When private equity firms evaluate an acquisition, they focus on metrics such as revenue growth, margin trends, and customer concentration. Pricing gets a passing glance: “Are they competitive?” or “What’s churn look like?” Yet, the real hidden opportunity or risk lies not in the numbers themselves but in how the company creates and captures value.

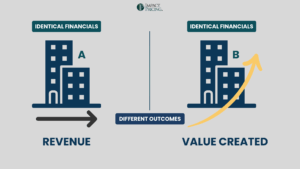

Pricing isn’t a spreadsheet exercise; it’s a reflection of how well a company understands its buyers. Two companies with identical financials can have vastly different upside depending on their value literacy—their ability to see the world through the customer’s eyes.

Value literacy is to pricing what credit scoring is to lending: it separates sustainable margins from temporary luck.

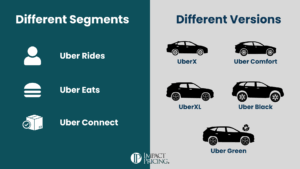

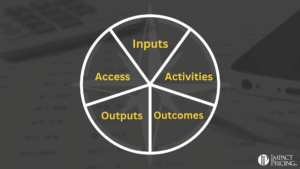

During due diligence, I probe whether leadership can articulate not just what they sell, but why different customers buy—and crucially, whether they recognize that different segments extract different value from the same features. Can they describe what problems they solve and how customers measure results? Do they know why buyers choose them over competitors?

Sometimes the opportunity is immediate, like raising prices 10-15% or tightening a misaligned pricing metric. More often, it’s structural: a company selling “all you can eat” access when buyers clearly segment by use case or outcome. That’s not just a packaging problem, it’s an architectural one. Fixing it post-acquisition can add several points of profit without adding cost.

The beauty is that this insight can be discovered without consulting the target on pricing. It’s possible to assess the maturity of value-driven pricing simply by examining how the company talks about value internally and in its market conversations.

When done well, pricing due diligence tells investors not just how the company earns money today, but how expandable that money is tomorrow.

That’s where the hidden pricing power lives.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: pricing, pricing metrics, pricing strategies, pricing strategy, pricing value, private equity

Tags: pricing, pricing metrics, pricing strategies, pricing strategy, pricing value, private equity