Florian Bauer is an internationally sought-after expert and speaker on the subject of price psychology and behavioral pricing. He is an honorary professor at the Technical University of Munich and author of several books on price research. He also has a doctorate in Psychology at TU Darmstadt, MIT, and Harvard.

In this episode, Florian talks about how discounts can give you short-term gain but cost you long-term. He underscores that there are other means to incentivize customers without diminishing a products’ value perception. And that cashback is one thing to consider other than discounts. He also talks about buyers’ irrationalities and how to use Behavioral Economics to influence their decision-making and let it work in your favor.

Podcast: Play in new window | Download

Why you have to check out today’s podcast:

- Learn about the psychology of price structure and how it influences consumers’ buying behavior

- Find out what you can, what you should, and what you should not do when giving a discount

- Learn how Behavioral Economics can help you influence buyers’ decision-making and maximize your company’s profit

“If you want to price or sell something, you have to think in two dimensions. You have to think about what people want. That’s the traditional value-based approach. And you have to think in the dimension of how they decide.”

– Florian Bauer

Topics Covered:

01:28 – How Florian got started in Pricing

02:25 – What the psychology of price structure is all about

03:22 – What a price structure looks like

04:12 – What’s the psychology behind using cashback than just lowering the price

06:03 – How do discounts differ from cashback

07:39 – The feeling of disconnect with cashback

08:20 – Cashback being an icing on the cake that can potentially make you feel more decided about your choice

10:02 – What’s the disadvantage of discounting

11:36 – What behavioral economics means for pricing

16:15 – Different people behave differently when it comes to decision irrationalities

18:00 – His thoughts on the ethical issue about Behavioral Economics

23:22 – What is Behavioral Economics showing us and why this works in the B2B world

25:38 – How heuristics simplify complex decisions

29:35 – Florian’s best pricing advice that can significantly impact your business

Key Takeaways:

“Never ever give a discount without anything the customer has to give in return.” – Florian Bauer

“That’s the issue with discounting. It really works very well short-term. So, you have to gain short term, but you have to cost long-term.” – Florian Bauer

“If I want to sell somebody something, I need to know what he wants, or she wants, and I need to adapt my sales approach and my pricing model, potentially, to how he decides.” – Florian Bauer

“For me, the purpose of marketing, pricing, and sales is to influence decisions. So, there is no reason to have a marketing campaign or a marketing team if you would not have the idea that I can influence my customers’ decision in my favor.” – Florian Bauer

“I think when we talk about value and price acceptance, it’s very much a story. And there is not one story better than another one. People hate to make decisions, they want to be made decided and with some stories, they are quicker in deciding than in others.” – Florian Bauer

“Think about that you’re not only selling value; you’re also managing decisions. If you keep that in mind when you design your pricing model, you also avoid the traditional clash between pricing and sales because you’re also able to tell your salespeople how they can actually execute your pricing strategy to make the customers actually follow the decision or the directions you want them to.” – Florian Bauer

People/Resources Mentioned:

- Daniel Kahneman: https://en.wikipedia.org/wiki/Daniel_Kahneman

Connect with Florian Bauer:

- Email: [email protected]

- LinkedIn: https://www.linkedin.com/in/profdrflorianbauer/

Connect with Mark Stiving:

- LinkedIn: https://www.linkedin.com/in/stiving/

- Email: [email protected]

Full Interview Transcript

(Note: This transcript was created with an AI transcription service. Please forgive any transcription or grammatical errors. We probably sounded better in real life.)

Florian Bauer

If you want to price or sell something, you have to think in two dimensions. You have to think about what people want. That’s the traditional value-based approach. And you have to think in the dimension of how they decide.

[Intro / Ad]

Mark Stiving

Welcome to Impact Pricing, the podcast where we discuss pricing, value, and the oftentimes relationship between them. I’m Mark Stiving. Today, our guest is Florian Bauer. There are three things you want to know about Florian before we start. He is a member of the Executive Board of Vocatus. So, we’re going to learn what they do. He has a Ph.D. in Psychology, which makes a ton of sense when you learn that he, number three, specializes in Behavioral Economics, a topic most of us find fascinating. Welcome, Florian!

Florian Bauer

Hi, Mark!

Mark Stiving

It is great to have you. Tell us how did you get into pricing?

Florian Bauer

Oh, that’s a good question. Well, first of all, I started studying Psychology. And I was never really interested so much in the clinical part. So, I was really very early on focusing on decision-making. So, in the early ’90s, when the term Behavioral Economics was not even coined, I started with decision experiments. And my master thesis actually was already about a certain pricing application. And so, I continued that, and my Ph.D. was about the psychology of price structure. And then after founding Vocatus, we are focusing on implementing behavioral pricing in a lot of different companies.

Mark Stiving

Okay, so you’ve got to tell us what was the finding in the Ph.D. And you got to make it in English. In English, as in not academic….

Florian Bauer

Well, basically, it was about how the price structure… So, if you think about a complex tariff, like a telecommunication price model that consists of a basic fee, and some usage-based fees. This is what I would call the price structure that is not only a one-off price. How this structure influences how people decide. So, it turns out that no matter what, even if the effective price people pay at the end of a contract period, at the end of the day is the same, the structure, how you structure these little elements, makes people decide for or against a certain offer. So, in fact, the structure has as much importance for people spending a certain amount of money as the price level itself.

Mark Stiving

So, give us an example of the structure.

Florian Bauer

A structure would be, for example, a simple way is buy one, get one for free. That’s already a price structure that goes beyond a certain price for a certain product, or a price structure would be a cashback, for example. So why is cashback working? Why don’t you just lower the price? There’s a lot of psychology involved that people prefer the cashback over a lower price at the end. And so, there’s margin and conversion rate to be optimized by understanding the psychology of people dealing with different and more or less complex price structures.

Mark Stiving

Okay, so tell us why does cash back work better than just lowering the price?

Florian Bauer

Well, because you can actually trace that back to prospect theory, the model with which Daniel Kahneman won the Nobel Prize in 2002. That basically, is saying that if you have a certain pain, which is associated with spending money, so this pain has a diminishing marginal value, to say so. The more you spend, the higher gets the pain. But if it’s already on a high level, adding 50 euros or $50 doesn’t make that much of a difference anymore if you are on 20,000 already. The first $50 hurt a lot. But the 50 you add when you are at the price of $20,000 doesn’t hurt so much anymore. So, it is diminishing pain, more or less. But on the other hand, if you gain something like this $50 that you get as a cashback, they feel much better than the $50 that the last 51 you pay. So, if you buy a car for $20,050, and you get a cashback of $50, that feels better than just paying 20,000. Because this 50 at the end, which you pay on top of the 20 do not hurt so much as the 50 you get as cash for your pleasure.

Mark Stiving

That makes all the sense in the world. Now let me push back just a little bit if you don’t mind. What’s the difference between a discount? So, I walked out to the car dealership, it’s 20,050. And they say, ‘Hey, we’re going to knock $50 off for you’, or actually buying the car for 20,050. And then later, I get $50 cashback.

Florian Bauer

Oh, that’s a huge difference because the price the product has is just something made up. The price is also a signal of the quality and the value of the product. So, at the moment you give a discount, in the very same moment you devaluate your product. So, if you are able to give discounts like we see on Black Friday, or whatever, discount without basically any substantial reason, then people have no other way than rationalize this by saying probably the product is not worth the original price. So, it makes a lot of sense to stick to the list price, or the original price and try to incentivize people in other ways than directly discounting from the price of the product, because the price of the product is always the signal of value of the product.

Mark Stiving

Okay, I’m with you. I’m having a lot of fun pushing back to try to understand this better.

Florian Bauer

Go ahead.

Mark Stiving

What you’re saying to me is that I’ve got a buyer who looks at a discount that I’m given on the spot differently than I consider getting cash back later. So, in other words, when it comes to the value of the product, I’m not going to diminish my perception of the value of the product. And yet, I still use the fact that I’m going to get $50 in a month and a check as part of my decision process. That feels like a disconnect.

Florian Bauer

It feels like yes, it is mentally disconnected and that’s why it works. So, the mental accounting of the customer, is, he pays that price, a little bit higher price, but one month later, he received 50 euros, or $50 as a cashback, which feels nice.

Mark Stiving

It does, but we expected him to use that 50. Okay, so now you’re at the time of purchase, talk through the buyer for a second. We’re at the time of purchase. It’s 20,050 but I’m going to get cashback for $50. Am I anticipating the pleasure I’m going to get a month from now, when I get my $50 check?

Florian Bauer

Well, you probably somehow mingle that into your decision. Definitely, as a matter of fact, it doesn’t make a big difference to you whether you pay 20,000 or 20,050. But having this little, you know, the icing on the cake makes you probably or can potentially make you feel more decided about your choice and say, ‘Okay, let’s do this.’ And actually, it would not be such an interesting offer if you would just say, ‘Oh, okay, here’s the card $20,000’, because you would also already be, you know, tempted to say, ‘Oh, let’s negotiate.’ But in the moment, I tell you as the salespeople, ‘Okay, this is 20,050, and you get a cashback in one month, let’s say. But this is all I can do’, then you don’t, you know, at a certain point when you have to feel you’ve got enough out of your negotiation you stop, but you stop at the point where you did not discount the price of the product. For from a seller perspective, this is really crucial. So, from behavioral economics, you can draw a lot of conclusions for what you can, what you should, and what you should not do when giving discount. So, the main concept here, for example is never ever give a discount without any thing the customer has to give in return.

Mark Stiving

So, that’s a very pretty standard negotiation concept.

Florian Bauer

Well, but a lot of companies don’t follow it.

Mark Stiving

Definitely.

Florian Bauer

Because they very often, people sit around and think how can we trigger revenue? Okay, let’s give a discount. What can we do? How can we give discounts and they have like creative meetings on how they can give discounts, but they completely forget about the long-term implication this discount has on the perception of product value or price acceptance from the customers’ perspective and that’s the issue with discounting. It really works very well short-term. So, you have to gain short term, but you have to cost long-term.

Mark Stiving

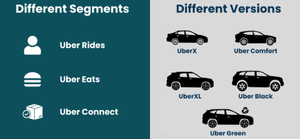

Yep. I agree. Let me slightly switch topics, but I think it’s really similar. And I’m curious about thinking about the segmentation of customers, and how behavioral economics impacts different segments. And the example I want to use that I think is really similar to what we’ve been talking about, is, I remember when I was younger, and I would shop, if I saw that there was going to be a rebate on some product, I just subtracted the rebate price from the price and said, ‘Oh, yeah, that’s a great deal. I’m going to buy this product.’ And yet, I realized I almost never sent in the rebate coupons and went through the hassle of getting it. And so eventually, I taught myself to stop doing that, right? Just don’t do the math and assume it’s less price. Okay, so now that you have one person with two different behaviors with one pricing structure, pricing tactic, I assume that there’s segments like the old me and there are segments like the new me; how do we think about segmentation for behavioral economics?

Florian Bauer

Well, that’s a very good point. I mean, with that question, we are coming right to the heart of what behavioral economics means for pricing. Behavioral economics is about how people make decisions, and the fact that under certain circumstances, they make predictably irrational decisions, because they follow certain heuristics that are in many cases are leading to good results in terms of their decision outcome but in predictable situations, they lead to bad or suboptimal results. Okay, that’s the notion of every behavioral economics publication. Now, unfortunately, this is also where behavioral economics, academic research stops, because the focus was really only on proving that the standard economic theory assuming a rational decision-maker is wrong. But we did actually go one step further in our work and said, okay, we think that people can not only be simply irrational, but there is a difference between people in how irrational or what kind of irrationality they show. So that was it. I guess it was 15 years ago, in a global study in different industries. We segmented people with respect to how they made a decision, or in other words, what kind of irrationalities they showed in their decision-making process? And we found five types ranging from the bargain hunter, probably the earlier you, the risk avoider, the price acceptor, the routine buyer, and the indifferent buyer. And this segmentation did actually hold true in any situation in any industry, B2C, or B2B. And the interesting part about this is that this is the only segmentation that is referring to how people make decisions. Whereas normal marketing segmentations are referring to what people want. So normally, in marketing, we segment people with respect to their needs, or what they want from a product. But in fact, for pricing and sales, where the target is to influence decisions, purchase decisions, it makes a lot of sense, if there are different decision types to understand how they decide. So actually, what we say from our perspective, behavioral pricing and sales is, if you want to price or sell something, you have to think in two dimensions, you have to think in what people want. That’s the traditional value-based approach. And you have to think in the dimension, how do they decide, because if I want to sell somebody something, I need to know what he wants or she wants, and I need to adapt my sales approach and my pricing model, potentially, to how he decides because a bargain hunter, he needs a discount, otherwise he doesn’t buy it because his decision-making process is, I want to have something, I just don’t get. I want to have something special, I need to give Nick, I need the discount, whatsoever. Very often those guys buy because of the price rather than although the product has a price. So, we have to cater to this very specific psychology of their decision-making process in pricing and in sales. And that’s actually the implication from my perspective. Behavioral economics brings to the table as it sheds light on this second dimension that is very often forgotten in pricing and sales because we think we basically price for product features and the value they generate. But in the very moment, people buy a lot of other things that play a very important role. And that those have to do with how they decide.

Mark Stiving

A long, long time ago, back when I was a professor, I remember doing a research project and my dissertation was on 99 cents, and why does it work? And what I found fascinating was one of the experiments we ran was a cost of thinking experiment. How hard is it to subtract two numbers? And what you found is the people that are very numerically literate, are much less likely to drop the nine. And people who are less numerically literate are more likely to use a heuristic and just use the left-hand digits. Yeah. And so, it’s pretty fascinating that different people behave differently when it comes to these irrationalities.

Florian Bauer

Yeah. And even more interesting. We use those types not so much in a trade way. Those scripts hats are not traits you have; you are not always a bargain hunter. I am a bargain hunter, maybe when it comes to selecting my DSL provider or my telephone provider. I’m not a bargain hunter when it comes to buying cars, for example. Maybe I’m a price acceptor their or for booking a holiday. Maybe I’m a risk avoider there. So, what is really important about this concept is that what we have been calling the hybrid customer is nothing else than the statement that people can follow different kinds of psychology in decision-making in different industries. That doesn’t mean, what we found is that once you are a bargain hunter in one industry for one product that really stays very stable, but that has no indication whatsoever, whether you are a bargain hunter in a totally different industry.

Mark Stiving

Yeah, that makes sense. And that’s totally okay. Because you’re in one industry, you don’t have to classify an individual as a bargain hunter in every industry, you just need to know they are in yours.

Florian Bauer

Absolutely.

Mark Stiving

Nice. I got two really big questions or topics I want to bring up with you for and about. First one, and I love asking this question because I don’t know how I feel about it. But it feels to me like Behavioral Economics has the ability to trick customers. And so, it almost feels unethical, or you could describe it as unethical. So how do you square that in your own mind?

Florian Bauer

Yeah, that’s a good point. And that’s a very often asked question. It is on my top five list. I totally agree. That’s an issue you can see in Behavioral Economics. And I think it’s an issue that’s very often dictated when you apply Behavioral Economics to redesigning decisions about healthcare, financial planning, or whatsoever. But my perspective on this is very abstractly speaking, for me, the purpose of marketing, pricing, and sales are to influence decisions. So, there is no reason to have a marketing campaign or a marketing team if you would not have the idea that I can influence my customers’ decision in my favor. So, you could also say manipulate, but people hate this word, although it’s more to the point. So marketing is there to manipulate decisions, pricing is there because a company wants to take as much consumer rent as possible. Okay. It’s very much I want to have the money you would be willing to give to me as much as I can. So, that’s the target of pricing at the end of the day.

Mark Stiving

So, I’m going to push back a second, Florian. I could describe but I’m not disagreeing that marketing can’t be used for manipulation. But I could describe marketing as I’m making people aware of the value of my product. And I teach them about the value of my product because I want to help them make the best decision for themselves. And as they understand the value of my product, they’re willing to pay me more. And so, I price in order to capture all that. And so, in my base world of value-based pricing, it’s all about teaching value, understanding how our customers perceived value, pricing for value. And then we get into, yeah, but I can trick you into thinking my product is more valuable than it really is.

Florian Bauer

Okay, let me give you an example and discuss this example. We did a project for an insurance company; they are selling nursery care insurances in one part of their portfolio. So, basically, when you get older, and you need nursery care, they pay for it, okay? And they used to sell this product, like every insurance by saying, okay, you know, if you get older, you might get ill or you might need some nursery care. And if you have this insurance, we pay for it, if you don’t have it, you have to pay for it yourself. And so basically, this insurance covers your own financial risk, go and buy it. Okay, this was the storyline of this insurance. This was their way of, you know, discussing their value. Now, what we did is we said, okay, we want to change the mental account you’re talking to, and we said, we designed, in parallel mailing, we did it in an AB test where people actually bought or did not buy at the end. And we said, you know, our storyline was, if you get older, and you get ill, and you need this nursery care, and you don’t have the money, and you probably have to sell something, you have to sell your apartment, you have to sell your house to get that care. And then what, there’s nothing left for your children. So actually, you buy this insurance, not for your own financial security, you buy it for the future of your kids. Now, that’s just another way of reframing the value of your product. Is it a trick? I don’t know. I think when we talk about value and price acceptance, it’s very much a story. And there is not one story better than another one. People hate to make decisions, they want to be made decided and with some stories, they are quicker in deciding than in others. So, the point I was going to with my argument that marketing has the purpose of influencing decisions, and pricing has the purpose of maximizing my profit as a company in an assumed to be zero-sum game. This intention is there before Behavioral Economics was there. The only difference between applying behavioral economics or not applying behavioral economics is that the standard pricing model is assuming a rational decision-maker, which is simply wrong. So, the difference between applying behavioral pricing or standard pricing is whether you want to build your pricing on a falsified model or a validated model. And if there is something like validation. So that’s for me the difference, not an ethical issue because the purpose is still the same, the intention is still the same.

Mark Stiving

Okay, I’m going to let that slide because, in my own mind, I don’t have a good answer yet. I’m not disagreeing with you. And it just isn’t there yet. But I have one really important topic to bring up with you. I had a call yesterday from someone who asked me, so does this behavioral economic stuff work in the B2B world? How would you answer that question?

Florian Bauer

But that’s my number one on the list? Yes, absolutely. And we can answer that on different levels. Let me first give a very fundamental answer to that. What is Behavioral Economics showing us? What are these effects all about? Where do they come from? Why do people make mistakes when they make decisions? Why are they predictable? They are predictable because our human body is shaped by evolution. Our cognitive apparatus, our decision-making apparatus is shaped by evolution. And you can trace back a lot of these behavioral economic mistakes people make back to an evolutionary value they have. So, for example, if people are loss averse, that has an evolutionary value. If people perceive things relative rather than absolute if they are more sensitive to changes than the status quo. All this has an evolutionary value in itself. So, our decision-making apparatus like our vision, like our hearing is shaped by evolution. So, it does not go away, we will behave that way in the future. And we will always behave that way because this is how we are. And we will behave that way when we are privately shopping for a car or milk. And we will do so when we are in a business environment. Nevertheless, the way we do it can be different. Think about, maybe I’m more a bargain hunter in the business environment. Maybe I’m more a price acceptor in the business environment other than in the private environment. But nevertheless, none of them is really rational. Okay, so this was a very fundamental answer. So, this is not about mistakes people can learn to not make anymore, this is how we are shaped. So, it doesn’t go away.

Mark Stiving

So, my answer, I repeat what you just said. You just said people are irrational, decisions and companies are made by people, therefore those decisions are likely irrational.

Florian Bauer

That’s a very good summary. Yeah. And I actually hate this. It’s very, very popular is irrational, but you can have a lot of discussions about it. So, for me, it’s really important what we learn from behavioral economics is that people apply certain heuristics to simplify complex decisions. And those heuristics, like any evolutionary outcome, they very often have well, led to good results, but in under some circumstances, they lead to predictable mistakes. That is the essence. It’s not just saying people are always irrational.

Mark Stiving

I think it’s more accurate to say people are less than perfectly rational.

Florian Bauer

Yeah, probably that’s much better. It’s very, you know, it’s a catchy term that’s often used, sometimes if you take a little bit deeper, what it means it’s a bit misleading. And for me, it’s very important that it’s predictable because if it would not be predictable, you could not use it in any kind of application. So, it needs to not simply be mistakes people make or errors, there is a certain logic to that. Now, I have a more pragmatic answer to your question, why it is also, in B2B. Any business decision-maker, it already starts with having this twofold motivation of any business decision-maker, which is I want to have a solution that is good for my company, but I also want to secure my career. So, you know, this famous sentence of no one ever got fired for buying IBM? This is a core statement of a risk avoider; it is not reflecting a rational decision mechanism. And just because of the fact that everybody making decisions in the company has the tendency to follow or have these two motivations in mind that there is a high risk of some irrationality involved. Now, the next step is a lot of decisions in companies are made by groups of people. And we know from a lot of research that proves do not necessarily tend to be more rational than an individual. So, there are a lot of reasons for that. And I think it’s a good heuristic for a company to not start and assume every customer is rational, but maybe shed a little bit more light also on those who are less rational because behind this predictably irrational behavior is nothing else than additional margin or conversion rate. That’s why we are talking about.

Mark Stiving

Yeah, I often get the feeling that companies put in place things like buying committees or RFP processes, because they’re trying to minimize, in part irrationality or bad decisions by individuals.

Florian Bauer

You know, that’s absolutely true. It doesn’t mean that it will end up that way but that’s the intention. I often have people sitting or clients asking me, you know, in my industry, we have a price war. And I don’t think that this Behavioral Economics works here because they are really only focused on price and everybody is under pressure. So, when somebody tells me like that, some have asked me like something like that, I say, ‘Okay, are you the cost leader in your industry?’ And then most likely, they’re not. And I’m saying so why aren’t you out of business because rationally speaking, you should be out of business. If you ask me the only reason why you are still in business is that you implicitly somehow apply behavioral economics somewhere on the way, otherwise there would be no reason why you’re there.

Mark Stiving

All right, we’ll leave it at that point. But I have to wrap it up with the final question. Yeah, what’s one piece of pricing advice that you would give our listeners that you think could have a big impact on their business?

Florian Bauer

It’s really about, think about those two dimensions when you price and sell. Think about that you’re not only selling value; you’re also managing decisions. If you keep that in mind, when you design your pricing model, you also avoid the traditional clash between pricing and sales, because you’re also able to tell your salespeople how they can actually execute your pricing strategy to make the customers actually follow the decision or the directions you want them to.

Mark Stiving

Nice, nice. I have had such a great time talking and listening to you. If anybody wants to contact you, how can they do that?

Florian Bauer

Oh, by mail, it’s [email protected]. Maybe you can you can write that somewhere in the announcement of the podcast or something. It’s very simple or buy a book. That’s that simple.

Mark Stiving

When you said by mail, I thought you were going to give your address and let people send you a letter.

Florian Bauer

No. Email. Sorry.

Mark Stiving

All right, to our listeners, would you please, please, please leave us a review. These are so valuable to us. If you have any questions or comments about the podcast or about pricing in general, feel free to email me [email protected]. Now, go make an impact!

[Outro / Ad]