James Wilton is the founder and managing partner of Monevate, a consulting firm focused on pricing strategies. With a background in consulting from McKinsey and A.T. Kearney, James has a wealth of experience in helping companies capture value through effective pricing. He recently published a book titled “Capturing Value,” which delves into the strategic importance of pricing in business.

In this episode, James discusses the nuances of pricing and its critical role in understanding value within a company. He shares insights on how businesses can develop pricing strategies that align with their value propositions and enhance their overall success. James emphasizes the importance of aligning pricing strategies with corporate goals and understanding customer needs, particularly in the SaaS and B2B sectors.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Learn about the relationship between pricing, value, and corporate strategy.

- Gain insights on the differences between B2B and B2C pricing strategies.

- Understand the evolving landscape of usage-based pricing and its implications.

“Being a little bit more thoughtful of thinking about, what are those different levels of offering that I can give? What is the right price metric that really does help me scale across a few different segments? That can make a massive difference to how much value you’re able to extract from your market.”

– James Wilton

Topics Covered:

01:22 – James’ journey into pricing and consulting

03:36 – The strategic importance of pricing in business

04:48 – Understanding value and its impact on pricing decisions

06:24 – The role of pricing in SaaS and B2B companies

08:12 – Pricing strategy and corporate valuation.

15:05 – James shares insights on pricing AI, arguing that the fundamental principles of pricing remain the same, despite the unique challenges AI presents.

17:08 – James discusses how Monevate is using AI to analyze qualitative research, improving efficiency in summarizing interview results.

20:37 – Exploration of usage-based pricing, with James explaining its advantages and the importance of aligning pricing metrics with the value delivered to customers.

27:32 – James offers key pricing advice for companies, stressing the importance of creating a differentiated pricing structure to maximize value extraction from the market.

28:45 – Connect with James.

Key Takeaways:

“Capturing value is about understanding what pricing should do for your company, to capture a fair portion of the value that you create for your customers.” – James Wilton

“With AI models these days, you’re seeing token-type models that fundamentally focus on the amount of work the system is doing. This results in a cost-based metric rather than a value-based metric.” – James Wilton

“Value really is getting some kind of utility from something in its basic way.” – James Wilton

People/Resources Mentioned:

- Monevate: https://www.monevate.com/

- McKinsey: https://www.mckinsey.com/

- Capturing Value: https://www.amazon.com/dp/B0DRDVPQJ9

- A.T. Kearney: https://www.kearney.com/

- RELX: https://www.relx.com/

- Steven Forth: https://impactpricing.com/podcast/665-the-future-of-ai-monetization-trends-and-challenges-with-steven-forth/

- PayPal: https://www.paypal.com/

Connect with James Wilton:

- LinkedIn: https://www.linkedin.com/in/jamesdwilton

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

James Wilton

Being a little bit more thoughtful of thinking about, what are those different levels of offering that I can give? What is the right price metric that really does help me scale across a few different segments? That can make a massive difference to how much value you’re able to extract from your market.

[Intro / Ad]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing value and the nuanced relationship between them. I’m Mark Stiving, and I run bootcamp to help companies get paid more.

Our guest today is James Wilton. Here are three things you want to know about James before we start. He is the founder and managing partner of Monevate. He did his three year stint at McKinsey so he’s an official consultant now. And he just published a new book. I love the title. It’s called Capturing Value. Welcome James.

James Wilton

Good to be here, Mark. Thanks for having me.

Mark Stiving

Hey, how’d you get into pricing?

James Wilton

Oh, it was a random walk there. Mark. Has anybody come on this and said that they made a beeline for pricing from the beginning of their career yet?

Mark Stiving

Never.

James Wilton

Never. No. I can’t quite believe it. Now, for me, it was largely by chance. I guess I’ve always been a consultant since the beginning of my career.

I started off doing sales and marketing and strategy consulting about six years of that with my MBA sandwich between it.

And then in about 2012 I was at a firm called A.T. Kearney doing general strategy and ops work. And it was very classic consulting, four day a week travel. And I was having to go in the office at the weekend, and I’d also just had a baby.

So, I was essentially seeing my son Harrison on the weekends for the first couple of months of his life. And I was in this really difficult position because I really liked consulting and I identified as a consultant, didn’t really want to change that. I loved the variety of the work that I was doing.

But I just, I knew I couldn’t, from a values perspective, keep this going, right? I wanted to be able to be around my family more than I was. So I didn’t know what I was going to do. Lo and behold I ended up getting headhunted by this internal consulting firm for a company called RELX. It was called Reed Elsevier back then.

But this internal consulting team focused on pricing, which I had not done anything of at this point in my career. But they were coming to me not because I was a pricing expert, because they wanted to leverage my experience in consulting and bring that approach into what they were doing.

And the value proposition for me was, you’ll probably really like consulting, you’ll probably really like the pricing consulting. But then also you’ll get a lot more time to spend at home with your wife and your son, and the work life balance will be better. I decided to roll the dice on it just for that reason really.

And as it happens, I found out that I love pricing through that experience. I think it was, it immediately struck me how it was a lot more strategic than I was expecting it to be, and there was a lot more room for creativity than I was expecting there was going to be as well. So, I was hooked pretty quickly.

Mark Stiving

Nice, nice. I actually think it’s the most important role in the company. And it isn’t the idea of setting the number, it’s the idea of understanding, what does value mean inside our company?

James Wilton

Right, exactly.

Mark Stiving

Okay. A quick plug because I want to hear you say it. What did you write in the book Capturing Value? What’s interesting? And then I’m going to ask you a really hard question.

James Wilton

Okay. Wow. I’ll brace myself. Okay. Exactly. So, yeah, I mean, capturing value. The reason I called the book Capturing Value as a pricing book is because I fundamentally believe that really what pricing does, or what it should be doing for your company, is capture a fair portion of the value that you create for your customers, right? So, you build a great product, build a great offering. You create a whole bunch of value from that, and then your pricing strategy captures it. And I think because A, it can be quite difficult. And because B, there’s just a lot of that, people don’t necessarily build in that strategic lens of pricing.

They don’t think about, let’s build a pricing strategy that helps us capture their value. It’s just so easy to leak a lot of that value along the way. You end up with a pricing approach that doesn’t really serve you. So, really what the book was there, was written to do, was to say for people who were in SaaS businesses, really, what is the approach that you need to take to go through every step and think about how you build a pricing strategy that aligns to value and helps you be better able to capture the value that you create?

Mark Stiving

Nice. Nice. I absolutely love that. Now, here’s the really hard question. I spent years debating with different pricing people, what is value? I want to hear your definition of value.

James Wilton

That is a very hard question. I want to think back to Dr. Spaceman on 30 Rock. It’s like, value is whatever you want it to be. No, I mean, I think to a certain extent, value really is getting some kind of utility from something in its basic way, right?

I think sometimes people over rotate in that conversation and say that value has to be tangible and you have to be able to measure it, and quantify it, and all the rest of it. I don’t necessarily think that is true. I think value can be very intangible. But it’s really something that does create that utility for you, that is value.

People will usually be willing to pay something for access to that value. They won’t usually be willing to pay the entire sort of monetary equivalent of that value, if you can quantify it, but they’ll pay something for that.

Mark Stiving

Okay. That was reasonable. That was okay.

James Wilton

Alright. Yeah. Okay.

Mark Stiving

It’s such a hard word. Can I give you my two definitions? And you’re welcome to disagree with them if you want. So, the one that I use for the basics is, results of solving problems. And so, that’s pretty consistent with everything you just said. And then, the second line I usually use is, in B2B, value is measured in incremental profit.

And so, now we get to the quantifiable part, right? How much more money am I going to make my customer when they buy my product? Now, what you pointed out clearly is that buyers aren’t willing to pay me all the money I’m going to make them. And so, willingness to pay is not the same thing as value, necessarily, so.

James Wilton

That’s true. So I agree with your first part of that completely, Mark. I actually disagree with your second part to that. Not to say that it isn’t ever about profit. But in a lot of cases, a lot of the companies that I serve actually, and they are B2B companies, value ultimately isn’t about profit, right?

Really, what they are like, looking into and trying to achieve really is more about, it’s often more about revenue growth or volume growth at certain parts of it. So what they’ll think about at value at that stage is different from what you might be thinking about value later on.

And I’d probably agree that, for me, ultimately what businesses should be trying to get to is profit, right? I don’t think that’s necessarily what these earlier stages are thinking about because when they are valued by investors or companies coming to buy them, they may not really be looking at profitability at all.

They might be looking for a path to profitability at some point in the future. But even when you start to consider things like the rule of 40 and saying, look, the revenue growth plus the profitability has to be greater than 40. In a lot of recent years, or months within recent years, revenue growth on its own has been a better predictor of enterprise value than the profitability has, which I know is counterintuitive.

But that is, it does tend to be the way that the markets work for these companies that are on, on their way up because they think that is going to be a better predictor of what success is ultimately going to look like for them.

Mark Stiving

Yes. And so, I’m going to say what you just said in slightly different words, and that is, instead of measuring it in incremental profit, we’re actually measuring it as an expected increase in corporate valuation.

James Wilton

Yes. Yes.

Mark Stiving

And that’s especially true for companies who don’t care about profit at the moment, right?

James Wilton

Exactly. Exactly.

Mark Stiving

I mean, Amazon in so many years didn’t make a profit and didn’t care.

James Wilton

Precisely. Precisely. And that’s actually one of the things that I do talk about within the book is that, a pricing strategy, when you’re building a pricing strategy, the first thing that you should be doing.

And it’s amazing that you know how many people don’t do this ’cause it sounds so trivial, right? But the first thing you should be doing is thinking about what are you trying to achieve? What do you want this pricing strategy to be able to do for you? Do you want it to be maximizing the profitability on every single deal?

Which, once you get up to enterprise level, especially if you’re serving really big, big companies, that probably is what you’re trying to be doing. Or is it that you are trying to maximize revenue in the near or the long term? Or is it that you’re trying to maximize volume or is it a some kind of a combination of those different things with constraints around each one.

And when you’re building a pricing strategy to say, say you had two companies, right? They were both exactly the same. Everything was identical about them in terms of their, customers they were serving, the product that they had, et cetera, et cetera. Everything’s the same except for company A is trying to maximize profit and company B is really trying to maximize volume.

Like, the pricing strategies you would build for those two companies would be completely different. And it’s true that it’s not, it’s not usually the case that you would be so polarized and it would be just about this or just about that. But there are going to be, there are going to be priorities within that.

You’re going to be thinking, this is the most important thing, this is the second. If you have that list of all the different prioritized items, then you can start making trade-offs when you are building your pricing strategy and say, I’m going to like slightly sacrifice the achievement of this objective in service of trying to get to this one, or trying to build something that balances across all of them.

Mark Stiving

Yeah, I think that’s absolutely right and most of the time I would expect the CEO, CFO, a corporate team, to say, here’s what it takes for us to increase our valuation. And that would be, hey, we need more customers. We need more logos. We need higher NRR, whatever the heck it is that they’ve said this is what we need to increase valuation, go focus on that. And that’s how we built, that’s the goal of our pricing strategy is to help achieve the corporate strategy, right? Whatever that happens to be.

James Wilton

Definitely should be. Definitely should be. Yeah. And you do end up, I’ve been in situations when I’ve worked with clients before where, ’cause usually when I work with clients, the stage of the clients I typically work with, you’re usually working directly with the executive team.

But then there’s also a board involved, which will have the investors and so forth, and most of the time, those two entities are going to be aligned in terms of what they’re trying to achieve. But not always. I’ve actually been in a couple of situations where what the executive team wants to focus on is different from what the board and the investors want to focus on.

That becomes incredibly difficult to navigate, right? Because as we just talked about, you can’t, you need to know what you should be trying to achieve in order to build a pricing strategy that’s going to be able to do that. So the first step is getting that alignment.

Mark Stiving

Yep. Absolutely. I’m going to share a Bezos quote with you, which I’m going to butcher slightly, but you’ll get the gist of it. It’s something to the effect of there are two types of companies, those that try to raise prices and those that try to lower prices. And we’re the latter. And when I lead presentations with that quote, I always say, and I help companies with the former, right?

James Wilton

Yes, exactly. Yeah, that makes sense.

Mark Stiving

So, pretty amazing. Do you do any work in…and how do you see the difference between B2B and B2C when it comes to SaaS pricing or pricing in general?

James Wilton

Yeah. Yeah, I do. I’ve actually, if you look back at my portfolio work over the last 15 years or so, I’d say it’s probably about 70, 80% B2B and the rest B2C.

So I’ve definitely done more B2B, and I really, I learned how to do pricing like working for B2B businesses. So I’m probably slightly more that way. But yeah, I think it’s, it’s interesting because I think when I, back when I was at McKinsey, actually, there was a school of thought. I used to get taught that there were, B2B pricing and B2C pricing were completely different, like completely different animals.

You’d split the practices. You don’t do both of those because they are fundamentally different. And I actually, I disagree with that. I don’t think they’re fundamentally different. I actually think they obey, it’s all the same principles. You need to obey all the same principles to build a good B2B pricing strategy as you do if you’re building a good B2C pricing strategy.

It’s just that the situations that you’re going to be directing those principles towards are going to be different, and therefore you end up doing slightly different things and focusing on slightly different areas. Like for example, I think with, with B2B businesses, especially if you are the enterprise side of it you’re going to end up with much smaller deal volumes, right?

They’re going to be much larger deals and therefore to do B2B pricing well, it really, most of the time you’re going to be focusing on trying to get the best price that you possibly can with those smaller sets of deals, right? And using all the tools at your disposal to understand what their willingness to pay is, drive up their willingness to pay.

If indeed you can, you can do that and then be able to set price at exactly that level, which is probably going to involve some kind of a longer sales cycle to be able to do all of all of that. And there’s going to be discounting and negotiation. So it’s less about the pricing strategy that you, sorry, the price level that you start with and more about the price level that you end up with.

Whereas B2C pricing by contrast is, you’re usually going after huge volumes of customers. And therefore it’s, it isn’t so much about maximizing the value of every single one of them. It’s about getting to a generally good price point with a large number of customers at this point, and being able to make it so that they’re able to make that decision quickly, land at something that’s relatively good.

You don’t want a lot of negotiation within there ’cause you haven’t got the infrastructure or the resources to be able to do that. So therefore it really is about getting that list price exactly right as much as you possibly can because you’re not going to have the ability to discount as much.

So, there’s no differences in the things that you’re thinking about and the principles that you’re trying to obey. But because the situations are so different, you’re going to end up with very different answers.

Mark Stiving

Yeah. I think that’s pretty accurate. I like to think of B2C as having what I call a TIOLI market. So it’s a take it or leave it market. Buyers say, am I going to buy it or not buy it? And in B2B, we’re often negotiating, right? We’re often dealing with individual prices for individual customers. And so for there, we have to understand the value for an individual customer instead of the value for the marketplace or average value, something like that. So, pretty fascinating and pretty different.

Okay, so now here’s the hard question. What’s different about pricing AI? I’ve been having this argument with many of my pricing threads lately and is there anything different?

James Wilton

That’s a great question. Certainly if you read everything that’s on the internet now, you’re going to think it’s completely something completely different.

It’s a whole different beast. That’s certainly the way that it’s being talked about, like the rule book is being ripped up by AI.

I think it’s, I go with what I sort of saying, it’s very similar to the way thinking about B2B and B2C pricing, Mark. I actually think, if you were going to go through what I would suggest is the right process to price something. Start off with your objectives and understanding the market, and then building a pricing system which helps you price differentiate et cetera, et cetera.

Going through all those steps. I don’t think pricing AI is really any different from pricing a different product or pricing SaaS. You still think about all the same things. But again, because AI is different to software and to SaaS and there are, it creates value in different ways.

There’s this, at least at the moment, there’s this very different cost component of it, right? And there’s all these things to be thinking about there. If you go through that process, you are probably going to come out with different answers to what the general answers have been for SaaS over the past 10, 15 years.

And so again, going through that process I don’t think is any different. But a lot of people aren’t going through that process when they’re pricing their SaaS products, right? They’re thinking, oh, it SaaS, let’s do a good, better, best packaging scheme and let’s price it per user.

It’s like a knee jerk sort of easy answer there. And I think, that knee jerk easy answer doesn’t necessarily work for AI as frequently as it works for SaaS, and obviously that makes people feel uncomfortable cause it’s quite different.

Mark Stiving

I guess it depends on what you have as your foundational belief of pricing, right? So if you think that it’s good, better, best, and per user, then I would say it’s very different.

If you believe it’s, we’re charging based on willingness to pay and willingness to pay as a function of how much value we deliver to our customers. It’s the exact same thing.

James Wilton

Exactly. Yep. Yeah, we’re on the same page.

Mark Stiving

So, nice. Okay. I dunno if you’re willing to share this with all of us, because I’m really curious, how are you using AI in your business?

James Wilton

Yeah, it’s a great question. It’s a, it’s an evolving area. We’re definitely. We’re using a couple of ways. I think like generally most of our associates and consultants now have access to it, and they’re just using it for the kinds of things that we do day to day. Being able to message things.

It’s quite useful for writing copy and for drafting things in nice and clear ways. When you have it set up to be able to do that, like you have to customize your GPT a little bit, I find. But once you’ve done that, that can be quite useful. We’ve also started using it to summarize results of interviews as well.

A lot of, we do market research in various ways at Monevate, but we always do at least a few interviews with buyers of different segments. And then I think the challenge for the consultant becomes summarizing and synthesizing the themes across all of these different areas.

You literally would have to just as you’re going through the interviews, keep your eyes open for these things that you are looking for and flagging them, and then going back over previous interviews and seeing whether they start to build up that kind of fact base around all these different themes and outputs that are coming out.

AI is able to make that a lot more seamless. Now, it wasn’t originally, you go back about 12 months to 18 months and it would hallucinate all the time and pull out things that weren’t actually said. And you have to be really careful.

It’s now, actually, some of the GPT we’re using are a lot more accurate about doing that. And we’ve been testing, right? We’ve been doing our sort of our own synthesis in parallel to looking at what the AI does to make sure that it does this in a pretty robust way now, and it’s a lot further along than it was, and certainly is a time saver for that part of our projects.

Mark Stiving

Nice. To summarize what you just said was you’re using it to analyze qualitative research, which I think is awesome. And I dunno if you’ve tried this yet or not, but you could get one LLM to crosscheck the results of another LLM. So if they give you an output, you could just put the original and the output into a different LLM and say, Hey, is this a good summary of this?

James Wilton

That’s true, yeah. That’s a good point.

Mark Stiving

Now we don’t even have to do the summary, the analysis.

James Wilton

That’s right. That’s right.

Mark Stiving

So just a thought. Just a thought.

James Wilton

I like it.

Mark Stiving

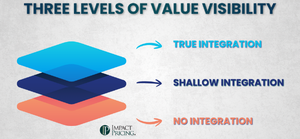

So, let’s jump to usage-based pricing. So I, before we jump to usage-based pricing, I learned this from probably Steven Forth. Most of what I learned, I learned from Stephen Forth. He’s brilliant. I always disagree with him when he comes up with new ideas until he convinces me they’re right.

I think he’s the one who said there are pricing metrics, there are usage metrics, and there are value metrics, that’s what it was. Right. So three different types of metrics, right? So a value metric is how does a customer measure the value they get? Usage metric is how do we measure how much someone uses our product? Pricing metric is, what do we charge for?

James Wilton

Yes, okay.

Mark Stiving

In usage-based pricing, what we’re really saying is how much are they using and is that, and we want to use that as our pricing metric, right? We want to use some usage metric as their pricing metric. I set that stage up so that I could ask you, tell me about usage-based pricing.

Is it the future? Subscription was supposed to be the future and everything was going subscription, but now everybody’s talking usage.

James Wilton

Yeah. Great question. I think firstly, at least in the way that I see usage-based pricing, I don’t think usage-based pricing and subscriptions are either or, right?

I think there’s ways of doing subscription pricing, which is also got a component of of usage-based pricing in it as well. There’s these kind of hybrid models, some of which are very much anchored towards doing this very predictable subscription pricing, but just having this usage element in there.

I think that when people think about usage-based pricing, they’re really what comes into your head is these models where you just literally measure how much somebody was using in a particular month or time period. And just charge them based on those number of units, which is definitely one way of doing it.

But I’ve been watching usage based pricing for about the last sort of 12 or 13 years. And the pendulum keeps swinging backwards and forwards between it, because I think people like usage -based pricing. When usage aligns to value, which it does sometimes, and I think in increasingly as we get more or automation and so people can do more with fewer users and obviously these AI models that are coming in, there’s a big usage element to them as well.

But they don’t tend to like the lack of predictability, right? People like predictable pricing. I think the buyers like it because they want to know what they’re going to end up paying. Actually the vendors like it as well. Because you’d rather know what your revenues are going to look like exactly.

Whereas if you’re just literally charging based on how much somebody uses it, somebody’s usage drops off, you end up with decreased re revenue. What I’ve seen a lot of in the last couple of years as we’ve been doing usage-based pricing at Monevate are these models, which are, they are usage-based, but they’re more about charging for capacities of usage than they are about charging for exact usage.

So like you’d say, if I was starting off with a new customer who’s on my product and I’m charging based on, I’ll just say transactions as a generic usage-base metric, I would need some way of looking at their profile and estimating what their transactions is going to look like for that first year.

And I say, this is going to be the price for your first year. I’m charging you for this many trans transactions, and they’re going to start using it. They may end up using more than that. They may end up using it less than that. If I want to upsell them within the first year because they use more. That’s a design decision that you could make. But you may not do. But then you’ve measured how much they’ve actually used it over that first year, and then their pricing for the second year is going to be changed based on the amount that they used it in that first year.

And there’s many variants around that kind of a system, right? But it’s a simple form that would be the way it is. The benefit in that is, you still get the short term predictability in terms of the payments, which is very helpful for companies for budgeting, thinking about what they’re going to end up paying.

But you still get the value alignment with usage, assuming that you do have, there is a measure of usage which aligns to to value for you and you get the other big benefit of usage-based pricing, I think, which is we call it growth orientation, right? Because usage-based metrics, if you pick the right one, it’s usually going to be something that ends up growing over time and can take you to higher price points.

So you get that growth orientation over the long term, but you still keep the predictability in the short term, and that still counts as recurring revenue. And it’s still by default a subscription. So I think there’s a kind of that blurry hybrid world I think is where a lot of models have been going recently.

And actually I think we’ll end up seeing AI go a lot in that direction as well, particularly when the cost starts coming down.

Mark Stiving

Yeah I agree completely with what you said in terms of, I usually call it bucket or tiers. You’re buying the access to a capacity. So, one of the ways I think about this and share your thoughts with me on this is, is that when you think about something that’s a cost…and that really belongs…tiers. But if I can sell something that…then I can think of…usage and you’re very happy. And the example I always use is PayPal. PayPal charges 2% of your revenue or whatever the number is. And I look forward to the day I get to pay PayPal a million dollars.

James Wilton

Right, exactly. Yup, now I got you. So Mark, I think what you just said was like, if it’s something that that is about a cost to you, that’s something you’d want in tiers, whether it’s something that more aligns with generating revenue or something, that’s something that you could do a more of a scalable model. Did I get that right?

Mark Stiving

Yes. Yes.

James Wilton

Yes, I agree. That’s it, right? Because I think this is the thing with usage-based pricing, right? It was very, it’s been quite trendy for a while, which means a lot of people end up wanting to do usage-based pricing. And I think there is a, a step that can be skipped, which is, is usage-based pricing right for me?

And I would say that, usage-based pricing, setting out your stall to actually do usage-based pricing, which is, I’m going to make this, the main way that I am, that I’m monetizing you, is you want it to be the latter of those two examples that you just said, right? It is something that actually drives value for the customer.

It is value aligned. I would say in that kind of a case, it does make sense to have that as being your main metric. If it’s cost aligned, but it’s not value aligned. It really shouldn’t be your price metric, right? You should not be doing that because you’re going to get all the kind, all the friction that you get from picking a metric that doesn’t really scale with value for the customer, but you are incurring your own costs there.

So usually the way to deal with that would be to build into your pricing model, setting your prices. You got coverage for a, call it 95% of the time you are covered in terms of costs and are sufficiently profitable. And for those other edge cases where people use it more than you would expect them to, and it drives up extra costs, just pass through those extra costs in some way, right?

So you’re still covering yourself when you need to, but you’re not aligning your pricing model with a metric that doesn’t align with the value that the customer gets.

Mark Stiving

Yep. So it’s not always easy to do that is the thing that strikes me. And so, most pricing metrics that we use, they tend to be looked at as cost…, right?

So pick texting. So texting drives value, but our customers would look at it as a cost. And so, how are we going to charge for it? Is it per user? Is it per message? And so typically what we’ll do is we’ll put together buckets and say…here’s the price.

James Wilton

Yah, exactly. And that’s what you’re getting with AI models these day, right? You’re getting these token type models, which are fundamentally around the amount of work that the system is doing. And that’s a cost-based metric rather than a value-based metric.

Mark Stiving

Yeah, that’s absolutely. In fact, it’s a cost-plus pricing metric.

James Wilton

Yeah. Hundred percent. Hundred percent.

Mark Stiving

Excellent. We are running out of time. James, let me ask you the final question. What is one piece of pricing advice you’d give our listeners that you think could have a big impact on their business?

James Wilton

What is one piece of pricing advice I could give our listeners that would have a big impact on them?

Yep. Absolutely. It depends on which stage I was going for. I guess I serve a lot of companies at the lower end who are really building relatively early pricing strategies for them.

And therefore, I think, the most powerful piece of pricing advice you could get would be to build a price structure that helps you to price differentiate more effectively. The amount of times that I see companies come out with just one package and it’s take it or leave it.

And a price metric, which is just defaulted to like a per user, incredibly common, right? And that really means that you’re not setting yourself up to be able to charge different amounts for different customers based off the value that they are getting. And based off the willingness to pay that they have.

So, being a little bit more thoughtful of thinking about what are those different levels of offering that I can give, what is the right price metric that really does help me scale across a few different segments that can make a massive difference to how much value you’re able to extract from your market.

Mark Stiving

Yeah. James, thank you so much for your time today. If anybody wants to contact you, how can they do that?

James Wilton

Yep. Best way Mark would be on my LinkedIn profile. My handle is James D. Wilton.

Mark Stiving

Excellent. Appreciate that. And to our listeners, thank you for your time. If you enjoyed this, please leave us a rating and a review. Scott Sinning said about my newest book, Instant Profits:

This is a quick read with powerful ideas about how to raise prices the right way. It’s very timely given the impact of tariffs rippling through the supply chain, highly recommended for sales management and pricing leaders.

Scott, the check is in the mail. Thank you very much. And finally, if you have any questions or comments about the podcast or if your company needs help getting paid more for the value you deliver, feel free to email me, [email protected]. Now go make an impact.

[Ad / Outro]