The first time I heard the concept – Price for Market Capitalization – was from a close friend of mine, Brent Bilger. Brent has been involved with start-up companies for over 3 decades, and has had a hand in many successes. Like most great ideas, once you hear this concept, it seems obvious – but I didn’t think of it until Brent did.

As we’ve discussed previously, pricing must align with your corporate strategy.

Aligning Your Pricing With Your Corporate Strategy

The CEO defines the company strategy and the rest of the company – including the pricing team – follows suit. Almost all companies select a strategy with the goal of maximizing their market capitalization. In large companies, the strategy has been extensively defined and passed down to marketing and pricing, who don’t tend to think about market cap – instead, they think about executing the strategy.

In smaller, start-up companies though, the strategy is often not as clearly defined and communicated. We are often breaking new ground, putting a first price on a first offering. We have no historic examples to follow, and there may be very little guidance on how to set our prices. The founder typically creates the pricing strategy – and this is where market cap pricing comes into play.

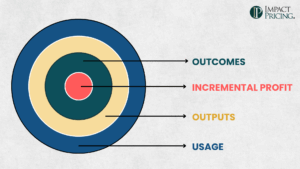

The executive must determine what maximizes the value of the company. In the late 1990’s, investors famously invested based on the number of “eyeballs” on your internet site. In today’s world, investors look more at how many customers you’ve already served, and at what price – thinking that if you want to maximize the number of customers, you ought to keep your prices low. However, investors also look closely at your profit margin, to see how much money you might make when your business really takes off. The great news is they may even look at projected profit margin, using your projected future costs rather than your current costs.

If you have a realistic belief that your costs will decrease significantly and rapidly, you may want to “forward price” your products, by pricing as though you already have those lower costs. In some circumstances you may even set your prices below your current costs – you can justify the losses as part of your product launch expenses. Of course, you must have pockets deep enough to cover these losses. This strategy allows you to capture customers more quickly, but it’s very high-risk.

Another helpful tactic, especially when creating a software product, is to offer a free version and then upsell a more featured product (often called a Freemium model). It is much easier to create large demand by offering something for free.

Your job, when determining pricing strategy for your start-up company, is to charge a price low enough to capture enough customers to prove to potential investors the idea is a great one, while holding prices high enough that your investors see the idea is profitable.

As an executive in a start-up, you must understand (or at least guess) what maximizes your market capitalization. This should absolutely be part of your strategic planning.