If you never lose on price, you are not charging enough!

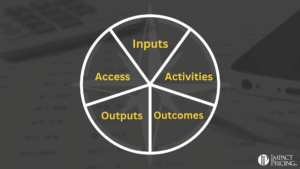

I know, many of you wish you had this problem. But the key here is that there is some optimal percentage of deals you should lose due to price. This optimal percentage is dependent on how unique your product is, how competitive your market is, how much differentiation you offer, and of course, how well you sell value.

Let’s look deeper. Assume you never lose on price. Then, you raise your price by 10%. You may still not lose any deals. That’s free money. WooHoo! But what if you lose 15% of your deals now based on price. Was that a good decision? It depends on your margin.

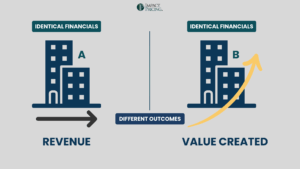

Assume you have a product with 50% contribution margin. You sell $1M/year of this product which breaks down into $500K in costs and $500K in margin. If you increase price by 10% and lose 15% of your business, your revenue goes down to $935K ($1M*1.1*0.85). Your costs went down to $425 ($500K*0.85) which means your margin went up to $510K ($935K-$425K). From a profitability standpoint, this is a smart decision.

Even if you’re not winning them all, you can still do these calculations. If you raise price, you will probably lose more. Is it a good decision? Assuming you want to maximize profit instead of revenue, this may be a good decision. Should you raise prices another 10%?

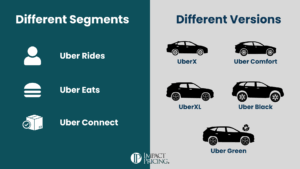

Finding that profit maximizing price isn’t easy. And what happens when you target a new market segment, or change the way you sell value? In both cases, your win rate will likely change. Although you won’t know the precise number, you should have a feel for if you’re winning a reasonable amount. You should be watching this trend. If you start winning more, consider a price increase.

FYI, we created a breakeven volume calculator tool to help you do the math we used in this blog. You can find it at breakeven.impactpricing.com.

Good luck.