You can listen to the full audio version of this blog we call — Blogcast.

The first tenet of Context Driven Pricing is that Willingness to Pay (WTP) is contextual. On a hot day, a Coke is worth more than on a cold day.

WTP is largely based on how much a buyer values a product. That value fluctuates based on context. As I’ve written previously, value is the RESULT of solving a problem. It follows then that context is really the severity of the problem. In the Coke example, thirst is a bigger problem on hot days than on cold days.

Weather, or temperature outside, is an obvious example of context, if it matters to the product. Tickets to a baseball game are more valuable on sunny days. Umbrellas are more valuable on rainy days. Weather is an example of a dynamic context. It changes frequently. In pricing, we should be thinking about price segmentation, charging different prices based on the immediate context. We may even think of this as dynamic pricing.

On the other hand, climate is a more stable context. Snowblowers are more valuable in Minnesota than in Texas. This example drives a longer term price segmentation, with snowblowers selling for higher prices in Minnesota. To take it a step further, they should sell for higher prices in the winter than in the summer. It is still price segmentation, but it doesn’t change as often.

This longer term price segmentation could be thought of as serving different market segments. Minnesotans have different problems than Texans. You may consider building different product lines for the different segments. Texans may be willing to buy a light duty snowblower for the occasional snow, but it would be completely useless for a Minnesota winter.

But this post isn’t about the weather; it’s about your buyers’ contexts. When you can identify large stable differences in context, consider treating them as different market segments. When you identify frequently changing conditions that drive buyers’ WTP, figure out how to systematize price segmentation.

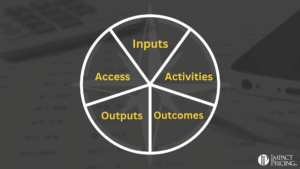

I think of market structures in terms of a Value Architecture. At the highest level, we identify the stable characteristics of buyers that drive their buying behavior. These often define market segments. For each market segment, we determine an effective product portfolio. Finally, for each product, we adopt effective price segmentation based on the current context.

The key for today’s post: Think through what truly drives your buyers’ WTP. Identify which factors change frequently and which are stable. Then, take a moment to see if you’re using market segmentation and price segmentation effectively. If you need some help, let us know. It’s what we do.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: pricing, pricing skills, pricing value, value, value architecture

Tags: pricing, pricing skills, pricing value, value, value architecture