Steven Forth is Ibbaka’s Co-Founder, CEO, and Partner. Ibbaka is a strategic pricing advisory firm. He was CEO of LeveragePoint Innovations Inc., a SaaS business.

In this episode, Steven explores the concept of generative pricing, emphasizing how AI can transform pricing strategies through real-time value measurement and dynamic proposal evaluation. He discusses how composable AI applications and generative adversarial networks might drive advancements in pricing and proposal management. Practical advice is also provided on using AI to optimize proposals, including developing effective evaluation rubrics and leveraging AI for better decision-making.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Delves into the concept of generative pricing and how it can revolutionize pricing strategies through real-time value measurement, composability, and AI-driven proposal evaluation.

- Discover actionable advice on using AI to evaluate and improve proposals before submission which includes tips on developing effective rubrics and using AI tools to enhance proposal quality.

- Explore the future of pricing in a world increasingly influenced by AI, including the challenges of scaling costs, measuring value, and managing pricing with AI.

“Build a system that will evaluate your proposals, including your pricing proposals, before you send them out. You can do this using your currently available AI tools.”

– Steven Forth

Topics Covered:

01:01 – Introducing the concept of “generative pricing” in the context of generative AI applications

02:17 – Elaborating on the concept of generative pricing by discussing the cost dynamics associated with generative AI applications compared to traditional SaaS applications

04:35 – Discussing the differences in cost between traditional search engines like Google and AI-powered services like Perplexity, highlighting the implications for generative pricing

09:28 – Shift in cost structures and the emerging properties of generative AI applications

13:54 – Configuring solutions that optimize the value delivered to customers continuously

16:02 – The potential for generative AI to enable more accurate and transparent value-based pricing models

18:41 – Explore the concept of generative pricing in the context of proposals and outcome-based pricing

22:10 – The idea of making predictions about the future of pricing, particularly in the context of generative AI, using a website called longbets.com

23:01 – How generative pricing necessitates a rethinking of pricing approaches

24:01 – Generative AI and how it affects cost management and value capture

25:30 – Discussing the implications of generative AI on the value and pricing of applications, particularly focusing on composable AI

28:42 – Steven’s best pricing advice and actionable steps for leveraging AI in proposal evaluation and improvement

Key Takeaways:

“Yes, we have to be aware of costs. And the pricing systems are also going to need to be cost-management systems. But what’s going to drive the configuration is value optimization.” – Steven Forth

“Is generative pricing a clear, fully baked concept today? No, it’s not. But I believe that generative AI is going to cause enough change that it’s going to force us to rethink how we approach pricing.” – Steven Forth

“…possibly as we get more sophisticated and flexible models, we’ll be able to more formally manage the relationship between emotional values and also do a better job of pricing in order to reflect externalities.” – Steven Forth

“We’re going to have to really start designing our proposals and our pricing with the assumption that the consumer or one of the consumers is actually going to be an AI. And I think that also changes how we think about the pricing as well, and we’re gonna need AIs in order to generate pricing that other AIs are going to accept.” – Steven Forth

People/Resources Mentioned:

- Intercom: https://www.intercom.com

- Perplexity: https://www.perplexity.ai

- Google: https://www.google.com/?client=safari

- Gemini: https://gemini.google.comTheory

- Theory Ventures: https://theory.ventures

- Oracle: https://www.oracle.com

- Microsoft: https://www.microsoft.com/en-ph/

- Totogi: https://totogi.com

- Long Bets: https://longbets.org

Connect with Steven Forth:

- LinkedIn: https://www.linkedin.com/in/stevenforth/

- Email: [email protected]

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Steven Forth

Build a system that will evaluate your proposals, including your pricing proposals, before you send them out. You can do this using your currently available AI tools.

[Intro / Ad]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the probabilistic relationship between them. I’m Mark Stiving, and our guest today is the one and only Steven Forth. Here are three. Well, no here are three things, you know Stephen, by now. Hey, Steven, welcome.

Steven Forth

Very glad to be here.

Mark Stiving

Hey, it’s going to be fun. Today we’re going to talk about a topic that, well, you’re going to educate me on, and then I’m going to ask really hard questions about. Let’s talk about something called generative pricing. What the heck is generative pricing?

Steven Forth

So, Mark, as generative AI has been rewriting a lot of the rules about how we develop applications and what those applications are able to do. And having now been engaged in this sort of stuff for over a yearI’ve come to the conclusion that conventional approaches to pricing are not going to be adequate to how we need to price generative AI-based applications. And that we need a new way to frame that and why not call it generative pricing.

Mark Stiving

So you think generative pricing means pricing generative AI?

Steven Forth

Yes, but it’s a bit deeper than that. I think that it represents a shift in how we approach pricing that is uniquely suited to pricing applications that derive from generative AI. So, it’s not just the pricing of generative AI applications. It actually takes some of the principles and ideas from generative AI and uses those to guide us through pricing.

Mark Stiving

Okay. I’m not with you yet, so let’s start with an example.

Steven Forth

Yeah. So, let’s just think of this, I think there’s two places to start here. One is the cost side of the equation, and I know we’re pricing people. We’re not supposed to talk about costs, but I think we have to now and the reason that we have to is, generative AI has a very different cost profile from traditional SaaS applications. And some of the differences are great. Generative AI radically reduces the cost of developing an application. and I’ve seen estimates anywhere from 50% to 90%. So that in itself changes market dynamics. Generative AI also radically reduces the cost of delivering customer support and customer success, and that’s one of the main early use cases for a lot of generative AI applications. Think of what Intercom is doing.

Generative AI also really reduces integration costs and the costs of integrating multiple data sources. Great costs are going down. Why do we care about costs? Well, those costs are going down, but operating costs are going to go way, way up. and the reason for that is the compute cost of a prompt is way higher than the cost of a SQL call. And we’re not talking like 5% higher or 10% higher, or a hundred percent higher. We are talking multiple, many X higher, and most real generative AI applications that are going to have real business impact, use complex multiple prompts. So you’re not just running one simple prompt. You’re running a series of complex prompts, probably against a variety of different language models.

Mark Stiving

So, let me ask you a question.

Steven Forth

Go ahead, Mark.

Mark Stiving

Yeah, let me ask you a question. So before we started the call, I needed to google generative pricing to see what the heck it was, and then I put it in Perplexity generative pricing to see what it was. What do you think the difference in cost was? So, do you have any guesses on what it costs Google to deliver me that answer? And do you have any guesses on what it costs Perplexity to deliver that answer?

Steven Forth

Well, Google of course, is probably running it through Gemini now, but I think you mean how much did it cost Google to answer a search request, right?

Mark Stiving

Sure.

Steven Forth

Yeah. So, the cost for Google is fractions of a cent. it’s inconsequential. Well, I mean, when you have as many searches as Google does, it actually does add up to quite a bit of money. But the cost per search is extremely small. And Google has spent years optimizing its architecture to drive down those costs and to drive up the speed. The cost that perplexity paid, it actually depends because Perplexity uses a lot of different language models, right? And you can choose which language model that you use at Perplexity. So, it was very variable, but it was probably in the range of a few pennies to maybe a dime which does not sound like a lot of money, but that adds up a lot faster than Google searches do.

Mark Stiving

Yeah. So that was what, 10 a hundred, a thousand X.

Steven Forth

Yep. I would think it’s probably in the range of a thousand X.

Mark Stiving

Okay. So, it certainly does drive costs up. Well, because we think of SaaS businesses as being almost cost-free to operate.

Steven Forth

Yep. And so this has all sorts of consequences. But don’t forget, it drives some costs down too though, right? So you can now develop faster, cheaper, and you can explore more different things. you can go to market faster because it’s driving down search costs. It’s making it easier to make buying decisions because you can use the generative AI to evaluate proposals. So all sorts of costs are getting driven down, but operating costs are going up.

Mark Stiving

And the other thing that’s interesting about operating costs is it seems like they’re less predictable. It isn’t like building a car where I know what it costs me to build a car.

Steven Forth

Yeah. I’m hoping they will become more predictable over time, but I think that is currently true. So I’m just going to think about, Ibbaka situation for a moment. So we use generative AI extensively. We use it to evaluate the quality of a value model. We don’t yet, but we plan to use it to evaluate pricing models. On the logic that with generative AI, if you can evaluate something, you can also generate something as that’s sort of a standard property. We tend to run things against at least three different models. And we tend to use at least three prompts quite often, more like five to seven prompts. and we also create context documents of different types that we use to inform the generative AI and we actually use generative AI to create those documents.

I’ve actually asked our finance director to try and start figuring out what the cost is going to be because, which I’ve never done before. I’ve never thought about the cost of running SQL queries or searches or stuff like that. not in the last, yeah. I don’t think I’ve ever done it, probably back 30 years ago. But, I didn’t, so to me that that in itself changes how you think about pricing, right? Because now you can explore lots of things, but you have to make sure that you’re generating enough value to cover those operating costs, and that you can capture enough of that value in price to have a sustainable business. Now, I know people are going to say, of course, that’s true. That’s always been true. yeah, okay. It has always been true, but it’s hitting us in the face now in a way that it didn’t five years ago.

Mark Stiving

I think that’s true if you say software, right? In the world of cars, that’s always been true.

Steven Forth

Yep. But in the world of cars though, it also costs an enormous amount of money to even design a new car, let alone put it into production.

Mark Stiving

Now, I am sitting here trying to rack my head, because what typically changes with all these different technologies isn’t the fact that economics changes or consumer behavior changes or any of that there’s some underlying concepts that are going on. And so we think about software and what really changed is , we got rid of the variable costs, right? There’s no real variable cost to the liquor product to someone. But there was still the economics behind all those decisions. And what we’re saying here is, okay, we’re adding back in variable costs, but we’re getting rid of a ton of the fixed cost overhead of generating this.

Steven Forth

Yeah. And that leads to very different operating models for software companies.

Mark Stiving

Yes. Okay. So what have you come up with? What’s the answer?

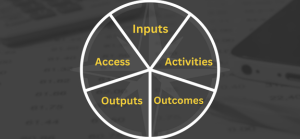

Steven Forth

That’s just the cost is just one part of this, though. Because the other part is that the next generation of generative AI is going to have some very different properties from current ones. And I’ve sort of boiled these down into four things. So, the emerging properties of generative applications is that they’re composable. We had an example of that in the webinar we did, but I’ll come back to that. they’re conversational. They have a very different user interface and user experience than conventional applications. They’re integrative. So they can take data from many different sources and integrate it sort of on the fly in ways that you were not able to do in the past. and then finally, they generate vast amounts of synthetic data. And the implications of that synthetic data is something I think that we are just barely starting to think about. But let’s start with the composable andTheory Ventures has a great post on this called composing software platforms in practice. I think we should give people the link to. But really, you remember in our webinar, we had the company, the example of the company Totogi? Was able to really configure an application in near real-time. So we’re going to have applications that are configured based on customer needs in real time. And those configurations can be dynamic and constantly changing. And because it’s easy to integrate all sorts of different data, they’re going to be integrating data in near real time as well. But that data is not necessarily free. There’s going to be costs associated with that data as well. So I think that these composable integrative applications, which is where the second generation of generative AI apps is going to be, have very different pricing requirements.

If I can configure something in seconds, I better be able to price it just as fast. And if my configuration changes, depending on my needs at the moment then how should my pricing change? And how do I keep pricing predictable? Because predictability is an important part of pricing. How do I keep pricing predictable in this very dynamic environment? Just one more thought and I’ll let you jump back in here, Mark. Think of configure price quote systems. Our hairs are thin enough to suggest that we can remember big machines. and which was later acquired by Oracle. What were big machines? Big machines were at its heart, it was a constraint-based reasoning system. And the goal was to prevent salespeople from selling stuff that you couldn’t build. That’s what configure meant for the initial generation of configure price quotes. It was a way of preventing sales from doing dumb things.As the CEO of a software company, I promise you that I have sold stuff that my team did not know how to build. And I actually regard that as a virtue. But when salespeople do it, it’s a big problem. So that’s what the first generation CPQs were made for. But if you have a world of generative AI-based applications that can be developed rapidly, configured rapidly, the configurer goal is not a constraint-based goal. I think it’s a value optimization goal. How do we rapidly design a configuration for this user, for their current situation, and then allow that to change? I think that puts all sorts of new demands on pricing.

Mark Stiving

Okay. I wish I was as smart as yours, Steven, because I do not have my head wrapped around this yet.

Steven Forth

Nobody does, Mark. None of us do.

Mark Stiving

It seems to me that if you’re going to configure an application essentially on the fly in real time, then pricing is going to end up going back towards cost-plus pricing. Because we somehow have to figure out what’s the value in real time and what percent of the value do we get to keep? And I just find this, I mean, it’s unfathomable at this point, at least for me.

Steven Forth

I strongly disagree.

Mark Stiving

Good.

Steven Forth

Yes, we have to be aware of costs. and the pricing systems are also going to need to be cost-management systems. But what’s going to drive the configuration is value optimization. So what configuration of the solution or to use Theory Ventures words, how do you compose a solution so that it is constantly optimizing the value that it delivers to you. And I believe that if you have an underlying value model, and you can connect the value model to the configurations, you can do real time value modeling. And then you’re going to say, well, you can only really know value down the road once you’ve actually got the proof. So that’s partially true, but this is also where synthetic data comes in. So these systems are also going to be generating vast amounts of synthetic data that give you the ability to explore the configurations and to estimate in advance how much value they’re going to create. Now, clearly, you’re going to have to have self-correction feedback loops built in. But, I believe this is very different from the way of thinking that dynamic pricing is based on.

Mark Stiving

Yep. Okay. So I’m going to take a pause and say I’m embarrassed that I said what I said, because it seems obvious that if you’re going to use value as the optimization variable, then we’re measuring value. And so if we’re measuring value, we could charge for value. How much are we going to optimize now? Do people believe it? What percent of it we’re going to get? Those are different conversations. But the fact that we’re measuring value or at least predicting value, and later on we can do the feedback loop to figure out how much we actually delivered. But if value becomes the independent variable, then yeah, of course we can measure it. Of course we charge for it.

Steven Forth

Yeah. I think that we’re finally going to get to actual value-based pricing. So when I think about the sort of pricing principles that we’re going to need for AI for what I’m calling generative pricing, it’s going to need to be responsive. So it’s going to be, and the fact that the applications are composable are going to make it it’s going to have to be responsive. I also think it’s really going to have to be explainable. So you’re going to have to be able to explain how you priced and black box pricing applications and black box pricing optimization are going to go away. And then as we just discussed, it’s going to need to be value-based. So your pricing mechanism is going to need to explain and justify how it came up with the price.

Mark Stiving

So let me, one of the common things that we often hear, even in today’s world in pricing, so I’ll go in and I’ll work with the pricing team, and they’ll say, oh my gosh, we’ve done such a great job in pricing. We’ve raised ASPs by 10%. And the sales team comes in and says, oh, no, no, no, no, that one’s us, right? We switch to value-based selling and we’re doing a better job of selling. And marketing comes in. He goes, oh, are you crazy? That was us. Did you see the marketing campaigns we put together? Did you see how we generated all that additional revenue? So how are we going to get around that problem in the world of composable software? Who gets the credit?

Steven Forth

Yeah. I think that, first of all, I think that’s a really high quality problem to have, because there’s credit to get…

Mark Stiving

Yeah, okay.

Steven Forth

So, we all want that problem. so there is a lot of work being done in causal reasoning AIs. So this is sort of like a, I think a future topic, but causal inference, I think will be part of generative pricing. I’m not completely ready to, I haven’t thought that part through as deeply as I would like, and I’d like to actually have done it a few more times before I talk about it too much. But causal inference is going to be part of generative AI, and there is already some pretty good research being done, especially at Microsoft. But I think at meta too, I’ve seen some, and there’s some stuff from Princeton that shows that you can use generative AI to explore causal structures and to attribute causality. So, yeah, maybe we need to add that to the definition of generative pricing, that it has to be able to attribute the multiple causes of success.

Mark Stiving

Yeah. Okay. Topic for later discussion. Yeah.

Steven Forth

Yeah. I think maybe next year.

Mark Stiving

Okay. So, what else are we going to do with generative pricing?

Steven Forth

I think it’s going to be super exciting in a number of different places. So one, I think that the ways that we create proposals is going to change dramatically. And with that, the way that we evaluate proposals is going to change, and proposals include pricing, right? if it doesn’t have the pricing in it, it ain’t really a proposal unless you’re volunteering to do something for free. So, that’s part of it. The generative pricing applications will be joined at the hip to proposal generation applications, but proposal generation applications will be part of a system where there’s proposal evaluation AIs. So all of those things will work together.

Mark Stiving

Okay. So, I think of an analogy, Steven. And maybe I’ve taken a step too far forward or a step too far back, but this almost sounds like I’m a financial advisor, and all I’m going to take from you is a percentage of your gain, right? That’s my fee. So if you make a million dollars, I get my 10% of that hundred thousand. And so it almost feels like that’s what a proposal looks like in AI. Look, we’re going to go make you money and we’re going to take a piece of the money we make you.

Steven Forth

Yeah. But we’re also going to ask you to give us money. So I need to be able to compare your proposal to other proposals.

Mark Stiving

Why would I ask you to give me money? Why not just take the risk and say, look, I’m, I’m going to take 10%.

Steven Forth

Could do that, may happen in certain situations. but what if there’s a large upfront cost who gets, and all what happens when there are these sort of multiple causal connections that have to be attributed and managed. So I would be surprised if it, in most cases, I’d be surprised if it becomes that simple.

Mark Stiving

I mean, even in our world today, we all dream about doing some kind of outcome-based pricing, but it never happens, when you say, we’re going to take a percent of the increase. Right? No one believes it, no one prices that way.

Steven Forth

Was it you who was talking about this recently? Or maybe it was Gary Bailey, but when you do this, and I’m sure all of us have done outcome-based deals, they become very hard, hard to collect, right? Because often the outcome is so large that people don’t want to pay it.

Mark Stiving

Yes.

Steven Forth

Yeah. A well-executed price change where you’re changing the packaging and the pricing and supporting with value-based selling, we can be talking about a hundred million dollars or more of impact if for a large company it could easily be a billion-dollar impact. Easy. And, people are, even if it’s 1% of that people balk at paying that. There’s going to have to be a lot of socialization, a lot of changed expectations before we really get to pure outcomes-based pricing, I think we are going to move there. and this will be a step in that direction, and that over the next decade, actually, I’m going to say over the next two decades, and that way I don’t have to worry because I won’t be around to see the result. But I think a lot of pricing will get to outcomes-based pricing over time. And AI will be a major enabler of that.

Mark Stiving

Okay. It’ll be interesting.

Steven Forth

Yeah. Do you know the website longbets.org?

Mark Stiving

Yes.

Steven Forth

Yeah. Great website, right? Because for all those, I bet you in five years such and such is going to happen. Those are great bets, right? Because nobody ever collects on them. In five years from now, someone will say, I never said that. What are you talking about?

Mark Stiving

Right.

Steven Forth

But can we sort of register those on long bets. We should register a bunch of pricing bets on longbets.org.

Steven Forth

Oh, that would be fun.

Mark Stiving

Yeah. Let’s not put them too far out though because I actually want to see what happens.

Mark Stiving

Okay. We’ll make them around AI.

Mark Stiving

Yeah. I’ll take the pessimistic side. You take the optimistic side.

Steven Forth

Don’t I get to do some arbitrage here? So I get to put in a few pessimistic ones too.

Mark Stiving

If you want.

Steven Forth

As long as I find the ones that you’re willing to be the counterparty to. Right?

Mark Stiving

Right.

Steven Forth

Okay. But, is generative generative pricing a clear, fully baked concept today? No, it’s not. But I believe that generative AI is going to cause enough change that it’s going to force us to rethink how we approach pricing. And that the things that are going to drive that are the emerging properties of generative AI applications around composability and integrations and synthetic data, and the conversational nature, and also around the cost dynamics.

Mark Stiving

Do you think that generative AI is able to predict the costs of running itself?

Steven Forth

Well, I’m sure we’ll have an opinion.

Mark Stiving

Good point. Because in general, if you think about pricing, what we do today is we say, what’s the value? Is that above our cost? Okay, we’ll sell it, right?

Steven Forth

Yeah. Well, I think I hope, for most of us, it’s a three-step, right? So what’s the value? How much of that value can we actually capture in price, and is that larger than our costs? And how does that change at different scales? Because one of the things that we assumed with B2B SaaS is that the cost curve would flatten out, right? Because the variable costs were low. What happens when the cost curve does not flatten out? So, managing price across scale is going to be a really big deal in the next wave of generative AI-based applications.

Mark Stiving

Okay, let me go back to generative AI and composable. By the way, my favorite thing that we said today is that, if value is the independent variable, then obviously value-based pricing makes sense, right? Because we can measure value. That’s beautiful. But when I think about composable AI, I don’t think most applications say, here’s how I’m going to make you more money, right? I think most applications are, here’s how we make your allocation of staff more efficient. Here’s how we make your usage, or here’s how we make your preventive maintenance on your equipment more effective. Right? I think it’s always something going on, but it’s not, here’s how much money we’re going to make you.

Steven Forth

Yeah. But when you say efficient and effective, I think implied in those are that you can measure those in using monetary value. Now, it’s possible because we know that there are other forms of value other than just economic value.

Mark Stiving

Really. I don’t believe that. I’m just joking, Steven. Go ahead.

Steven Forth

There’s emotional value. and there are what economists would call externalities. And possibly as we get more sophisticated and flexible models we’ll be able to more formally manage the relationship between emotional values and also do a better job of pricing in order to reflect externalities. So there’s a whole bunch of other super interesting things that are likely to come out over the next five to 10 years. But on the other hand though, let’s also think though, if our proposals are being assessed by AIs, which is already happening. If I get a proposal today from a vendor, one of the things I do is run it through a generative AI and ask it to compare the different proposals I’m getting. I suspect that the AIs are less subject to emotion. Maybe I’m wrong.

Mark Stiving

I would think they are.

Steven Forth

I try to explore that, but, I do know that like, think about back when you used to get like 50 page proposals from five different vendors. Did you read every one of those? Every one of those 250 pages?

Mark Stiving

Heck, no.

Steven Forth

Of course not. Life is too short. But your AI is happy to read it. and if you provide it with a good rubric to evaluate the proposal, it’ll go in and score those proposals for you in a very granular way. and pricing is one of the things that’ll get scored. So, we’re going to have to really start designing our proposals and our pricing with the assumption that the consumer or one of the consumers is actually going to be an AI. And I think that also changes how we think about the pricing as well, and we’re going to need AIs in order to generate pricing that other AIs are going to accept.

Mark Stiving

Okay, that actually is a study. I mean, that’s something that we should be thinking about, and that is how do you write a proposal so that when AI analyzes it, you win the deal.

Steven Forth

Yep. And of course, the buyers are going to be doing the same thing, though. They’re going to say, how do I write a rubric to evaluate proposals so I get the one that’s going to give me the most value?

Mark Stiving

Right.

Steven Forth

Which sounds to me like what artificial intelligence people like to call a GAN network, a generative adversarial network where you have two AIs competing with each other, which generally drives rapid improvement.

Mark Stiving

It’ll be interesting. Steven, we are running out of time already. It feels like we just started butlet’s wrap it up. Last question. Today, what’s the one piece of advice you want to give our listeners that is going to have a huge impact on their business?

Steven Forth

Build a system that will evaluate your proposals, including your pricing proposals before you send them out. So, I wouldn’t mean, trivial, might be a stretch, but you can do this using your currently available AI tools, or you can make great progress towards it.

Mark Stiving

So are you doing that?

Steven Forth

Yes, we are doing that now, and I’m glad to say, yeah, the last proposal I sent out, we actually had three versions, three iterations. and it scored each. To my surprise, actually, each iteration scored better. Now, we’ll hear back next week as to whether we win this piece of work or not. But boy, I am never sending out another proposal that I have not tested against our rubric using generative AI.

Mark Stiving

Okay, I always learn something when I talk with you, but I’ve never said I’ve gotta go do something. I’m going to run some proposals through chat GPT or an AI system. I’ve never done that. That’s a brilliant idea.

Steven Forth

Yeah. What you need to do though is you need to have a rubric so that it will score the proposals. And one of the things that we discovered doing this over the last few weeks is that, so we started with a really simple rubric with sort of I think it has scored them on a scale of one to five. And that didn’t give us enough discrimination power. So you probably want a rubric that’s running from one to 20 or one to a hundred. The other thing you have to remember is, don’t just ask it to score your proposal. Ask for recommendations on how to improve it.

Mark Stiving

Yeah. I’m not even sure if I care about a score, how to improve is what I care a lot about.

Steven Forth

Yeah. That’s a critical part of this.

Mark Stiving

Yeah. So cool.

Steven Forth

The score, note, lets you compare one versus version two, lets you know if you’re moving in the right direction.

Mark Stiving

Nice. Steven, thank you so much for your time today. If anybody wants to contact you, how can they do that?

Steven Forth

The best way is to send me an email, email steven, S-T-E-V-E-N @ibbaka.com. But I am also very easy to find and very approachable on LinkedIn.

Mark Stiving

And very active too. Thank you for being active on LinkedIn.

Steven Forth

Hey, there’s a brave new world emerging.

Mark Stiving

Yes, no doubt. And to our listeners, thank you guys for your time. If you enjoyed this, would you please leave us a rating and a review? And finally, if you have any questions or comments about the podcast or pricing in general, feel free to email me, [email protected]. Now, go make an impact!

[Ad / Outro]