You can listen to the full audio version of this blog we call — Blogcast.

You’re sitting in a conference room facing a software purchase decision. Two vendors, similar products. Vendor A costs 15% more but has a proven track record with companies like yours. Vendor B offers better ROI on paper but is relatively unknown in your industry.

Your CFO is adamant: “We’re going with Vendor B. The numbers are clear—23% better ROI. This is a no-brainer.”

But your project manager looks uncomfortable. “What about implementation risk? Vendor A has never missed a deadline on projects like ours.”

“The spreadsheet doesn’t lie,” your CFO replies. “We can’t justify paying 15% more for gut feelings.”

Who’s right? The CFO following financial logic, or the project manager trusting experience and intuition?

This scenario is repeated in boardrooms around the country. Buyers have access to more data than ever, yet many decisions still feel wrong afterward. The reason is simple: every purchase exists in two worlds simultaneously.

Like the old concept of left-brain versus right-brain thinking, buying decisions are split between analytical and intuitive processes. The metaphor isn’t scientifically precise, but it captures something important about how buyers actually behave.

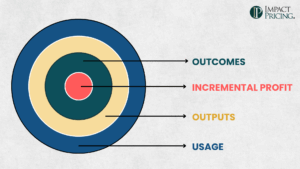

On the Left Side, the analytical side, buyers engage logic. In B2B, this means incremental profit: more revenue, lower costs, or reduced risk. In B2C, it means utility: functional benefits, convenience, or savings. Left Side buyers build spreadsheets, compare features, and try to optimize outcomes.

On the Right Side, the intuitive side, buyers respond to emotion. They’re influenced by fairness, fear of loss, social proof, identity, and shortcuts that simplify decision-making. This is where behavioral economics operates—the biases and heuristics that shift willingness to pay in ways that seem irrational but are deeply human.

The CFO in my example was purely Left Side. The project manager who advocated for the more expensive vendor was being Right Side, sensing risks the spreadsheet couldn’t capture. Both perspectives were valid. Both can influence what actually happens.

The challenge is that these two sides work differently, and neither tells the complete story.

Here’s what both sides miss: buyers never act on real value. They act on perceived value—their own calculated story of worth, shaped by the data they considered and the biases they carried. Your job as a seller isn’t just to deliver value. It’s to shape how that value is perceived.

This article explores how these two worlds work together. Because if you want to understand why buyers really buy, you need to master both sides.

The Two Sides of Every Decision

Every buying decision takes place in two worlds: the world of logic and the world of emotion. Both exist simultaneously, though their relative weight differs by context and buyer.

The Left Side: Value and Logic

On the Left Side, buyers engage in deliberate reasoning. They slow down, evaluate, and try to make the best possible choice based on measurable outcomes.

In B2B, the Left Side ultimately comes down to incremental profit. A company invests in software, equipment, or services because they expect it to generate more revenue, lower costs, or reduce risks. Every feature comparison and benefit analysis eventually ladders up to one question: how will this improve profitability?

When a manufacturer buys automation equipment, the justification is straightforward. The equipment reduces labor hours and increases throughput, which improves margins. When a company adopts new sales software, they’re betting it will help close more deals or shorten sales cycles. When they invest in risk reduction like cybersecurity, it’s to prevent costly breaches. These are Left Side decisions—logical, measurable, defensible.

In B2C, the Left Side shows up as personal utility. Consumers evaluate fuel efficiency in cars, durability in appliances, or convenience in services. A parent buying a family car compares safety ratings, repair histories, and total cost of ownership. That’s Left Side thinking applied to personal value.

But utility extends beyond pure function. A Starbucks purchase delivers caffeine (functional), predictable quality (economic), a pleasant environment (experiential), lifestyle signaling (social), and daily ritual comfort (emotional). The same purchase creates value across multiple dimensions.

The Right Side: Behavioral Economics and Emotion

On the Right Side, buyers are guided by feelings, biases, and mental shortcuts. This isn’t irrational—it’s deeply human and often efficient. But it operates by different rules than logical analysis.

Five characteristics drive Right Side behavior:

Loss aversion: People hate losing more than they enjoy gaining. A small loss feels larger than an equivalent gain. This explains why price increases create anger, why discounts feel less powerful than expected, and why buyers resist switching vendors even when numbers suggest they should.

Relativity: Buyers don’t evaluate value absolutely—they decide by comparison. A product feels expensive or cheap only relative to other options. A $10 difference matters on a $50 item but disappears on a $50,000 purchase. Buyers ask, “Is the upgrade worth it?” rather than “What is this worth?”

Fairness: People often care more about being treated fairly than about financial outcomes. They’ll give up profit to punish unfairness. A company discovering it paid more than competitors for identical services will feel cheated, even if its return was strong.

Identity: Buyers use purchases to express who they are. Decisions reinforce group belonging, personal values, or status. This is why “nobody ever got fired for buying IBM” resonates, and why Patagonia succeeds on values alignment.

Ease: Buyers prefer paths requiring less effort. Simplicity, defaults, and clarity reduce cognitive load. People accept suboptimal deals if they’re easier to understand or execute. Complexity slows decisions; friction kills sales.

These characteristics explain why behavioral tactics work. Scarcity leverages loss aversion (“only three left”). Anchoring exploits relativity (high reference prices make actual prices seem reasonable). Good-Better-Best packaging uses both—the middle option feels safe, avoiding the “too cheap” or “too expensive” extremes.

Of course, no decision happens in isolation—these two forces always collide.

How They Connect

Both sides almost always play a role, but their balance differs. In B2C, emotion often dominates—buyers choose brands that feel right even when logic is weak. In B2B, logic carries more weight because purchases require credible profit justification.

Yet even B2B buyers need emotional confidence. They might trust one vendor’s implementation capability over another’s, worry about career risk from choosing unknowns, or prefer familiar solutions that feel safer. The project manager in our opening example was being logical about risk, even if he couldn’t quantify it in a spreadsheet.

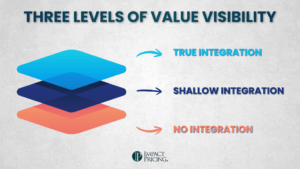

Here’s the critical piece: What economists call Real Value is the actual profit or utility a purchase delivers. But buyers never act on Real Value directly. They act on Perceived Value—their constructed view of worth that combines Left Side analysis with Right Side filters.

Perceived Value takes logical analysis (ROI models, feature comparisons, cost-benefit calculations) and runs it through emotional and behavioral filters (trust, fairness, identity, ease). A buyer might see strong ROI numbers but discount them because the vendor feels risky. Or they might accept weaker numbers because the solution feels familiar and safe.

Buyers aren’t just evaluating what you deliver—they’re evaluating what they believe you’ll deliver, filtered through their biases, experiences, and emotions.

Your job isn’t just delivering superior ROI or utility. It’s shaping Perceived Value—ensuring the logical case gets processed through emotional filters that build confidence rather than doubt.

The Right Side Bias

Different groups focus on different sides of buyer decisions, but there’s a dangerous imbalance in the places that matter most.

Academics gravitate toward the Right Side. Kahneman, Tversky, Thaler, and Ariely built careers studying loss aversion, anchoring, and cognitive biases. Their work is fascinating and has reshaped how we understand decisions. But it mostly lives on the emotional side.

Consultants camp out on the Left Side. Business cases center on ROI. Pricing consultants emphasize value, cost savings, and profit improvement. This is essential work, but it often stops at surface-level ROI claims rather than deeply understanding how buyers actually perceive incremental profit.

Sales and marketing lean heavily Right Side. Advertising appeals to emotion, urgency, social proof, and identity. Salespeople rely on relationships and storytelling. These tools are powerful, but when overused, they can overshadow the fundamental work of demonstrating value.

Procurement and finance live almost exclusively Left Side. They demand detailed cost comparisons, feature matrices, and business justifications. They’re trained to be skeptical of emotional appeals and focus on measurable outcomes.

Here’s the problem: sales and marketing teams interact with far more buyers than consultants or academics. This creates a massive Right Side bias in how most purchase decisions get influenced. Buyers are constantly exposed to emotional appeals, relationship tactics, and behavioral triggers, but rarely encounter deep value articulation.

The Right Side gets more attention because it’s fun, exciting, and easy to communicate. The Left Side work is harder—understanding how buyers actually perceive value requires deep customer insight, not clever tactics.

Yet in B2B especially, the Left Side is what ultimately decides. Executives may enjoy reading about behavioral economics, but when they approve significant purchases, they need credible profit justification. All the relationship-building and urgency tactics in the world won’t overcome weak value perception.

The most successful sellers understand both sides. They highlight solid Left Side value—real profit impact in B2B, genuine utility in B2C. And they use Right Side understanding to shape how that value gets perceived and processed.

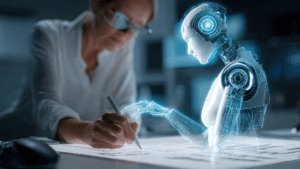

Looking ahead, this balance may become even more critical. As AI plays a larger role in purchasing decisions, algorithms won’t be moved by charm or scarcity tactics. They’ll respond to clear value and logic. Mastering the Left Side isn’t just important today—it’s becoming the foundation for future sales success.

What This Means for You

Understanding both sides changes how you approach selling, but the application differs dramatically between B2B and B2C contexts.

In B2B: Lead with Left, Reinforce with Right

Start with credible profit justification – no significant B2B purchase survives without it.

Begin with deep value discovery. Don’t assume you understand how buyers perceive incremental profit. A manufacturing client might care more about reducing downtime risk than increasing throughput. A SaaS company might prioritize faster time-to-market over cost savings. Surface-level ROI claims miss these nuances.

Build your Left Side case meticulously. Quantify revenue impact, cost reduction, or risk mitigation with specifics. Use the buyer’s own metrics and terminology. Connect features to business outcomes they actually care about.

Then use Right Side understanding to reinforce that case. Address fairness concerns with transparent pricing. Leverage social proof by highlighting similar companies’ success. Make the decision easy with clear next steps. Reduce loss aversion by offering trials or guarantees.

The sequence matters. Buyers who feel “sold” rather than convinced become difficult customers.

In B2C: Lead with Right, Support with Left

Consumer decisions often start emotional and get rationalized later. Lead with Right Side connection, then provide Left Side justification.

Create immediate emotional resonance. Appeal to identity, social belonging, or aspirational outcomes. Make the experience feel right before proving it makes sense.

But don’t neglect logic entirely. Consumers need rational justification to feel good about emotional decisions. Provide clear utility benefits, cost comparisons, or quality indicators they can point to later.

The key is sequence and emphasis. B2C buyers who connect emotionally will seek logical support. B2B buyers who see logical value will need emotional confidence to act.

Common Pitfalls

Over-relying on Right Side in B2B: Relationship tactics and behavioral triggers can accelerate decisions but can’t overcome weak value perception. The executive who buys based on relationship alone becomes your biggest risk when results don’t materialize.

Under-estimating Left Side in B2C: Even emotional purchases need rational support. Luxury buyers want to believe they’re making smart investments. Convenience buyers need to justify the premium.

Misreading your audience: Some B2B buyers are highly emotional (worried about career risk). Some B2C buyers are purely analytical. Read the specific person, not the category.

Here’s the hard truth: most B2B sellers are terrible at Left Side decisions. They lead with features, build generic ROI models, and wonder why buyers choose cheaper alternatives. The companies that win understand how their specific buyers perceive value and know how to shape that perception.

If you’re struggling to calculate and communicate value in ways that resonate with buyers, we can help. We specialize in helping B2B companies master Left Side value articulation, turning features into profit stories that buyers believe and act on.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: marketing, pricing, pricing foundations, sales, value

Tags: marketing, pricing, pricing foundations, sales, value