Business school professors love to preach that companies exist to maximize shareholder value. The idea is simple enough: shareholders take the risk, so the company should serve them. But that framing misses the essence of why companies survive in the first place.

Companies exist to create value for customers. Full stop.

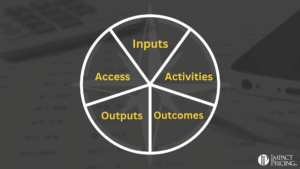

Every transaction is a trade. Buyers trade money for value. That value comes from solving problems in ways customers care about: making their lives easier, helping them grow, removing risk, saving time, or unlocking new possibilities. If a company consistently solves problems better than anyone else, customers keep buying. Revenue flows in. Profits follow. Shareholders are rewarded.

That’s the flywheel: value for customers drives value for shareholders.

Now flip the equation. What happens when companies prioritize shareholders first? Short-term actions—cost cuts, layoffs, squeezing suppliers, raising prices without adding value—might boost quarterly earnings, but they do nothing to improve customer value. In many cases, they actively destroy it. The company becomes weaker in the long run, not stronger.

Private equity provides some stark examples. When a PE firm buys a company and dismantles it for parts, shareholders make money. But customers? They’re left stranded. The company no longer exists to solve their problems. It’s a reminder that shareholder-first thinking can literally destroy the very thing that made the business valuable.

Contrast that with companies that invest in customer value. Amazon’s relentless focus on customer experience built a trillion-dollar business. Apple didn’t get there by focusing on shareholder return, but by obsessing over design, usability, and the joy of owning its products. Shareholders reaped massive rewards, but only because customers kept lining up for more.

Here’s the hard truth: maximizing shareholder value is not a strategy. It’s an outcome. The only sustainable path is through customers. Companies that understand this thrive. Those that don’t might shine for a quarter or two before fading away.

So why do companies exist? To solve customer problems in ways that create value. Shareholder returns are the by-product. Get the order wrong, and the company fails its reason for being.

The lesson is simple: focus on creating more value for customers. Shareholder value will follow.

Share your comments on the LinkedIn post.

Now, go make an impact!

Tags: private equity, shareholder value, value

Tags: private equity, shareholder value, value