You can listen to the full audio version of this blog we call — Blogcast.

Do you have an opportunity to increase your profitability? The answer is undoubtedly yes, but that’s neither satisfying nor informative. You need to know where the opportunities lay and which ones are likely to lead to more success. Enter our Opportunity Signals tool.

We built the Opportunity Signals tool to help our Private Equity partners assess their portfolio companies for potential unrealized growth, but we are opening it up to you.

The tool is simple to use, consisting of 43 yes/no questions across five different categories. They are simple and straightforward, information you most likely know off the top of your head.

Each question is correlated to one or more opportunity types related to value optimization. The six opportunity types are:

- Raising Prices

- Market Segmentation

- Price Segmentation

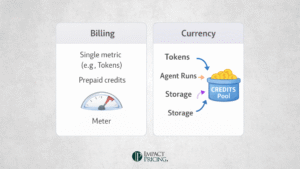

- Pricing Metric

- Packaging

- Communicating Value

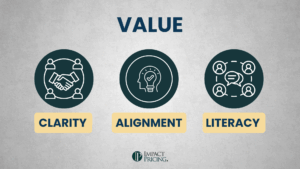

That’s right, when we think of pricing strategies we think way more than just the number on the price tag. All of these six areas play a significant role in optimizing your profitability and are all highly related to how your buyers perceive the value of your product. If you’re not paying attention to all of these, you are likely leaving money (maybe even significant amounts) on the table.

After answering all the questions, the tool scores the strength of each opportunity area, pointing the portfolio company toward its biggest potential areas for improvement. If Pricing Metric shows up as a dark green cell at the bottom, then you likely have an opportunity to grow profit by revisiting your pricing metric. It doesn’t mean there is definitely an opportunity, but it means the signals are there.

Our goal is to help every company get paid what they deserve, which is why we decided to make the Opportunity Signals tool available to everyone. Feel free to download it at https://impactpricing.com/pricing-opportunity-signals/.

Remember: Focus on the opportunity types that show up green. There is likely profitable growth in those areas. And as always, let us know if you need some help.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: pricing, pricing strategies, pricing strategy, profit, value

Tags: pricing, pricing strategies, pricing strategy, profit, value