You can listen to the full audio version of this blog we call — Blogcast.

Long-term holding companies acquire businesses with the intention of growing them for decades, not years. While many LTH firms identify pricing opportunities during due diligence, creating sustainable pricing excellence requires more than just quick wins – it demands systematic change in how portfolio companies think about and capture value.

The Value Opportunity in LTH Companies

Most acquired companies lack pricing discipline. Some haven’t raised prices in years despite delivering more value. Others give excessive discounts to preserve relationships. Many have inconsistent pricing across customers and products. Almost all lack a deep understanding of their true value to customers.

These gaps represent immediate EBITDA opportunities. However, the real prize for LTH firms is creating a sustainable approach to value capture that compounds over decades of ownership. This requires both infrastructure and culture change.

Value Architecture: Your Foundation for the Long-Term

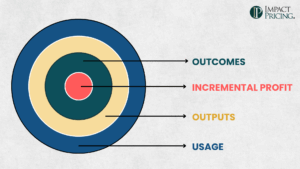

To make sound pricing decisions that stand the test of time, portfolio companies need a framework to think about value. This Value Architecture has three critical layers:

Market Segments are your foundation. You must first choose which buyers value your capabilities most. Many companies resist focusing on specific segments out of fear of missing opportunities. Yet without focus, you can’t build the right products or capture the right value.

Products come next. Once you know your target segments, you can create offerings specifically for them. This often means a portfolio of products with different value propositions for different types of buyers.

Pricing follows naturally. When you understand your segments and have built the right products, pricing becomes about capturing the value you’ve created. Without the first two layers, pricing decisions become guesswork.

Most acquisitions haven’t articulated a clear value architecture. Some large companies have. Think of a value architecture as your company roadmap. What market segments will you go after in the future? How will you fill out the product portfolios?

Building Sustainable Processes

While the Value Architecture provides the framework, you need consistent processes to maintain pricing excellence over the long term. We recommend two key recurring meetings: an annual pricing strategy review and quarterly pricing reviews.

The Annual Pricing Strategy Review is where you make decisions that compound over time. Review your market segment focus – are you trying to serve too many segments? Evaluate your product portfolio structure – is Good/Better/Best still right for your market? Consider your pricing metrics – are you charging for the right things? These decisions are hard to change quickly, so they deserve deep strategic consideration.

The quarterly pricing review (QPR) is where the rubber meets the road. Each quarter starts with a quick review of your Value Architecture to ground the team in your strategic decisions. Then you evaluate the results of the previous quarter’s actions using established KPIs, deciding whether to abort, tweak, or expand each initiative. Finally, you choose and plan 1-2 new pricing actions for the quarter. These might be targeted price increases, new approaches to price segmentation, package restructuring, sales incentive adjustments or any other tactical decision projected to lead to winning more deals at higher prices.

Creating a Value-Driven Culture

Perhaps the biggest challenge – and opportunity – in LTH portfolio companies is shifting the organizational mindset from relationship preservation to value-based decisions. This transformation starts at the top. Leadership must consistently reinforce the importance of capturing value. They need to:

- Set clear value capture goals tied to long-term value creation

- Review value capture metrics regularly

- Support pricing decisions that may initially feel uncomfortable

The sales team needs new capabilities. Train them on value discovery and communication. Tie compensation to margin, not just revenue. Give them tools to understand and articulate value. Coach them through difficult negotiations.

Product teams must quantify the value they create. Marketing needs to build messages around value drivers. Finance needs to track value capture metrics. This cultural shift takes time, but it drives lasting results.

Implementation Roadmap

While the end state is comprehensive, you have to start somewhere. Here’s how:

First, document your current state honestly. Map your pricing processes, tools, and capabilities. Identify quick wins versus long-term gaps. Assess your organization’s readiness for change.

Next, choose ONE high-potential market segment. You aren’t betting your company on this segment, you are using it to create processes that can work. Think of this segment as a carve-out while the rest of the company is business as usual.

For this segment, map their value drivers and decision-making process. Design a segment-specific product strategy. Create a value-based pricing approach.

Then, build your infrastructure. Establish your quarterly review cadence. Define how you’ll select and measure initiatives. Train your teams on value discovery and communication for that segment.

Finally, expand what works. Roll out to additional segments. Build more sophisticated tools. Develop deeper pricing expertise across the organization.

And of course measure what matters along the way. For LTH firms, that means tracking both immediate progress and sustainable capability building. In the near term, watch price realization (actual vs. list price), margin by segment, and win rates by price level. But also track longer-term indicators like sales team value selling proficiency, customer-reported value realization, and price increase acceptance rates.

Summary

For LTH firms, pricing excellence isn’t just about capturing more value today – it’s about building capabilities that compound over decades of ownership. While the journey takes time, the increase in free cash flow makes it one of the highest-return investments an LTH firm can make in their portfolio companies.

Remember, value capture is never “done.” The best companies are always testing, learning, and improving. But with the right foundation, processes, and culture, you can build pricing power that lasts.

Share your comments on the LinkedIn post.

Now go make an impact!

Tags: pricing, pricing foundations, pricing skills, pricing value, value

Tags: pricing, pricing foundations, pricing skills, pricing value, value