As I’ve been studying and cogitating on subscription value and pricing, I keep running into interesting “subscription” type businesses.

The definition for a subscription business I’ve been working with is:

Companies that receive a periodic payment for delivering a periodic benefit.

However, when you get to the end of this post you’ll see there may be another, more helpful way to think about this. In fact, you may already be a subscription business without knowing it.

Subscription Based Businesses Are More Common Than You Might Expect

First, let’s look at some examples. We’ve had subscriptions around us long before the dawn of the Internet. Consider gym memberships, newspapers, wine of the month club, cable TV, phone service, and utilities. How about insurance companies and banks? What about temporary employees? In each of these, there is a periodic payment for a periodic benefit.

Nowadays, the Internet is filled with SaaS companies and products like Salesforce, Adobe, Microsoft Office, Zoom, Slack, Trello, Hubspot, and probably a million more. Then there are even newer subscription types like Porsche and Amazon Prime. All of these have a periodic payment for a periodic benefit.

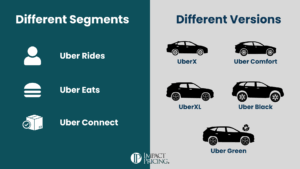

Then there are non-subscription, transaction based companies that can and probably should act like a subscription. For example, Uber and Lyft go here. We pay by the ride, we don’t subscribe. Amazon AWS and Microsoft Azure probably fit here. We pay for usage, we don’t subscribe. Although they don’t really fall into the working definition of a subscription business, they probably should be managed just like a subscription business. Why do I say this?

Breaking Down Various Streams of Revenue

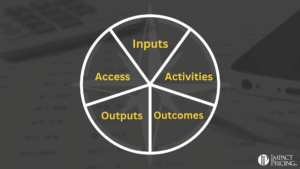

In our new course Accelerate Your Subscription Business, where your revenue comes from is the fundamental difference with a subscription business compared to a traditional business. In traditional businesses, you need to win new customers.

That’s where revenue comes from. In subscription companies you have three different revenue buckets: win, keep, grow.

- Win new customers

- Keep current customers paying

- Grow revenue from your current customers

Great subscription companies have very low churn rates (keep revenue) and find ways to earn more money from their existing customer base (grow revenue). Of course they have to win new customers too, but the key difference is the focus. They spend a large portion of their resources trying to keep and grow customers. They create new departments like customer success to make sure customers get value from their products. They carefully manage their product packaging and price changes to capture more revenue.

Considering A New Definition for the Subscription Business

What if we changed the definition of a subscription business from “Companies that receive a periodic payment for delivering a periodic benefit” to the new definition of subscription business:

Companies where the lifetime value of a customer is much larger than the initial transaction.

To make this happen, a company must intentionally manage the customer’s lifetime value. Suddenly examples like Uber and AWS fit nicely into this definition.

Uber and AWS should be building relationships, helping customers be successful, packaging and pricing for market segments, choosing the right pricing metrics. These are all things subscription companies should be doing.

Okay, but here’s what I don’t like about this new definition.

What about Coke? They rely on the lifetime value of a customer. Yet Coke doesn’t feel like a subscription. But maybe it is. It’s possible the product team at Coke is trying to figure out how to win new customers. They put programs in place to keep their current customers buying. And they launch new products and initiatives to get their current customers buying more.

This win, keep, grow concept is so crucial to subscriptions it feels like it could be the defining factor for a subscription business. But maybe not. What do you think?