A reader who works in the automobile industry asked me to comment about the residual value and leasing rates. This topic immediately jumped to mind.

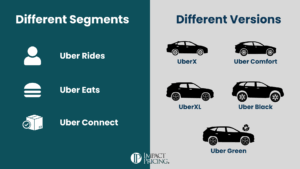

First, let’s assume that the residual value of a car is certain and it’s known by both the seller and the buyer. Then, the decision about leasing rates should be relatively similar to a decision about setting the price of a car. What is the buyer or lessee willing to pay based on their perception of the value of the car. Not to say it’s easy to set that lease rate or price. Buyers’ perceptions are still hard to know and dependent on their perception of the competitive alternatives as well.

One thing we do know, the lower the lease rate, the more likely the buyer will buy (in most situations).

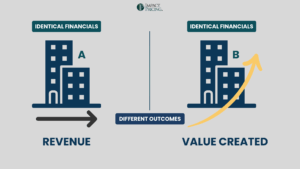

Now, let’s add in the extra complication that the residual value of the car is not certain. The manufacturer has a better understanding of the used market for their vehicles and hence, a better estimate of the residual value when the lease is up. The manufacturer has more information than the buyer. What does this do to the pricing calculation?

Buyers know that sellers have a better feel for the residual value. Hence, buyers are using your residual value (or implied residual value) as an indicator of how much you believe in the quality or ability of your car to hold its value.

It’s a double whammy. When you have a higher residual value, you can charge a lower lease payment, and you are signaling the quality of the car to the buyer.

Buyers, either intentionally or unknowingly, look for a signal from people they believe have more information than they do. They read reviews, listen to an expert like consumer reports and even listen to suppliers. Residual value is a signal to buyers about what you believe about your cars.