Value Is Not the Same as Willingness to Pay

You can listen to the full audio version of this blog we call — Blogcast. In pricing conversations, we often treat value and willingness to pay

You can listen to the full audio version of this blog we call — Blogcast. In pricing conversations, we often treat value and willingness to pay

You can listen to the full audio version of this blog we call — Blogcast. Charging what a buyer is willing to pay is the single

You can listen to the full audio version of this blog we call — Blogcast. Two weeks ago I defined Context Driven Pricing as charging what

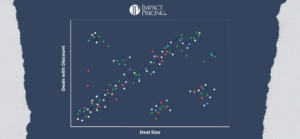

You can listen to the full audio version of this blog we call — Blogcast. Price segmentation is one of the most important and potentially powerful

You can listen to the full audio version of this blog we call — Blogcast. Daniel Kahneman, in his book Thinking Fast and Slow, described

You can listen to the full audio version of this blog we call — Blogcast. I have a ton of thoughts swirling in my head

You can listen to the full audio version of this blog we call — Blogcast. One of my favorite pricing tools is a scatter plot.

You can listen to the full audio version of this blog we call — Blogcast. Value is ambiguous. People think they know what they mean

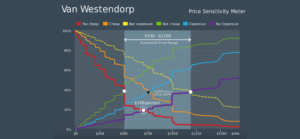

My go-to pricing research method for learning how much buyers are willing to pay is Van Westendorp’s Price Sensitivity Meter. (There is a plethora of

Inflation is here. It’s time to raise prices. OK, all good pricing professionals know that costs don’t drive pricing. Willingness to pay drives pricing. Sure