In this episode, Mark engages in a conversation about conjoint with EPIC Conjoint leaders, Matt and Pavel.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Learn the importance of running market segmentation studies and figuring out what people’s price sensitivity is to know which groups are becoming more price sensitive

- Find out why you should understand the challenges your target market is facing and react accordingly to that to be of help instead of going for your typical pricing mechanics

- Understand why you should be realistic in the way you do your design

“If you’re addressing the question ‘what is the proper price right now?’ and ‘what is the proper price three months after?’ you have to properly specify the price intervals for that, and you have to deal with – specifically in conjoint – you have to deal with the realistic market situation.”

– Pavel Knorr

Topics Covered:

01:25 – The backstory of how Pavel got into pricing

02:49 – Going back to the story on how and why EPIC Conjoint came to exist

05:56 – Talking about EPIC Conjoint’s project which Mark got involved with

09:56 – The global economy, recession, and its impact on people’s purchase decisions

17:08 – The challenge that arises when inflation rises but incomes do not

21:40 – Making decisions in the midst of supply constraints

29:50 – What Mark loves about what Conjoint does + the beauty of Conjoint

31:59 – Pavel’s piece of pricing advice for today’s listeners

33:39 – Connect with Matt, Pavel, and EPIC Conjoint

Key Takeaways:

“When you have product development background, for you, it’s actually quite important when you want to come up with the product line up, when you’re doing the product optimization, because it’s fine to get the product which shows the overall quite good results with the aggregated view. However, in the reality, it might end up with the case when you have build the product that platform suggested to be the best aggregate of products in the market, however, nobody really needs it because all your market is several subgroups of the niche customers.” – Pavel Knorr

“We believe most people make purchases based on their needs. And what we’ve seen in the work we’ve done with clients is that needs can dictate different willingness to pay under different price sensitivities.” – Matt Johnston

“Conjoint is the good tool to compare yourself against the competitors, but it’s not performing well when it’s considering buy or no buy at all. All the magic behind the conjoint is something like 50% of success, because if you collect the bad data or from wrong people, you will have nothing as the output; nothing useful for you as the output.” – Pavel Knorr

People / Resources Mentioned:

- EPIC Conjoint:https://www.epicconjoint.com/

- O2: https://www.o2.co.uk/

- Telefónica: https://www.telefonica.com/

- URIDU: https://www.uridu.org/

- BMW: https://www.bmw.com/

- Hyundai: https://www.hyundai.com/worldwide/

- Audi: https://www.audi.com/

Connect with Matt Johnston:

- Website: https://www.epicconjoint.com/

- LinkedIn: https://www.linkedin.com/in/matt-johnston-5a53672

- Email: [email protected]

Connect with Pavel Knorr:

- Website: https://www.epicconjoint.com/

- LinkedIn: https://www.linkedin.com/in/pavel-knorr/

- Email: [email protected]

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Pavel Knorr

If you’re addressing the question “what is the proper price right now?” and “what is the proper price three months after?” you have to properly specify the price intervals for that, and you have to deal with – specifically in conjoint – you have to deal with the realistic market situation.

[Intro]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the clustered relationship between them.

I’m Mark Stiving, and today, we have two guests – Matt Johnston and Pavel Knorr. Here are three things you’d want to know about Matt and Pavel before we start.

Matt is the CEO of EPIC Conjoint. Pavel’s the CTO of EPIC Conjoint. And I had the pleasure of working with these guys on a project a few months ago and they’re both brilliant. Well, Pavel’s brilliant.

Matt Johnston

Agreed.

Mark Stiving

First, welcome, Matt. How are you today?

Matt Johnston

Great, Mark. Thank you, again. Great to be back on. It’s a privilege. Delighted to be here with my good friend, epic CTO Pavel.

Mark Stiving

It’s great to have you back. And Pavel, I didn’t ask you this before because you haven’t been on yet. How did you get into pricing or how did you get hooked up with Matt?

Pavel Knorr

Oh, that’s a very interesting story, because back in the days, I’ve worked as a software developer in the outsourcing company, and Matt was one of the potential clients that I had to work with and make sure that Matt will be satisfied with the quality of our service. And then actually, when we started to work, it relatively quickly transformed into something more tangible for me and for Matt and it seems that we found a good match. So, in the end of the days, we’ve decided that I will move from my old-fashioned outsourcing development role to the new position specifically with Matt. That’s how it happened.

Mark Stiving

So, for our listeners, Pavel is Ukrainian, and yes, he’s still in Ukraine three months after the war started, and we’ve been talking about how to get him out of there, if at all possible. But there’s a lot of outsourced coding that comes out of Ukraine. And so, you were part of that team before you joined Matt full time?

Pavel Knorr

Yes, this is correct. Before the war started, Ukraine was one of the biggest and the fastest growing market for the outsourcing world, so yeah. Hopefully, Ukraine will get back to that position relatively so.

Mark Stiving

Yeah.

And so, Matt, give us a quick recap. Why did you start EPIC? And then we’ll jump into the project that you and I worked on together, that you let me help you with.

Matt Johnston

I’ll be happy to. So, my background is pricing, actually. I would have had a pricing with some pretty high profile telecom companies – O2, Telefónica in Europe. And then I went out to the Middle East and I headed a group pricing for a country telecom group called URIDU, and we had operations all over the Middle East, North Africa, and Southeast Asia. It was a fantastic experience for four years.

My primary role there was to bring best practice pricing tools, skills, and processes to the group operations. The operations ranged in size from 600,000 subscribers in Palestine on the Maldives to up to 65 million subscribers in Indonesia. So, you can just imagine the gamut of pricing challenges and opportunities we faced. And what I wanted to do was bring conjoint analysis to the pricing governance in the operations to help inject more rigor and science into pricing decisions. As we know, pricing can be a bit of an art and a science, but that was the objective. And at the time, there was nothing off the shelf. And that was kind of the Genesis for EPIC Conjoint.

Thankfully, five, six years on, having met Pavel, we figured out that sort of very sophisticated algorithms underpinning conjoint analysis, but we figured out if we could box them off, those complexities in sophistication in the back end. By putting in a choose of front then on to that box, we could inject much more speed, cost effectiveness, and dare I say user friendliness into conjoint analysis, which sounds like a contradiction in terms. Anyone who’s been used to doing them with agencies will pretty much attest to that experience.

And just to kind of round off what you were asking Pavel about, from my perspective, when I had written the requirements for the platform and then I went out and conducted an RFP, I ran it with an Irish software house, a German software house, a Romanian software house, and a Ukrainian software house – Pavel’s, and the tenders came back by a long mile. The Ukrainian driven by Pavel – the Ukrainian tender – was from a professional, from an IT architecture perspective; was head and shoulders above the others, and dare I say the value was incredible as well.

And yeah, that’s kind of kicked off then. Five years of fascinating first early stage of EPIC Conjoint’s life.

Mark Stiving

Nice. Did I just hear you say Pavel is smart and cheap?

Matt Johnston

Value. I said value. I never use the word cheap. As a pricing guy, you never use the word cheap. That’s sacrilege.

Mark Stiving

So that our listeners know this, Matt and EPIC Conjoint were really nice and let me use their software when I created the conjoint course; that’s on our university. And I just thought it was an amazing piece of software. It’s super simple to use. And I’d given him a few suggestions, so then they thought that I knew something – which was really nice, and they brought me in to help out with the next project. And so, Pavel, can you tell us what that project was about?

Pavel Knorr

Yup. Sure. So actually, one day we’ve decided to make another step above our conjoint solution. And when we’re doing the typical conjoint, we get the benefit of what is called bias in analysis, and the idea of the bias in analysis that happens behind the conjoint is that we, estimating the utilities on the individual level. So, we’ve asked a bunch of respondents to pass their conjoint study, estimating the values on the very individual level. And then we actually thought, well, it is nice to have the aggregated view of what is the overall model of preference for that group of respondents.

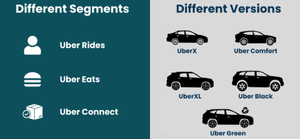

However, we also believe that among them, there are the stable clusters, how we call it, stable segments of the respondents with their very own maybe niche-specific needs, and we decided to try to identify them and search for such group or subsegments or clusters within the audience. Because when you have, like product development background, for you, it’s actually quite important when you want to come up with the product line up, when you’re doing the product optimization, because it’s fine to get the product which shows the overall quite good results with the aggregated view; however, in the reality, it might end up with the case when you have build the product that platform suggested to be the best aggregate of products in the market, however, nobody really needs it because all your market is several subgroups of the niche customers.

So, we’ve decided to take this data – the individual utility from the respondent level – and run a clustering algorithm on top of them to identify the group of people with the similar needs. Then, since we are really focused on the price elasticity in our clients, mostly, they are businessmen and they are counting the money. They are really all about the price elasticity. They’re all about the pricing; purely all about the pricing and growth.

And so, once we identified the people with the common needs, the obvious next question was, “Okay, so how much are they going to pay for that?” So, on top of the question over it, we then established the price elasticity measurement for that subsegments.

And finally, the step number three was the prototype of the customer. So let’s say the following: We identify the group of people with the similar needs, then we finish with their price elasticity to identify how much they are willing to pay for this product, and then finally, since our survey platform is quite sophisticated and also capable of conducting conjoint together with some genetic questions I’m asking, profiling questions to build these portraits of the customers, so we end up with the third step of our segmentation solution, which then allows you to map the average portrait within the subsegments. It can be geographical, demographical, behavioral portrait of the user.

So, it’s purely about what you’re going to ask during the conjoint study. What the type of questions you will include, they will define the portrait that you will have in then. So, the outcome is basically the same group of people with common needs, their elasticities, and their average portrait.

Mark Stiving

Okay. So, we’re going to go through that again a little bit slower. I love the answer. I thought it was great. But I’m not sure our listeners were able to follow all that, so we’re going to try it one more time. Well, actually, we’re going to keep this, but we’re just going to go in a little bit more depth.

So, the first thing I heard you say is “We do conjoint analysis and we were great at giving you the average part worth utility. We’re great at giving you the average person.” And I got to tell you, I live in Reno, Nevada, and in the summer, it gets to 100, and in the winter, it gets to 30. These are Fahrenheit for you, Europeans. On average, our weather is exactly like San Diego. But that doesn’t tell you a whole lot about what clothes to put on when you go outside.

And so, what you said was, “Look, we’re great at this average thing, but in truth, there’s market segments. There’s a lot of different people who fill out our surveys, who do conjoint studies, and we know different people have different preferences. So maybe instead of averages, we should focus on the individual segments.” And so that makes a lot of sense to me.

And what I loved, when you guys first started talking to me about this, what I loved is in Conjoint, you already have half or three quarters of the data on who is it that likes what features and what products. And so, I thought that was really neat.

So Matt, what are you going to add to this? Because you’re sitting there sipping all that up.

Matt Johnson

Yeah. Well, I mean, there’s no better time for this, really. You know, when you look at the macro global economy, China’s gone into self-inflicted recession, whereby it’s chasing a zero rate COVID policy, and it’s locked out, it’s shut down the manufacturing side, it’s shut down the service side. China actually represents nearly 1/5 of the global economy. And Western Europe and the U.S. has benefited from China’s cheap production because actually, we’ve imported China’s deflationary phase; much lower prices. So that’s partly what’s driving this inflation surge in this part of the world. Then we obviously have the hangover effect from COVID, where all the COVID payments and the surge coming from. People just kind of catching up has been driving inflation. Now, we have the energy. I think the headline inflation rate in the US is 8 ½ % now. The core rate when you strip out food and energy is over 5%, I believe, and there’s no end in sight. And that’s so very terrible in choppy waters ahead of us.

So, the question is how are these going to manifest themselves in the real economy, in household budgets, and in our pockets?

And when you think about it, the US has already started raising interest rates in anticipation of countering the inflation rate and hold it in check. At some point, that’s going to start to see through into the mainstream, in terms of credit’s going to become more expensive. Possibly, you know, now the talk is about recession; it’s not even inflation. We’ve surpassed that. Reduced demand on inflation. Now we’re talking stagflation, even. Scary.

So, what does it mean for pricing folks?

Really on our hypothesis is that the boom times we’ve lived through over the last decade since the financial crisis, that has masked, I guess, a price sensitivity. People who are spending more liberally with less discretion, I think. And now, with the threat of recession and the impact on household budgets, on people’s jobs, and the cost of credit, the concern is that people are going to start to attract and become much more discerning as regards their purchasing.

And the interesting thing is, what does that mean from a price sensitivity perspective? Well, people, I think, are going to become much more discerning and much more value conscious when they’re making purchases now for the foreseeable future. So, brands and companies need to kind of get ahead of this and try and understand what is the implication for this in terms of their pricing, or the pricing models underprice their price levels.

Mark Stiving

You just scared me and every listener around. Thank you so much.

Matt Johnston

Hey, the truth hurts.

Mark Stiving

But what I want you to do is tie that back to market segmentation and why this new addition to EPIC matters.

Matt Johnston

Yeah. Look. As part of I’ve described, we believe most people make purchases based on their needs. And what we’ve seen in the work we’ve done with clients is that needs can dictate different willingness to pay under different price sensitivities.

And our hypothesis is – and this is what we actually want to test, going forward, with a kind of a monthly series of conjoint, maybe using some bellwether products – is to see in those clusters of customers, those segments of customers, are the price sensitive segments starting to rise or expand vis a vis the less price segment? Is the mix going to start to change? And if so, by how much? We want to kind of track this and relish real time and to see what are the implications for products.

I mean, if you look at what’s happening on Wall Street, there’s been a sell-off in the stock market. There’s a sell-off in the bond market. That has never happened before, both at the same time and the same week. They’re looking in to recession. So, they’re expecting this. They’re pricing this in into their investment decisions.

Advertisement

Some companies pay $1,000 per hour to talk with me privately about their pricing issues. And yes, they get their money’s worth. Implementing just one suggestion can yield incremental profit much, much larger than that small investment.

However, some companies have found a way to hack my business. They join INSIDERS for just $100 per month. Sure, that gives them access to all of our courses, but many use it just to come to Office Hours.

During that time, I answer all sorts of pricing questions. I’ve reviewed upcoming price increases. I’ve helped price new products. I even helped one INSIDER prep for a job interview for a director of pricing, and yes, she got the job.

Sometimes only one person comes to office hours and it’s like they got the value of $1,000 one on one private session.

So, if you want to take advantage of me, and in this case, I don’t mind, become an INSIDER. Go to http://insider.impactpricing.com.

Mark Stiving

Yeah. And so, a company who wants to know which of their segments are becoming more price sensitive. In order to do that, we have to quickly start running some price segmentation or market segmentation studies and figuring out what the price sensitivity is, and then practically do that on a quarterly basis just to see what’s changing in our marketplace, to understand what’s happening in our segments. Does that make sense to you, Pavel?

Pavel Knorr

Yeah. That’s actually very correct, and that’s what we already understand and plan to validate, practically. So, the idea is to build a visible use case, especially now, it’s super relevant in this time.

Actually, several clients already requested a bunch of conjoints. So, they’re coming to us and saying that “Well, months ago, we raised the prices, and now, we see that most probably because of the inflation, we’ll have to raise price one more time,” end of June, middle of July, and then they probably will expect another price raise somewhere September and October. So, they’re super concerned about this and they want to be ahead of their competitors, because from the one point of account inflation, this pressure will call you and you’ll have to react properly to maintain your gains. And from the other hand, you need to be still competitive in the market. And that’s actually what we hear pretty frequently from our clients.

So yeah, I would totally agree with that wisdom. That is very nice. If, for example, we’re in their shoes, if I have a tool which can quarterly basis tell me that, for example, my low-end segment has rise for another 10% in the price sensitivity, that might be a silver bullet actually for me.

Mark Stiving

Yeah. Actually, as you started, we’re talking about that. It struck me that there’s a really hard problem that’s coming up right now.

Conjoint does a phenomenal job at helping people understand “are you going to buy from me or from my competition?” It does a really good job at that. I don’t think it does as good a job – Matt, don’t disagree with me –but it does a good job at “are you going to buy something in the category or not?”

And so, what happens is inflation goes up and incomes don’t rise, people are going to start saying, “Well, I just can’t buy anything in that category. It’s not yours or your competitors’. It’s nothing.”

And so, this is a real challenge that people are going to have to try to figure out. Matt?

Matt Johnston

Yeah. I actually remember it’s a great case study from the time of the financial crisis where cars; so, let’s take the car sector, the automobile sector. And some of the more premiums like BMW, they started to reduce their prices. But in actual fact, what Hyundai did was went out, ask the customer, survey the customer, listen to the customer, try to understand their needs. And what they realized was the reason why customers or potential buyers didn’t want to pull the trigger and buy a car was for fear that they were going to lose their jobs within the next 6 to 12 months. So, what Hyundai did say, “Well, look. Buy the car, and we will guarantee if you lose your job, you can give the car back and we’ll give you your money back,” which was credible insight.

So, this is like thinking outside the box, getting ahead of it, not just relying on promotions and discounts, and your typical pricing mechanics, but instead looking at the broader picture of the customers and trying to understand what they’re facing, what they’re thinking, what are their concerns, what are the risks that they’re perceiving, and try to react accordingly and to help.

Mark Stiving

I absolutely love what you just said, Matt, because you actually weren’t selling your software there. And the reason I say that is I’m a huge, huge fan of Conjoint. It does a phenomenal job. It’s just not the magic bullet that does everything. And yes, we have to go out and listen to our marketplace and understand what the problems really are and how we can go solve those. So, we’re never going to just find the answers in data. We actually have to go listen and know what to ask in our questions. So that was a phenomenal answer.

Matt Johnston

Welcome.

Mark Stiving

So, one of the other things I’ve seen recently happening in the marketplace is if you go to buy an appliance today, you can’t buy a low-end appliance. And the reason you can’t is because there are supply chain problems and manufacturers can only make so much stuff, and their attitude is, “Well, I’ve got enough people buying all my high end. Why would I waste time building my low-end?”

Now, how would I figure that out using segmentation and/or just conjoint?

Pavel, I’ll let you take a shot at that if you want to try it.

Pavel Knorr

Okay. That’s an interesting question. What we can do to address that.

So again, we are starting with the study, which first of all, we’ll need to understand. Again, as Matt mentioned and as you mentioned, that conjoint is the good tool to compare yourself against the competitors, but it’s not performing that well when it’s considering buy or no buy at all. So really what I can say here is that algorithm and all the magic behind the conjoint is something like 50% of success, because if you collect the bad data or from wrong people, you will have nothing as the output; nothing useful for you as the output.

So, the point here is that we, first of all, need to understand who will be our customer there. So, if my case is that I cannot produce low-end appliance and my assumption that I can focus on the high-end appliance and gain some revenue or gain some market share, then I actually should start with the proper screening in my surveys, in my study. I need to find the people who are willing to get the high-end appliance. I need to build the model for them, maybe for some segments within this audience. But what I also would say is that since we’re already asking people about what type of appliance they are going to buy and screening out everybody who is not going to buy the low-end appliance, it’s super interesting to just see on the screen out rate and understand how much people just screen out because they cannot afford the low-end appliance. And then we can we can run another study on them; an in-depth study. We will, for example, evaluate without the competitors, just to understand at which price point they will be more or less comfortable to buy the low-end appliance.

Mark Stiving

Pavel, one second. I think you short-changed conjoint for just a second, because not only does it do well for us versus our competition; it does really well for people choosing within our product line, right? So, if we’re offering good, better, best products, we could see who’s going to choose which product as they go through that. And then we could watch their behavior. What if we took away the good product and it doesn’t exist anymore? Now, what’s their behavior look like? Which is pretty interesting.

Pavel Knorr

Yeah. I think in this in this time, as we’re starting to head into a more price sensitive clients where people are really going to apply the principles of value-based buy, “Do I really need this?” “What value does it bring to me?” It’s very short sighted and risky for a seller of a white good end appliance. In fact, that’s one of the products I think we need to bring it as a bellwether, because there’s a large segment of customers that are coming in to the new house market where they’ll need to buy. You know, young people, home starters that they’re ignoring, that in the boom times of the recent decade would probably have splurged on, and say, “Oh, let’s go for the premium model.” Going into this uncharted territory where they’re not in that mold anymore. So, these appliance vendors need to cater for a broader set of customers and customer segments.

Mark Stiving

So, I think that this is actually a really, really hard problem. I don’t know the answers to this, because the issue is if I can only make 100 refrigerators, I could make 30 good, 30 better, 30 best or 40 best; doesn’t matter, right? But what if I could make 100 best and I know I can sell them all? Does it really matter what people choose? And how do I figure out what I should be building? This is a really hard problem, because if I’ve got infinite supply, I don’t have a supply constraint problem, then you’re spot on, right? Let’s go serve that low end customer. If I have a supply constraint problem, now, we got a challenge. It’s just a really interesting problem.

Pavel Knorr

But how do you know that you will be able to sell 100 premium products?

Mark Stiving

That’s your problem to figure out using conjoint, doesn’t it?

Pavel Knorr

Okay.

Matt Johnston

Give us a call.

Mark Stiving

And so, kind of the whole point is, if I know I have a supply constraints, then how am I going to figure out what decisions people would make if I took away some of their choices?

Pavel Knorr

Yeah. This reminds me of the case when Audi launched the Q7 back I think it was 2006 and they had a supply constraint, but they didn’t go out and measure the demand and the willingness to pay. And results are a case study subsequently calculates the missed revenue opportunity at about a quarter of a billion by Audi under charging and not taking into consideration the surplus demand, that huge demand for that premium car. So yeah, that’s one that always sticks of it. But having said that, Audi was still selling the A3 and the A2, whether there’s any sector that segments, probably over segments. It’s the automobile, right?

Mark Stiving

Well, it’s interesting. And I guess if I were to summarize what we just talked about, it would be segmentation’s hard. It’s really important. And the tool is amazing to help you figure out where your segments are, but you have to put a ton of thought behind it. You have to have strategy and try to figure out what are you doing, what makes sense.

Pavel Knorr

How you design the survey is important as well. A lot of conjoint we do are very kind of products or service spec-oriented. With a needs-based conjoint, you need to think more categorical, really kind of less of the specs of the product and service, but more of the experience and trying to capture the more emotional aspects of the product; safety, occasion, sharing, rewards, treats.

Matt Johnston

Exactly.

Pavel Knorr

Because survey design defines what kind of the questions you then will be able to ask. So, if you’re designing this the way without keeping in mind what is your final goal and what is the questions you want to address, then you may end up with the model which still measuring quite good the market itself, however, it does not address all the questions that you have at first. So yeah, that survey design is still a hard part, and unfortunately there are no tools that can automatically understand what’s in your mind and what is your business strategy. Yeah, it’s still a tough part, I would say.

Mark Stiving

Yeah. Just because you guys have made the process simple doesn’t mean that you don’t have to think.

Matt Johnston

Yeah. And that’s why our proposition is a full-service proposition. We help the client do the thinking as well. We work hand in glove with the client in designing the survey to make sure it does address the product or pricing question that they have.

Mark Stiving

Yeah. So, we’re actually running long, but I’m going to ask one. Also, I’m just going to say this because I think it’s so important and we haven’t said it yet. And the thing that I loved when you guys first started talking to me about using conjoint data for segmentation. The thing I loved about that is, think about what Conjoint is really doing. It’s looking at individuals and saying, “How much do I value an attribute of a product? And the value of the attribute of a product is a really good proxy for what problems do I have, what problems is that attribute going to go solve for me.” And when you do market segmentation, in my opinion, the best thing to segment on is “what are the customer’s problems? What are the market’s problems?” And so, you guys actually had this data that said, “Hey, look, we’ve got this proxy for everybody’s market problems. Now, how do we use that for segmentation?” And I thought that was just a brilliant insight. That just excited the heck out of me. And I wish we had gotten to that early in the conversation, too. So nice.

Matt Johnston

And I guess that’s the beauty of conjoint. And Conjoint, you can bring in, obviously, the pricing. That’s the kicker for us. We can assess the needs, how we can address, help address with clients, how they can help address the target customers’ needs or problems. But we can also, because by the virtue of the fact that it is conjoint analysis, we can then overlay the price sensitivity of that onto that cluster and the willingness to pay. And it’s amazing; the difference in willingness to pay that you see based on the different needs of the clusters. It’s remarkable. And that’s smart pricing. If you can act on that, that is smart pricing.

Mark Stiving

It really is. I got to say I’m really impressed with what you guys did with that project. And as a quick summary, what they really did was they made it so that you can use conjoint to segment your market based on problems and then you can figure out price sensitivity for each market segment, which is really powerful. So, very, very nicely done.

We’re going to have to wrap this up. So, Pavel, I’m going to give you the final question because Matt was asked to answer that once before. And that question is what’s the one piece of pricing advice you would give our listeners that you think could have a big impact on their business?

Pavel Knorr

Pricing? Okay. So, you always should stand on the ground. The meaning that I put into this statement is that we quite frequently hear from our customers that they want to measure the price elasticity, but on the interval, that is so huge and so unrealistic. So, they would barely able, even to get the model that represents what they currently have, not even build the prognostic model. And this is very important.

If you’re addressing the question “what is the proper price right now?” and “what is the proper price three months after?” you have to properly specify the price intervals for that, and you have to deal with – specifically in conjoint – you have to deal with the realistic market situation.

So, you go with the competitor’s prices, you go with your prices, you go with the potential inflation, and count that. But if you will try to build like two obstruct prognostic model, you will just end up with the results that will tell you that it’s better to have no model than this one. So that’s probably what I will offer.

Mark Stiving

So, be realistic in the way we do our design.

Pavel Knorr

Yeah.

Mark Stiving

Which makes a ton of sense. Alright.

Guys, thank you so much for your time today. As always, I love talking to you, and hopefully everybody else did, too. And Matt, what’s the contact info we want to use for you or EPIC?

Matt Johnston

Well, probably go to our website – https://www.epicconjoint.com. There’s a “Let’s Meet” button on the top of the home page. And we’ll be delighted, we’ll get back to you very quickly to have a chat, and maybe a demo of our latest rapid segmentation solution with a pricing twist.

Mark Stiving

Nice. I love that. And Pavel, do me a huge favor and do your best to stay safe there in Ukraine.

Pavel Knorr

Yeah. I will do my best.

Mark Stiving

Oh gosh.

Episode 177 is all done. Thank you for listening. If you enjoyed this, would you please leave us a rating and a review, and please tell your pricing colleagues about the podcast.

And finally, if you have any questions or comments about the podcast or pricing in general, feel free to email me: [email protected].

Now, go make an impact.

Tags: Accelerate Your Subscription Business, ask a pricing expert, pricing metrics, pricing strategy