and I passionately believe that they are different. And the reason that I believe that is, first, willingness to pay, I think, historically has been promoted by the heavy metal pricing vendor, pricing software vendors. And we all know who they are but I’ll just name a few of them. Pros and Pricefx, and all of a sudden, I’m blanking on the other two.

Mark Stiving

Zilliant, Vendavo.

Steven Forth

Yes. Yeah. Thank you..

Mark Stiving

You’re welcome.

Steven Forth

I have a senior moment, but I’m embarrassed to have had that scene. But anyway, so, those guys what they do is that they have some fairly sophisticated models that based on your data estimate what they think your willingness to pay is. And then they give you a price that is based on that estimated willingness to pay. And basically they have a black box that comes up with a number. And the salespeople are expected to sell to that number. Now, I think there’s a whole list of problems with this. First of all, if I’m a buyer and I say, well, why should I pay that price? You can’t very well say, well, our fancy AI said that that’s the price you should be willing to pay. As a buyer, I don’t care.

Mark Stiving

Certainly agree with that.

Steven Forth

So, I don’t think any salesperson is dumb enough to say that. But that’s sort of the implication. And the second thing is that willingness to pay is, I don’t think it’s a given. I think it’s something that you shape. And in fact, Mark, your books, many of them talk about how you shape willingness to pay. So there are actions that you can take that change willingness to pay. So my focus is on those actions that you take. But as you’re setting up the conversation about price that determines willingness to pay, and if you think of Tom Nagle’s original economic value estimation, EVE models, what they do is they estimate the value that’s being provided to your customer. And then you can claim a part of that value. And how much of it you can claim depends on a number of factors, such as your brand strength such as the risk of actually realizing the value such as the amount of evidence you have to support your value claims, et cetera. So that allows you to have a big ability to shape willingness to pay. And so, to me value comes before willingness to pay and it’s one of the things that allows you to shape it. So when you conflate value and willingness to pay, I think you lose the power of value-based pricing and the ability to structure those conversations.

Mark Stiving

Okay. So, I want to start by saying you didn’t say anything that I can disagree with. So that annoys me. But we think about this quite differently, right? And so, let’s have a conversation about value for a second. And I often teach the difference between perceived value and real value. And so real value is what I actually got after I bought and used the product. How much value was their perceived value as what did I believe before I bought the product? And as you rightly said, a good salesperson increases perceived value, right? My job as a salesperson is to communicate the value of my product to you as a customer, so that over time you believe more and more and more that I have this value. And so how much are you willing to pay for a product? It has everything to do with how much value you believe you are going to get. And so that’s why I conflate these two a lot. Now, on the other hand, I’m going to agree with you in that willingness to pay in value isn’t the same thing, because there’s a whole other side of pricing that I often make fun of, and that’s called behavioral economics, right? And behavioral economics, I can get you to pay more without changing your value perceptions. Right? Go ahead.

Steven Forth

I think it probably does. A lot of the behavioral economics tricks I think do lead to a change in the value perception, like the anchoring and I also want to say that I think that that kind of behavioral economics gives us people in pricing a bad name. And inflating the perception of value also gives us a bad name, at least with customer success.

Mark Stiving

So inflating it beyond reality, absolutely. But if I tell you, ‘Hey, I just built this new software package, how much are you willing to pay for me?’ Your first question is, ‘Well, what does it do?’ Your value is zero. And then as I start to explain and give you information, you start increasing your perception of the value of the product. Now, if I inflate that too high, if I lie, then you’re totally right.

Steven Forth

Yeah. Okay, I think we’re in alignment here. Coming back to just briefly on behavioral pricing, I think many of the sort of fundamental principles of behavioral pricing a lot of which I think come from Tversky and Kahneman’s work about anchoring effects and the fact that people, many people, I do not believe it’s all people, but many people are willing to pay more to avoid a risk than they are to get a gain, fundamental aspect theory.

Mark Stiving

So if you just take that one argument, right? Prospect theory and losses loom larger than gains. Simply the way I describe something to you, in fact, I often teach this, right? So we’ll talk about good, better, best for a second, right? We see good, better, best on websites, and it always goes left to right, good than better than best. When I teach salespeople, I say, you need to present the best, better, good. Now, why do we do that? Because when you start with the best and you move to better, you’ve taken away features. So now the loss is there, I’ve lost features, and I’ve gained something in price. But because loss loom larger than gains, then the best looks better, right? And so that simple trick is behavioral economics has nothing to do with value.

Steven Forth

Okay? But anchoring, yeah, I think we’re starting to argue choices of words here, but that’s, I wouldn’t even call it a trick, because that’s setting up the frame for how people are going to perceive value, and that impacts willingness to pay, right?

Mark Stiving

Yep. Absolutely. By the way, this is the very first time I’ve said these words publicly, but I want to present to you and hear your opinion on what I think is the ultimate pricing strategy. And I’ve spent time figuring this out or thinking a lot about it, the name I want to give it is Context-Driven Pricing. Context-Driven Pricing is defined as charging what a customer’s willingness to pay and willingness to pay has, there’s three core tenets to this, right? One tenet is willingness to pay is context dependent. The second one is willingness to pay is malleable. So we have the ability to influence it. And the third one is, there are always constraints.

Steven Forth

Say a bit more about the constraints.

Mark Stiving

So the easiest constraint to understand is there’s no way I can read your mind to know how much you’re willing to pay. And so I can never charge exactly that price. That’s the easiest one to understand. But you might think of constraints as, ‘Hey, I’m selling something on retail shelf and there’s no way I can charge a different price to every customer.’ So that’s a constraint I’m dealing with. You might say, I’ve got a Vendavo pricing system, and it doesn’t allow me to do price segmentation in this way. So that’s a constraint that I have.

Steven Forth

That’s actually a reason to replace the pricing system.

Mark Stiving

Yeah. Well, to a point. Yes.

Steven Forth

First one is a real constraint. The second one is a constraint that you’ve imposed on yourself.

Mark Stiving

Yeah. Totally with you. But as we start thinking through, how do I want to do pricing, my view of it is let’s think through what’s optimal pricing, and then which constraints are we going to try to knock down? Because I can’t put a different price for each product and each situation for each customer.

Steven Forth

Well, actually, I’m going to challenge that last one. And, we’d said we weren’t going to talk about AI. But as you know I am working on something that I call generative pricing, which is an approach to pricing that is designed to be applicable to generative-AI-based applications. And I actually think, Mark, that there are a lot of connection points between what I’m calling generative pricing and what you’re calling context-based pricing. And what generative AI does is that it allows your configuration, so what, how your offer is configured to change dynamically based on the buyer’s context. And that’s why the conventional approaches to pricing, whether it be traditional value-based pricing or dynamic pricing, or cost-based pricing, or whatever other based version you want to use are not adequate to a world in which you can rapidly adjust to the buyer’s context. So that’s the core idea behind generative pricing. And I think there might be some connection points to what you’re saying.

Mark Stiving

I think absolutely. I had Barrett Thompson of Zilliant on the podcast. It came out this week, but we recorded it a month or so ago. And one of the things that was fascinating, we talked a little bit about AI, and you and I, you’ve probably told me this, but it didn’t sink in well enough, but he was talking about how we could use AI to estimate how much value a customer is getting from our product, right? And so I think this is brilliant, right? Yeah. And so whether we talk about context as in AI now knows it’s raining, so my umbrella’s going to be more expensive. I’m okay with that too, but I just find that whole concept of using AI to figure out what’s the willingness to pay. I’m totally okay with that.

Steven Forth

Yeah. Although, again, I think that one needs to have a value model in order to make these things work. And that’s another reason that I’m pushing back against willingness to pay equal value. Because a lot of the willingness to pay estimation is based on black box estimations such as the ones that Zilliant and Vendavo and Pros and Pricefx and so on do which have their intellectual roots in revenue management for airlines, I think is where a lot of this stuff originally came from.

Mark Stiving

Yep.

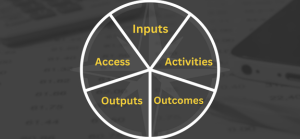

Steven Forth

And I think that does not give you the framework that you need to think about value so that you can provide guidance not just to sales, but also to product development. So, I mean, if I tell my product development team to develop a product for which there will be higher willingness to pay, we’re not giving them any levers to pull or anything to act on. Whereas, I say, here’s the value model for how we’re creating value for our customers, and we have these five value drivers and I want you to, and based on these three performance improvement claims how can you I improve the performance improvement claims so that it’ll flow through to the value drivers? Or how can you increase the value drivers? Or in some cases is there a new value driver that we can add? Can you innovate to find a new value driver? So to me, that’s a richer framework within which to act.

Mark Stiving

Yeah. By the way, I agree a hundred percent. So in my mind, I’m now putting willingness to pay at the highest level. And so when I think about willingness to pay, what’s that consists of? Well, I think it consists of the value and psychological behaviors of buyers. And so if it’s, there may be more, but those are the two I could think of off the top of my head. And so everything I do and everything I focus on is on the value side. Right? I want to know where value is coming from, how customers perceive value, how do we deliver incremental profit to our customers, right? That’s value, but in the end, it’s willingness to pay that I want a price for.

Steven Forth

Okay. We’re not being very successful here, Mark and disagreeing.

Mark Stiving

Okay. Darn it.

Steven Forth

But, I agree you need to get to a number that a buyer will buy. And the way that, but I would suggest that the way you get there is by, first of all, being able to understand and communicate value.

Mark Stiving

Yep.

Steven Forth

And then yes, there are ways to frame that value. And some of those come from behavioral economics and other parts of psychology. I think a lot of stuff gets lumped into behavioral economics that was already well known as far back as B.F. Skinner. Yeah. But that’s okay. Everyone has to have their own thing that they promote. But to me, thinking about these two things quasi independently allows you to think more clearly. So thinking first about value and then how you use your understanding of value to shape, willingness to pay, and as you said, it’s not the only way you shape willingness to pay, but it’s a very important part of it.

Mark Stiving

It absolutely is. I think the other thing that I like about the concept of context-driven value is, or context-driven pricing, is that value is truly different for every single customer. And so we talk about value models, but value models can be very different depending on what the market segment is I’m talking to. Or it could be very different depending on the situation that that buyer is.

Steven Forth

Yeah. So I would go even further than you said. Not only is it different, very different for each customer, it’s different for each customer at different points in time. And generative AI, forgive me, is going to enable us to build applications that are much more dynamically configurable so that they can real time configure themselves for the buyer’s context, and then update that context as it changes.

Mark Stiving

Okay. So, it’s sad that we can’t disagree, Steven.

Steven Forth

I will find something.

Mark Stiving

We’re only 18 minutes in. Let’s let the listeners have a break and we’ll pick up a new topic next time.

Steven Forth

Okay. But yeah, I just want to sort of underline though that willingness to pay is an outcome that you shape. It’s not something that is given to you by something outside of your product and how you sell it, and that you play a huge role in defining the context.

Mark Stiving

I couldn’t agree more. My third book, Selling Value is all about that, right? How do we shape someone’s willingness to pay by communicating the value of what we deliver to the customer?

Steven Forth

Good.

Mark Stiving

So, yeah, and I’m sure behavioral economics folks would say the same thing, right? Not about value, but they would say that, ‘Hey, we can shape willingness to pay.’ We can, in fact, all their studies are about how do I get people to pay more money?

Steven Forth

Yeah. And which, I think we have to be careful. We want people to pay a fair amount of money. If I can get people to, if I can trick someone into paying more than something’s valuable, greater than its actual value and value in this case means the economic return they’re going to get. I don’t think I’ve done myself a service in the long term.

Mark Stiving

Yeah.I couldn’t agree more. If you think about your own lifetime value, if you’re cheating customers, you will not last in the long run. Right? And so we have to be fair to our customers. We have to deliver way more value than we’re capturing. But I have to say, I think most companies have the problem that they don’t know how to capture their fair share of the value they deliver.

Steven Forth

Definitely I think that’s, I definitely think that’s true in B2B and it’s just getting worse. You would think that after all these years we would be getting better at it, but I think that technology is changing so fast right now, we’re getting worse, not better.

Mark Stiving

Yeah. Hey, let me actually, let me toss out one more thought. In the world of B2C, or even in the world of Vendavo pricing or Zilliant or Pros pricing the prices they put out, you and I would say, Hey, you didn’t do a value model. Right? You don’t know where the value comes from, but one could still argue that they’re just, they’re testing to see where value is, but they don’t really know why it’s there.

Steven Forth

I think they’re testing to see where willingness to pay is.

Mark Stiving

Yes.

Steven Forth

And where willingness to pay is without the tools that we’ve discussed to shape willingness to pay. So you know if I don’t shape willingness to pay I just accept the buyer’s perception that’s what the current generation, or maybe it’s not even the current, that’s what the original price management software and revenue management software did. I’m delighted that Barrett is talking about using AI to estimate and understand value. And I would love to know what Zilliant is actually doing on that. But I still don’t see how you do this without a value model. So when I think about what I do, I would call it Model-Driven Pricing. And what we need to do is to have more flexible and adaptive models for the reasons that you identified, right? That value is context dependent. And that context changes over time sometimes changes very quickly over time.

Mark Stiving

It’s really interesting. So, let’s go back to the original pricing work. And we have price elasticities, right? And so that’s definitely not value-based pricing, but it is trying to get at where’s… It isn’t even trying to get at where’s the most value? It’s just trying to get at where’s the optimal spot on the demand curve.

Steven Forth

Yeah. And basically it comes from economic theory. I think that the podcast he did with Tom Nagle does a great job of explaining this. And Tom’s first huge insight was that in B2B price elasticity curves don’t really exist. So to say to someone, well, you should price based on the price elasticity of demand is a meaningless statement.

Mark Stiving

Yes.

Steven Forth

And what Tom did was come up with an alternate way to think about the problem. And that’s where economic value estimation comes from. And basically, when I say value model, I’m really thinking about what Tom did. So our value models at Ibbaka are based on Tom’s work on EVE and economic value estimation.

Mark Stiving

Awesome. Steven, let’s go ahead and wrap this thing up. Let’s ask the final question anyway. What’s your one bigger pricing advice this week that you could give our listeners that you think could have a big impact on their business?

Steven Forth

That you need to make sure that the value you promise in sales is the value that you deliver and that you can document that value; because if you don’t do that, you’re going to struggle with renewals.

Mark Stiving

So I’m going to pile on for just a second. I think you are the one who convinced me that documenting value was so important and I’ve started teaching that after. So, I think of three types of value now. Let’s talk about a subscription, right? I think of perceived value, I think of real value, and then I think of proven value, right? Have you actually proven that they get this? And if you can prove it, then you don’t get the churn. But if you haven’t proven it, you’re susceptible.

Steven Forth

Yeah, absolutely.

Mark Stiving

Thank you for that one, Steven. Thanks so much for your time today. If anybody wants to contact you, how can they do that?

Steven Forth

The best way is to link to me on LinkedIn. I’m easy to find Steven Forth, or you can email me Steven, [email protected].

Mark Stiving

Alright, thank you. And to our listeners, thank you for your time. If you enjoyed this, would you please leave us a rating and a review? And finally, if you have any questions or comments about this podcast or pricing, feel free to email me, [email protected]. Now, go make an impact!

[Ad / Outro]